This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

The food tech and media industry was quite active in April, especially as consolidation continued to heat up in the restaurant and food delivery sector; with eight of the eleven acquisitions within that category. With over $250 million invested across 15 private funding deals during the month, there was a solid mix across all stages but a heavier concentration of Series A deals (averaging $9 million in size). Notably, three quarters of the funding deals were international, with a majority of them in India.

While India has been seen as a huge growth market for U.S. companies in the consumer sector, home-grown entrepreneurs are increasingly seizing the opportunity. The food tech industry in particular has seen a recent boom, as the Indian publication Your Story notes, “the rise in consumerism, strong economic background, and relatively better incomes are encouraging Indians to eat out like never before.” In the same article, Kunal Walia from Khetal Advisors says, “Food-tech investments are a perfect follow-through to the recent theme of ‘Habit Forming Companies’ that have been attracting significant rounds of capital in recent times.”

The grocery delivery space in particular is an area of growth in India, with both ecommerce incumbents and startups paving the road. Amazon India recently announced it would be launching an express delivery platform in partnership with mom-and-pop stores, calling it Kirana Now and Snapdeal recently partnered with gourmet food retailer Godrej Nature’s Basket to sell its products online, with orders delivered the next day. Flipkart is now reportedly poised to begin selling groceries from the second half of this year, and is most likely to be launched as an in-house offering rather than through an acquisition, according to The Economic Times.

Kunal Walia further points to “one clear leader” in the Indian food tech space, Zomato, “[which] is pushing all the boundaries to build a high-value business.” Zomato however, despite the Indian headquarters, is increasingly focusing its attention and growth prospects internationally, including in the U.S., as Zomato’s CEO has stated that India represents only 8 % of market for the company. Regardless, with its significant funding, and global aspirations, Zomato will likely continue to be a major consolidator as startups in the sector face scaling challenges in acquiring consumers and business clients/partners. As we are already seeing in the U.S. and selectively abroad, the mass funding in this space will likely lead to consolidation, as happened in the e-commerce and daily deals space.

M&A

Kroger Acquires Assets of DunnhumbyUSA. British grocer Tesco’s customer data science and loyalty division Dunnhumby will transfer many of its US employees and data assets to Tesco’s US-based joint venture partner Kroger. According to Supermarket News, the new venture will be a long-term service license to use Dunnhumby’s technologies under a new business to be known as 84.51°. The agreement will lift restrictions on Dunnhumby pursuing business with additional U.S. retailers, and will no longer restrict Kroger from employing other firms to analyze its data. Stuart Aitken, who previously led DunnhumbyUSA, will become CEO of 84.51°. Dunnhumby itself has reportedly been on the market for several months as its parent company explores “strategic options.” AdExchanger reports that Goldman Sachs will continue the search for outside investment for dunnhumby ltd., now sans Kroger.

Announced: 04/27/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: Joint Venture began in 2003

Zomato Acquires NexTable. The Charlotte, NC-based restaurant reservation and table management platform is Zomato’s second U.S. acquisition, as the company hopes to better monetize Zomato’s listings through reservation services. TechCrunch notes that NexTable, which will be relaunched as “Zomato Book,” may have been looking for an alternative exit path as a lack of outside funding and the headquarters location may have limited its ability to scale. Zomato will be taking NexTable’s technology internationally to India, UAE, and Australia.

Announced: 04/22/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: August 2012

Trimble Agriculture Solutions Acquires HarvestMark. Trimble, an agriculture solutions provider, acquired the assets of HarvestMark, a SaaS provider of food traceability and quality inspection solutions, from YottaMark, Inc. According to the release, the acquisition will help enhance Trimble’s position in agriculture and transportation and logistics within the food supply chain. Additionally, the CEO of YottaMark will join Trimble after the acquisition. Notably, HarvestMark had acquired Shopwell Solutions in 2013, however the Shopwell assets were not included in the sale.

Announced: 04/22/14 Terms: Not Disclosed Previous Investment: $53.0m Founded: January 2005

Rocket Internet Acquires Volo. The Munich, Germany-based food-delivery startup allows customers to order food online from restaurants that don’t offer their own takeout and delivery services. Volo operates in key cities within Germany, and had announced plans to expand into nine other European countries. One would assume Volo will become part of Rocket Internet’s Global Online Takeaway Group, however TechCrunch notes that Rocket Internet’s competitive strategy is unclear given its recent funding of Volo’s competitor, Take It Easy, which operates in similar markets. Nevertheless, the acquisition suggests that Rocket Internet sees food delivery as a growth opportunity.

