This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

With two monster acquisitions in the restaurant delivery space (totaling $1.3 billion) and 21 fundraises (totaling $549 million), capital continues to flow into the global food tech and media sector. Close to half of all the deals were based outside of the U.S. and there was a fair amount of early stage capital this month, with over three quarters of the deals Series A or earlier. In particular, meal delivery and e-commerce were dominant themes in the private funding sector with two thirds of the deals within those categories.

Speaking of monster acquisitions (for the food tech space), in early May it was reported that Yelp had engaged Goldman Sachs and is likely exploring a sale. Since the initial report, there have been no further updates, leading to speculations that a sale is “far from assured.” This however hasn’t stopped the industry from weighing in on potential buyers ranging from obvious candidates like Yahoo, Google, and Facebook, to the recent restaurant/local tech entrant Priceline, and even to the old guard news companies in order to strengthen their digital footprint in local.

Yelp certainly has its critics, from business owners to chefs to the food elite, however the tremendous amount of user-generated reviews are a treasure trove of hyperlocal data, with no single U.S. competitor yet able to compete in terms of scale (especially outside of major metro areas). Despite this advantage, Yelp has had a hard time scaling revenues at it only recently began to layer in transactional revenue to its long tail local advertising revenue model. As such, VentureBeat grimly declares that “the road to digital advertising glory is now littered with bodies” and that “Yelp’s history should remind us to be highly dubious of the remaining advertising-driven social businesses.”

While VentureBeat’s caution may be extreme, the tide is absolutely changing and startups must take note. Whether overtly transactional (such as Pinterest’s new “Buy Button”) or more nuanced, such as native campaigns which specifically resonate with a particular consumer segment, the most successful social businesses will be able to insert themselves as close as possible to the purchase path while continuously gathering and analyzing user data to actively drive product and service decisions.

M&A

TripAdvisor Acquires Dimmi. The Sydney, Australia-based online restaurant reservation platform enables users to discover and book a restaurant based on preferred location, availability, price, type of cuisine, and diner review. Dimmi is partnered with over 2,500 restaurants across Australia, and will join TripAdvisor’s restaurant division, TheFork, which is networked with over 24,000 restaurants across 10 markets. The Australian market is important to TripAdvisor, and according to tnooz, Dimmi had previously partnered with TripAdvisor in 2012 to allow TripAdvisor users to make restaurant bookings using technology powered by Dimmi.

Announced: 05/19/15 Terms: Not Disclosed Previous Investment: $11.5 million Founded: 2009

Alfred Acquires WunWun. The New York-based delivery platform promised promising “what you need, when you need,” aiming to deliver anything on-demand by letting users place orders through apps and sending the orders to SMS. According to TechCrunch, Alfred’s purchase of WunWun’s technology is a fire sale, and will enable Alfred to leverage WunWun’s experience with SMS to facilitate conversation with users. As per the company release, Hello Alfred will purchase WunWun’s technology suite in addition to bringing on several key hires.

Announced: 05/11/15 Terms: Not Disclosed Previous Investment: $17.5 million Founded: 9/1/2013

Just Eat Acquires Menulog. The Sydney, Australia-based online food ordering service claims to be the largest food delivery business in Australia and New Zealand, with 5,500 featured restaurants, 1.4 million active users, and LTM March 2015 revenues of £13.5m and EBITDA of £1.2m. The acquisition, which is expected to be EPS accretive in first full year of ownership, will enable Menulog to benefit from London-based Just Eat’s experience in digital marketing, and enhance Menulog’s customer service model to improve efficiencies and drive further growth. According to The Australian, industry consolidation, a trend in the restaurant delivery market, is an important strategic objective for Just Eat and as TechCrunch points out, even three months ago, Menulog merged with rival EatNow in a bid to protect their market share from encroaching competition. Separately, Just Eat’s competitor, Delivery Hero, was quick to point out that Just Eat may have overpaid for the acquisition, as evident by Just Eat’s shares dropping 12 percent following the acquisition.

Announced: 05/07/15 Terms: Approx $687 million in stock ($AUS 855 million) Previous Investment: Not Disclosed Founded: 2006

Ask.fm Acquires Foodily. The San Francisco-based social recipe network lets users browse and rank recipes from a set of criteria. TechCrunch notes that while the Q&A platform Ask.fm has little thematic overlap with Foodily, the acquisition of Foodily’s development team can improve the platform’s social platform and design aspects. Foodily had been looking for an exit strategy since competitor Pinterest gained popularity. According to TechCrunch, the Foodily team will now be focused on the continued development of Ask.fm’s Q&A platform, while the Foodily website and mobile app will be maintained by a separate division within IAC.

