This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

With two IPOs, fifteen private company fundraises and one acquisition, April brought a serious influx of cash into the food tech ecosystem totaling close to $1.1 billion. Grubhub and JustEat together raised close to $800 million in their IPOs, with private investment rounding out at $270 million. Delivery was a prominent theme as thirteen of the 18 deals involve direct-to-consumer delivery ranging from ecommerce to meals to restaurant dishes. Also notable was the lack of angel/seed rounds and substantial shift towards larger deals, with 8 of the 15 private companies raising over $10 million, and an average raise of $19 million.

While investors continue to make big bets on the delivery space, and internet incumbents are increasingly eying same-day delivery as the key to tackling brick-and-mortar retailers, food in particular brings an assortment of unique logistics to the table, and in general, consumers are still reluctant to pay anywhere near enough to cover the cost of speedy deliveries. Turning a profit will not be easy. As The Economist points out, firms such as Amazon, Google and Walmart are willing to lose money on deliveries for the data they glean about shopping habits as well as ad-ons and up-selling opportunities.

For the rest of the companies in this space however, most disruption is driven by venture-backed land grabs to allow money-losing start-ups to flourish, while providing services that “unsubsidized” businesses can’t match. While the “profitless-on-purpose way of doing business” is beneficial to consumers, Kevin Roose of New York Magazine argues that this practice is “deeply unfair competitive terrain for regular businesses,” and “trying to compete in the VC-backed economy as a profit-conscious business is like running a triathlon with ankle weights.” Without a subsidizing sugar daddy it will be tough to compete in the on-demand food market, as San Francisco-based Chefler recently discovered. Despite the hurdles, even the founder of Webvan is unable to resist, returning again to attempt to conquer the opportunity of grocery delivery.

M&A

Blue Bottle Coffee Acquires Tonx. The Los Angeles-based subscription coffee startup ships high quality whole beans, within 24 hours of roasting, directly to consumers. The Tonx team, which includes a co-founder of Foodzie, will now be responsible for creating the digital strategy for Blue Bottle and over time, the Tonx brand will fold into Blue Bottle. The Oakland-based coffee roaster also acquired LA-based Handsome Coffee Roasters which adds a downtown a Los Angeles-area roasting facility as well as a downtown-area coffee shop location.

Announced: 4/07/14 Terms: Not Disclosed Previous Investment: Seed Founded: 2012

FUNDING

PunchTab Raises $6.25m. The Palo Alto, CA omni-channel engagement and insights platform is a multi-channel loyalty and engagement platform that enables agencies, brands and enterprise organizations to incentivize user behavior and drive business success. Customers include Kroger, Arby’s and Nestle. The company intends to use the funds to accelerate the launch of a new Big Data analytics product for brands and agencies, expand its sales force, and continue to hire technology professionals.

Announced: 4/30/15 Stage: Series A Participating Institutional Investors: Mohr Davidow Ventures (lead) Previous Investment: $5.25m Seed Founded: 2011

Blue Apron Raises $50m. The New York-based meal kit delivery service ships pre-portioned foods (with recipes) to users cooking at home. The new funds will be used to support Blue Apron’s business growth, including hiring across all divisions, expanding geographically, adding warehouse space and investing in operations technology, marketing and dedicated supplier partnerships. See our video from last fall with CEO Matt Salzberg, as he speaks about the business model and mission, which digs deeper into the company’s sourcing policies, differentiating features and distribution infrastructure.

Announced: 4/30/14 Valuation: $500m Stage: Series C Participating Institutional Investors: Stripes Group (lead), Bessemer Venture Partners, First Round Capital Previous Investment: $5m Series B (Reportedly valued at $32m), $3m Series A, $900k Seed Founded: 2012

500friends Adds Strategic Investment. The San Francisco-based loyalty and marketing SaaS company brought in an undisclosed amount of strategic investment from key retail, loyalty, and e-commerce leaders. The company plans to take advantage of the connections and expertise of its new investors to expand its customer base of over 50 leading omni-channel and e-commerce brands, including 1800Flowers.com, Omaha Steaks, and Kabam.