Announced: 04/16/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: March 2014

Zomato acquires MaplePOS. The Delhi, India-based point-of-sale service for restaurants offers credit and debit card payment solutions, including menu and inventory management. The acquisition of the cloud-based payments platform marks Zomato’s first acquisition of a product outside of the restaurant search space. According to TechCrunch, adding a payments service will enable Zomato to increase its B2B offerings for restaurants. The Economic Times notes that technology has become increasingly integral to the online food services sector, and Zomato’s acquisition will enable the company to be more competitive in the market space. MaplePOS will be integrated with “Zomato Base”, Zomato’s own point-of-sale system.

Announced: 04/14/15 Terms: Undisclosed (cash and equity) Previous Investment: Not Disclosed Founded: 2011

Grofers Acquires Mygreenbox. The Gurgaon, India-based grocery delivery smartphone app delivers orders to users at their chosen time and location, and will give Grofers access to Mygreenbox’s client base, and also help it “to build technology for backend to further accelerate delivery.”Mygreenbox operates in the Gurgaon area and processes an average of 200 orders per day. Following the acquisition, the Mygreenbox business will shut down and be wholly integrated into to Grofers.

Announced: 04/10/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: April 2014

TripAdvisor Acquires BestTables. The Lisbon, Portugal-based online and mobile restaurant booking platform lets diners browse restaurants based on location, availability, price, cuisine type, and special offers before placing a reservation. BestTables will be integrated with TripAdvisor’s previous acquisition, TheFork (LaFourchette). As BestTables is partnered with 1200 restaurants in Portugal and Brazil, the acquisition will expand TripAdvisor’s European market and strengthen its presence in South America. As tnooz points out, the acquisition comes at a time where the market for restaurant reservations is in a period of consolidation.

Announced: 04/10/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2011

Square Acquires Fastbite. The San Francisco-based food delivery startup partners with restaurants to provide $10 meals that could be delivered in less than 10 minutes. As part of the deal, Fastbite will be integrated with Caviar, a food delivery company previously acquired by Square. The merged business will operate under the new name, Caviar Fastbite. According to Venturebeat, Caviar’s delivery infrastructure is geared towards upscale restaurants, so having Fastbite as a feature of Caviar will allow Caviar to tap into the lunch delivery business, while enabling Fastbite to be a stronger competitor in the industry. Fastbite currently only serves San Francisco, but may soon expand into other cities.

Announced: 04/08/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2014

Reserve Acquires zurvu. The New York-based mobile waitlist startup charges users a fee in exchange for securing reservations at in-demand restaurants. Users can book publicly available or exclusively held tables using the zurvu’s waitlist technology. Reserve plans to incorporate zurvu’s services into its existing service and technology. The acquisition will allow Reserve to expand into Philadelphia as well as increase its restaurant base in NYC.

Announced: 04/07/15 Terms: Not Disclosed Previous Investment: $1.2m Founded: 2012

Reserve Acquires HAIL. The Santa Monica-based payment technology platform offers bill splitting services for users. The app additionally calculates the tip and lets diners electronically hail their servers. According to the release, HAIL’s features will be integrated into the Reserve app and will further streamline Reserve’s payment services.

Announced: 04/07/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2014

Weight Watchers Acquires Weilos. The San Francisco-based mobile platform for fitness and weight loss focuses on introducing social media to users’ weight loss and fitness journeys, which will enhance the social networking and community capabilities of the Weight Watchers program. The acquisition will also “accelerate product and technology development” for the Weight Watchers platform. The startup lets users document and share their weight loss progress through selfies via a picture taking app, discuss weight loss and fitness goals, and track food intake and activity. TechCrunch reports that the average person posting progress pictures on Weilos loses 1.2 pounds per week, whereas the average Weight Watchers user loses .27 pounds per week.

Announced: 04/06/15 Terms: “Single millions” Previous Investment: Not Disclosed Founded: 2013

FUNDING

Keru Cloud Raises $10.7m. The China-based restaurant management software company aims to be an “all-in-one solution for restaurants and other businesses to go digital.” Restaurant staff can use Keru Cloud’s mobile platform to manage reservations, orders, and customer loyalty programs. Online, Keru Cloud’s mobile app lets client restaurants offer maps, menus, special discounts, and online ordering services from their individualized digital storefronts. Keru Cloud will use the capital injection to enter into more service sectors, invest in product development, and expand its sales and operations teams.

Announced: 04/24/2015 Stage: Series B Participating Institutional Investors: Baidu (lead), Tianxing Capital (lead), Fangjinglin Investment, Kaixing Capital Previous Investment: Series A Amount Not Disclosed Founded: November 2012

EazyDiner Raises Seed Funding. The Delhi, India-based restaurant reservation dining platform offers users reviews, recommendations, insiders’ advice, concierge services, and manages each reservation. EasyDiner currently operates in the Delhi region, where it has over 8,000 listings, and partners with nearly 300 restaurants for online reservation and exclusive deals. The startup plans to launch its services in Mumbai by July, and expand operations into Bangalore, Hyderabad, Pune and Chennai within this year.

Announced: 04/23/2015 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: 2014

Bring! Raises Seed Funding. The Zurich, Switzerland-based grocery shopping list app is focused on user experience, with an icon-based catalogue. Lists can be shared with several people and are automatically synced to ensure efficient planning and shopping. Using icons instead of text, the company aims to offer a similar user experience on both smartphones and smartwatches, including the new Apple Watch.

Announced: 04/21/2015 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: 2015

Sprig Raises $45m. The San Francisco-based subscription food delivery service makes and delivers locally sourced meals to customers in the area. The company’s goal is to deliver organic and ready-to-eat meals in an average of 20 minutes after ordering. To keep its delivery time short, Sprig uses data technology to predict times of incoming orders and sends out delivery vehicles in advance of orders placed by customers. Sprig intends to use the new capital to expand its service to cities across the country, with the rest of the Bay Area and Chicago as its immediate targets.

Announced: 04/15/2015 Stage: Series B Participating Institutional Investors: Social Capital (lead), Greylock Partners (lead), Accel Partners, Battery Ventures, 500 Startups, Ludlow Ventures, Lumia Capital, IDG Ventures, CAA Ventures, Previous Investment: $11.7 million Founded: April 2013

Grofers Raises $35m. The Gurgaon, India-based online mobile delivery app delivers produce and other goods from local stores on-demand. Grofers does not hold inventory, and currently partners with 400 merchants who list products on the app. According to TechCrunch, orders placed through Grofers’ platform have tripled over March. The company intends to use the capital to increase product offerings and expand into other areas of India.

Announced: 04/14/15 Stage: Series B Participating Institutional Investors: Sequoia Capital, Tiger Global Previous Investment: $10.5 million Founded: December 2013

Hello Alfred Raises $10.5m. The New York-based home management service partners with on-demand services to complete household customers’ chores, including groceries and laundry. Each user is assigned a home manager, called an Alfred, who takes care of chores so that users won’t have to manage multiple services themselves. Customers have the options of signing up for weekly automated chores or texting in requests. Hello Alfred currently operates in New York and Boston. The new funding will be used to scale Hello Alfred’s services and broaden its consumer base.

Announced: 04/14/15 Valuation: $33 million Stage: Series A Participating Institutional Investors: New Enterprise Associates (lead), Spark Capital (lead), Sherpa Ventures, CrunchFund Previous Investment: $2 million Founded: September 2013

PepperTap Raises $10m. Just a month after announcing its Seed round, the Gurgaon, India-based on-demand grocery delivery services app announced a sizable Series A, which will allow the company to expand into 10 more cities in India by the end of the year. Rather than maintaining its own inventory, PepperTap creates online catalogs for stock from local retailers, and claims to ensure delivery within Gurgaon in less than two hours after customers place their order.

Announced: 04/14/2015 Stage: Series A Participating Institutional Investors: Sequoia Capital, SAIF Partners Previous Investment: $1.2 million Founded: November 2014

Take Eat Easy Raises $6.4m. The Brussels, Belgium-based online and mobile platform markets itself as an on-demand food delivery for “trendy” restaurants that do not have traditional delivery services. TechCrunch reports that Take Eat Easy employs bike couriers to make the deliveries, a feature which makes the company both a logistics and a food ordering business. Customers can track their orders in real time, and the estimated time of delivery for each restaurant is continually updated. Take Eat Easy currently operates in France and Belgium, and will use the funding to accelerate its expansion across Europe.