Announced: 4/28/14 Stage: Series B extension Participating Investors: Matt Howland (former CEO of LoyaltyLab), Neel Grover (former CEO of Buy.com), Michael Butler (former head of e-commerce at HP), Jim Keller (former CMO of Shoebuy), Abdul Popal (SVP at CafePress), Brandon Proctor (CEO of Ice.com) Previous Investment: $5m Series B, $4.5m Series A; $1.4m Seed Founded: 2010

Caviar Raises $13m. The San Francisco-based high-end restaurant delivery service allows customers to order meals from restaurants that typically do not deliver, with Caviar-employed drivers serving as the delivery force. Before bringing on each new restaurant, Caviar performs market research and taste-testing, and sends professional photographers to capture all of the restaurant’s available dishes and uploads the photos and descriptions to their website. With 250 restaurant partners, Caviar will put the recent funding towards expansion into new markets, with plans to roll out to all major US cities by the end of 2014.

Announced: 4/28/14 Stage: Series A Participating Institutional Investors: Tiger Global (lead), Andreessen Horowitz, Mixt Greens Previous Investment: $2m Seed Founded: July 2012

ShopKeep Raises $25m. The New York-based point-of-sale solution builds point-of-sale software for mobile devices and tablets. The ShopKeepPOS – a combination of hardware and cloud-based software – is used by more than 10,000 storefronts ranging from food and wine purveyors, “quick-service” restaurants like coffee shops, bakeries or other counter-service establishments to small retail shops. ShopKeep plans to use its new funding for hiring, to set up new offices in the U.S. and to roll out its new, mobile phone-based system allowing staff at independent stores to roam the aisles, helping customers check out on the spot.

Announced: 4/24/14 Stage: Series C Participating Institutional Investors: Thayer Street Partners, Canaan Partners, TTV Capital, Tribeca Venture Partners, Contour Venture Partners Previous Investment: $10.3m Series B (valuation of $35m), $2.2m Series A Founded: October 2008

Delivery Hero Raises $85m. The Berlin, Germany-headquartered global network of online food ordering marketplaces operates in 14 markets across four continents. Just months after raising $88 million this past January, the new funds will be used to solidify its presence in existing markets by increasing investment in marketing and price discounts (including a permanent 25% promotion on selected restaurants in Germany) to win a leading position. It is also likely that the company will use some of its war chest for acquisition(s), and according to Tech Crunch, Delivery Hero is aiming for 2015 for a possible IPO. The company has no plans to enter the U.S. market at this time.

Announced: 4/23/14 Stage: Series F Participating Institutional Investors: Luxor Capital Group, with participation from unnamed existing investors Previous Investment: $88m Series E, $80m Series D, $33m Series C, $15m Series B, 5.6m Series A Founded: September 2010

AgLocal Raises $1.3m. The San Francisco-based e-commerce platform for buying and selling responsibly-raised meats began as a B2B marketplace for meat, connecting animal farmers to buyers including top-rated chefs, but has now pivoted to become a consumer-facing service. Fast Company and TechCrunch provided some insight into the major shift co-founder Naithan Jones and the startup undertook and why it was so necessary. On the new e-commerce site, online shoppers can browse through the meat products offered by family-operated farms, which are paid for on a subscription basis (currently only available to customers on the West Coast). The company plans to open up a facility in Chicago and expand to the Midwest later this year.

Announced: 4/23/14 Stage: Venture Participating Institutional Investors: OPENAIR Equity Partners, Andreessen Horowitz, Chicago Ventures Previous Investment: $1m Venture Round, $1.5m Seed Founded: May 2011

ezCater Raises $3m. The Boston-based catering platform connects people with local caterers and restaurants across the U.S, with a specific focus on business catering. As one of the oldest existing food ordering platforms the company has 30,000 caterers on the website, which provides a standardized way of displaying menus. The company will use the funds to add 20,000 caterers to its site.

Announced: 4/15/14 Stage: Venture Participating Institutional Investors: Breton Capital Management, LaunchPad Ventures Previous Investment: $1.0m Venture Round, $2.2m Series A, $630k Seed Founded: August 2007

NatureBox Raises $18m. The healthy snack subscription commerce company charges a monthly subscription fee for home-delivery of an assortment of healthy snacks, as well as recipes and ideas for nutritional eats. Rather than sourcing from large CPG companies, NatureBox produces all the food itself and currently has more than 130 SKUs. According to PandoDaily, NatureBox continues to add new products to its catalog and is also exploring additional new revenue channels as well, which will “almost surely mean offering a traditional ecommerce store and may eventually mean selling its products through brick-and-mortar grocers.”

Announced: 4/14/14 Stage: Series B Participating Institutional Investors: Canaan Partners (lead), General Catalyst, Softbank Capital Previous Investment: $8.5m Series A, $2m Seed Founded: January 2012

Munchery Raises $28m. The San Francisco-based meal delivery service delivers prepared meals, created by Munchery chefs, that are delivered cold and only need to be heated up. Munchery, which currently only operates in San Francisco, will partly use the funds to expand into Seattle, where construction of a new kitchen is already under way. The company has a goal of being in 15 to 20 cities within the next few years, and will focus on local tastes and preferences by hiring local chefs with each new market.

Announced: 4/10/14 Stage: Series B Participating Institutional Investors: Sherpa Ventures (lead), Menlo Ventures, e.ventures Previous Investment: $4m Series A, Seed Founded: April 2011

Drync Raises $2.1m. The Cambridge, MA mobile social network for wine drinkers released an iPad version of its app in conjunction with the funding announcement, which allows users to save wines they like, manage their wine cellars, and get recommendations for new bottles worth uncorking. By taking a photo of a wine label, the app identifies and describes the wine, and by using a network of licensed retailers and wineries, users can purchase the wine to have it shipped directly through the app. According to Tech Crunch, the additional funding will go towards customer acquisition and allow it to grow its team.

Announced: 4/09/10 Stage: Seed Participating Institutional Investors: Crosslink Ventures, Great Oaks Venture Capital, KEC Ventures, Foundry Group Previous Investment: $900k Angel Founded: 2008

Spoonrocket Raises $11m. The Oakland, CA-based food delivery service features fresh meals with a limited number of menu items stored in heating equipment delivered home in minutes. The company also operates a meal matching program (World Food Program USA) for every meal purchased, costumers donate one to a child in need. The company intends to use the funds to expand its business.

Announced: 4/09/14 Stage: Series A Participating Institutional Investors: Foundation Capital, General Catalyst Previous Investment: $2.5m Seed Founded: June 2013

Closely Raises $3m. The Denver, CO-based digital marketing platform for small businesses is the maker of Perch, a social analytics app for small businesses. The app provides more than 35,000 business owners with a view into the latest Facebook, Twitter, Yelp, Google+, Instagram, Foursquare, Groupon, and Living Social posts. The company intends to use the funds to build out its SMB marketplace platform, Perch, and expand support for small businesses throughout North America.

Announced: 4/08/14 Stage: Series A Participating Institutional Investors: Grotech Ventures (lead), Steadfast Venture Capital, CNF Investments Previous Investment: $4m Seed Founded: October 2009

EatStreet Raises $6m. The Madison, WI-based restaurant ordering and marketing platform has grown by focusing on secondary markets across the US, and providing small and medium sized restaurants with competitive tools they often can’t afford. The company intends to use the funding to continue to develop the platform, and enhance the customer ordering experience, double its staff and expand to more than 15,000 restaurants in 150 cities by the end of the year – including larger markets like Chicago and Los Angeles.