Announced: 04/14/15 Stage: Series A Participating Institutional Investors: Rocket Internet, DN Capital, Piton Capital Previous Investment: Not Disclosed Founded: 2013

TouchBistro Raises $6m. The Toronto-based startup is a provider of mobile point-of-sale solutions and digital menus for the food and drink industry. Restaurants use TouchBistro’s software for the iPad to take and process orders, split bills, and email receipts. Clients include food trucks, bars, and coffee shops as well as traditional restaurants. TouchBistro reported that it recently surpassed $1 billion in transactions through its point-of-sale system, and was the top grossing food and beverage app in the iTunes store in 33 countries in 2014. The new funding will be used towards hiring staff and global expansion initiatives.

Announced: 4/14/15 Stage: Series A Participating Institutional Investors: Kensington Capital Partners, Relay Ventures, Difference Capital, JUST EAT Previous Investment: $6 million Founded: 2010

Zomato Raises $50m. The Gurgaon, India-based restaurant search and discovery app allows users to see restaurant information, scan menus, follow food critics, and create personal food diaries. Having used most of its capital raised from the previous round to acquire Urbanspoon, Zomato now seeks to expand into related businesses, and is working on enabling consumers to order food from its website. As seen by its activity in the M&A section of this report, Zomato is attempting to build up the B2B aspect of its business.

Announced: 04/14/15 Valuation: Reportedly between $800 million and $1 billion Stage: Series F Participating Institutional Investors: Info Edge (lead), VY Capital, Sequoia Capital Previous Investment: $113.8 million Founded: August 2008

ZopNow raises $10m. The Bangalore, India-based online delivery portal sells a range of products, including groceries. The company sources its products from the supermarket chain, HyperCity, and claims to be able to deliver goods within 3 hours. Additionally, customers can use ZopNow’s program to track the location of their orders. ZopNow will use the capital for new hires and enhancing the technology platform, as well as expansion into more cities.

Announced: 4/13/15 Stage: Series A Participating Institutional Investors: Dragoneer Investment Group (lead), Times Internet, Qualcomm Ventures, Accel Partners Investment: Not Disclosed Founded: September 2011

Meican Raises $22.6m. The Beijing-based online food ordering service operates in Beijing, Shanghai, Guangzhou, Shenzhen, and Chengdu. Unlike some of its competitors, Meican’s target clients are enterprises that cater for employees. Tech In Asia notes that Meican’s funding “comes as China’s online food delivery sector finally heats up after a lukewarm start.” Meican intends to use the funds to expand into 30 more cities.

Announced: 04/08/15 Stage: Series C Participating Institutional Investors: Dianping (lead), Nokia Growth Partners, Kleiner Perkins Caufield & Byers, Trust Bridge Partners Previous Investment: $13 million Founded: 2010

HotSchedules Raises $20m. The Austin-based hospitality software company (formerly named Red Book Connect) produces mobile, cloud-based technology aimed at improving flexibility and work-life balance for employees in the restaurant, retail, and hospitality industries. Its flagship product of the same name is an employee scheduling and labor management software. HotSchedules also recently expanded its product suite also includes Josabi, a referral-based recruiting tool, and Bodhi, a data integration and delivery tool. The company claims to have a user base of more than 1.8 million in 26 countries. Funding will be used towards product development and sales and marketing initiatives.

Announced: 04/06/15 Stage: Growth Equity Participating Institutional Investors: Bridge Capital Holdings Previous Investment: Not Disclosed Founded: 1999

Swiggy Raises $2m. The Bangalore, India-based food delivery mobile app accepts orders from users and employs personnel to pick up and deliver food from restaurants to the customers’ doorsteps. The company claims its routing algorithm can ensure delivery in less than 35 minutes, and has made 30,000 deliveries in the Bangalore area. Swiggy will use the capital injection to expand into Mumbai, Delhi and Chennai.

Announced: 04/03/15 Stage: Seed Participating Institutional Investors: Accel Partners, SAIF Partners Previous Investment: Not Disclosed Founded: August 2014

Tapingo Raises $22m. The San Francisco-based mobile food ordering platform enables location-aware discovery for consumers and immediate order fulfillment through operational integration for merchants. Currently, the service is live on 84 college campuses. Tapingo’s partner institutions provide hubs where students can pick up and pay for food using the company’s mobile app. Now the company is looking to expand beyond college campuses into other verticals including hospitals and corporations. Tapingo will use the new funding towards off-campus expansion in addition to product development, operations, and marketing.

Announced: 04/02/15 Stage: Series C Participating Institutional Investors: Qualcomm (lead), Carmel Ventures, DCM Ventures, Kinzon Capital, Khosla Ventures Previous Investment: $14 million Founded: January 2012

PARTNERSHIPS

AmEx partners with Jawbone to offer mobile payments services through users’ fitness trackers.

Chipotle Partners with Postmates to launch delivery services in 67 cities in the U.S.

Zomato Partners with Uber to enable customers to book cabs to the restaurants at which they plan to dine.

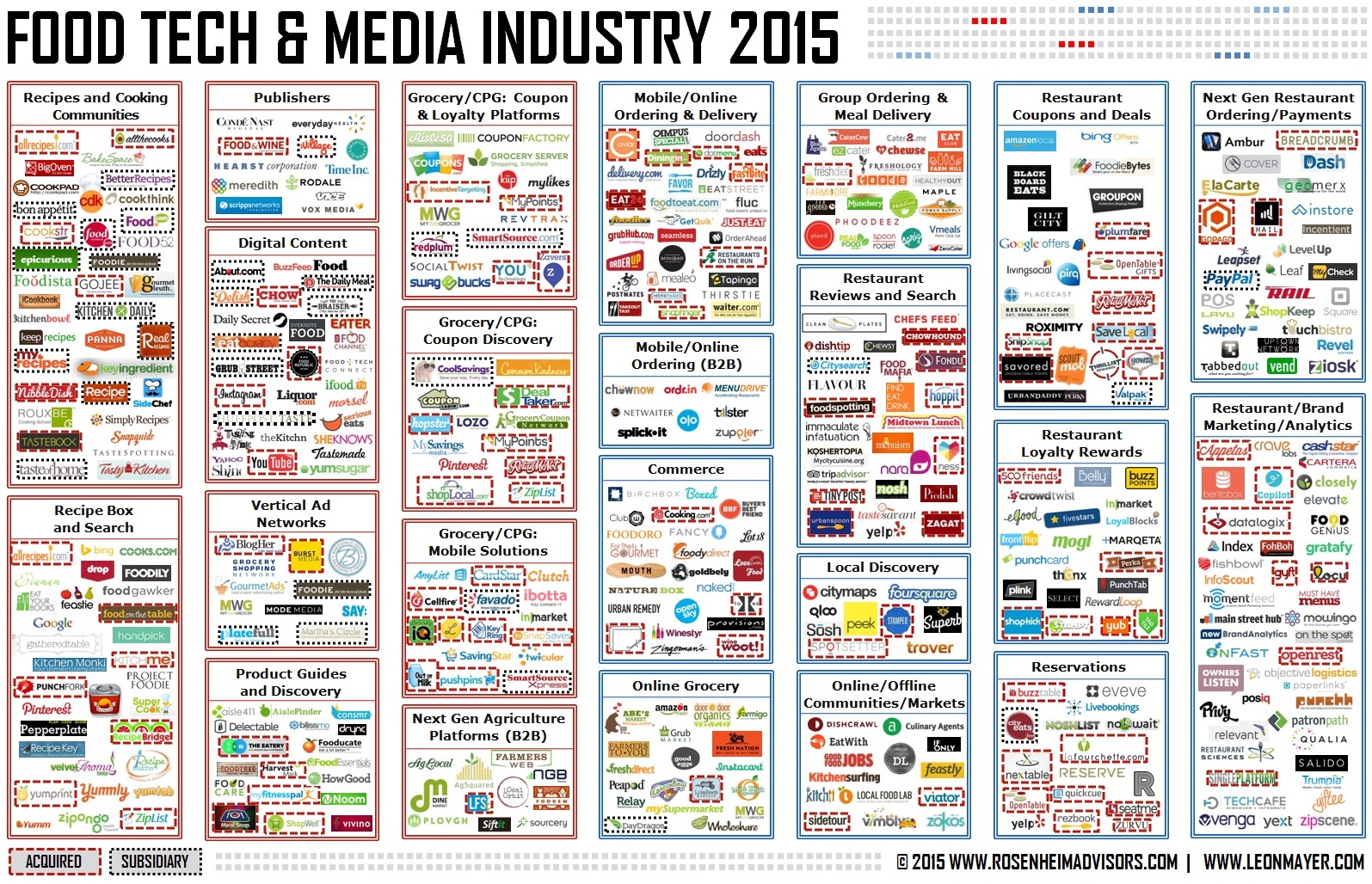

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out the 2014 Annual Report and last month’s round-up.