Announced: 4/07/14 Stage: Series B Participating Institutional Investors: CSA Partners, Cornerstone Opportunity Partners, Great Oaks Venture Capital, Independence Equity, Silicon Valley Bank Previous Investment: $2m Series A Founded: 2010

Buzz Points Raises $19m. The Austin, TX -based provider of loyalty and rewards programs, (previously named Fisoc) offers a reward system for consumers by linking community banks, credit unions and other financial institutions in local communities with their local merchants. Of note, the round included strategic investor Discover Financial Services. According to the Wall Street Journal, the company will use the funds to expand from one salesperson to five or six and enter new geographies around the nation with the goal of shifting consumers to local merchants via financial incentives.

Announced: 4/1/14 Valuation: $65m Stage: Series D Participating Institutional Investors: Discover Financial Services, Lead Edge Ventures, KEC Ventures, Greycroft Partners Previous Investment: $7.5m Founded: 2009

PARTNERSHIPS

Epicurious Partners with inMarket to Use In-Store Tracking Beacons. Through the partnership, Epicurious aims to deliver information and deals on partner products to people who have downloaded its self-titled app. The publisher, which will implement the tracking system for its Apple iOS app before an Android rollout, is only just testing the mobile tracking and targeting technology and how it would operate in a live store environment.

Vice Media and FremantleMedia Partner to Launch Online Food Network. Both companies will develop and produce digital content for the multi-channel food platform, which was built for a millennial audience, and the content will be featured on the VICE food vertical, which FremantleMedia will take to TV around the world.

MyCheck Partners with PayPal to Allow Users to Pay At Table, Split Bills And Tip Directly From PayPal App. The new collaboration allows PayPal users to pay for select restaurant bills and bar tabs, split their bill, tip their servers, redeem offers and more.

QikServe Partners with PayPal to Enable Mobile Food Ordering and Payments at UK Establishments. Mobile technology company QikServe announced a collaboration with PayPal that will allow the United Kingdom hospitality sector to take orders and payment using the PayPal app on their customer’s smartphone.

Lavu iPad POS Partners with LoyalTree to Offer Single-Click Integration, Targeted Analytics, and Programs to Reward Loyal Customers. Benefits of the partnership include connected backend dashboards for access to customer histories and customizable targeted marketing campaigns.

Personal concierge app Sosh partners with OpenTable to Make Restaurant Reservations Directly Within the Sosh App. The partnership will allow users to make reservations for restaurants that come up as recommendations in the Sosh app with a couple taps on the phone.

Look & Cook Partners With Amazon Fire TV to Be The Digital Food Network. Amazon’s newly launched media streaming box, Amazon Fire TV – which offers shows, games and apps like Youtube, Netflix and HBO – now comes standard with Look & Cook, a recipe app created by Israeli publishing startup Kinetic Art. In addition to the Amazon Fire TV partnership, the team is working on a project with the James Beard Foundation, which includes creative vegetable recipes by renowned chefs like Thomas Keller, Mario Batali, Grant Achatz and Alice Waters, among others.

Merchant Warehouse and TabbedOut Partner to Enhance the Reach of Mobile Payments and Digital Marketing in the Hospitality Industry. The partnership will serve to co-market each company’s payment solutions, and provides for the seamless integration and distribution of TabbedOut across a wide population of venues in the hospitality industry.

LiveDeal Partnership with Menu1.com Adds Over 120 Restaurant Sales Professionals. The LiveDeal program will now be an ‘included value-added feature’ of the Menu1 program, where restaurants will automatically be enrolled into the LiveDeal program, whether they ultimately sign up for the Menu1 program or not.

INDUSTRY LANDSCAPE

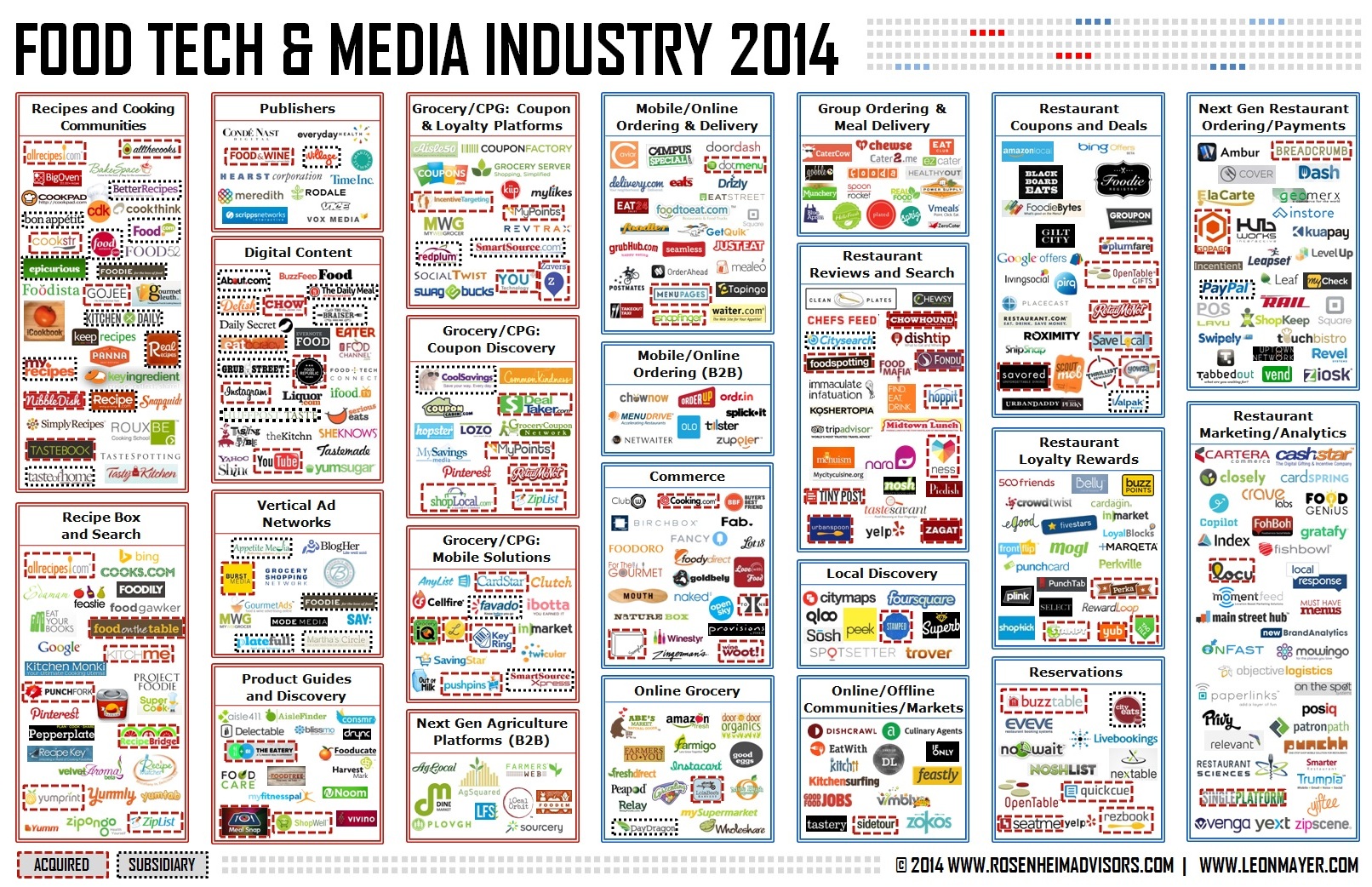

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape.

Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out the 2013 Annual Report and last month’s round-up.

Would you be interested in a round-up of agriculture-related funding, partnerships and acquisitions? Let us know in the comments below.