Announced: 05/01/15 Terms: Not Disclosed Previous Investment: $7.7 million Founded: 2010

Delivery Hero Acquires Yemeksepeti. The Istanbul-based online food ordering company marks Delivery Hero’s first move into Turkey, and will strengthen its position in the Middle East with the additional markets of the United Arab Emirates, Saudi Arabia, Lebanon, Oman, Qatar, and Jordan. Yemeksepeti (literal translation: “Food Basket”) currently processes more than 3 million orders each month, and is reportedly growing at 60 percent year. At the time of the announcement the deal was the largest ever acquisition in the food-ordering sector. In the acquisition announcement, Delivery Hero stated that Yemeksepeti’s “customer cohorts and reorder rates are among the best in the world,” however did not disclose any specific figures.

Announced: 05/01/15 Terms: $589 million in cash and shares Previous Investment: $44 million Founded: November 2000

FUNDING

TruWeight Raises Series A. The Hyderabad, India-based weight loss services company helps users manage their weight though a combination of counseling and customized nutrition plans focusing on ‘super foods.’ The company sells a food kit with products made with ingredients such as spirulina, barley grass, alfalfa grass, acacia gum, herbs, and foxtail millet. Additionally, TruWeight employs a team of nutritionists who design custom diet plans for clients and offers counseling online or at one of its seven offline centers. The undisclosed capital injection will be used towards launching a mobile app, as well as hiring new people, adding more food products, and opening up physical storefronts in Bangalore and Chennai.

Announced: 05/28/2015 Stage: Series A Participating Institutional Investors: Kalaari Capital Previous Investment: Not Disclosed Founded: 2012

Roads & Kingdoms Raises Angel Funding. The New York-based global web magazine focusing on the cultural and political aspects of travel and food recently received an investment from celebrity chef Anthony Bourdain (reportedly after the founder sent him a drunken email!). The site works with hundreds of freelancers around the globe, and claims to challenge digital media standards by offering higher quality content. The undisclosed amount of funding will be used to increase permanent staffing and to develop a creative content team. Bourdain has joined the company as a partner and editor-at-large, and as part of their partnership, the site will publish a series of food and travel books.

Announced: 05/27/2015 Stage: Angel Participating Investors: Anthony Bourdain Previous Investment: Not Disclosed Founded: 2011

Shift Messenger Raises $1.5m. The San Francisco-based startup provides a communication tool for the workplace to help employees manage their schedules. Shift Messenger has recently launched a web platform for people who do not own smart phones, enabling workers to post shifts online and get notified about timeslots that via SMS. According to TechCrunch, the company’s user numbers have increased five times since February. The company will use the funding to expand its design and engineering teams and add individual channels for teams within workplaces. Shift Messenger’s long-term plans include adding broadcasting tools to enable company leaders to communicate directly with their staff.

Announced: 05/27/2015 Stage: Seed Participating Institutional Investors: Version One Ventures (lead), Golden Venture Partners, Kapor Capital, Commerce Ventures, NewGen Venture Partners, Venrock, QueensBridge Venture Partners Previous Investment: Not Disclosed Founded: 2014

EveningFlavors Raises $500k. The Bangalore-based restaurant reservation platform lets users discover offers and discounts on dining, as well as events and parties. The company uses an automated system to handle requests, and partners with 200,000 restaurants to serve more than 300,000 diners annually. EveningFlavors will use the capital injection to expand into other cities and bring more restaurants and events under its network.

Announced: 05/25/2015 Stage: Angel Participating Investors: Sandiep Shrivatsava Previous Investment: $35k Founded: 2008

FruitDay Raises $70m. The Shanghai-based fresh produce ecommerce retailer claims to be China’s largest, and according to FoodBev Media, the company has achieved annual topline growth of over 150% for the past six years with a projected 10 million customers before the end of the year. FruitDay imports over 80 percent of its produce from foreign markets, and manages quality control over the entire logistics process, from produce selection to after-sale services. The company intends to use the funding to develop its infrastructure, recruit new management, and strengthen its upstream supply chain system. As part of the strategic investment, FruitDay will leverage JD.com’s nationwide fulfilment infrastructure to expand to serve markets throughout China.

Announced: 05/25/2015 Stage: Series C Participating Institutional Investors: JD.com (lead), ClearVue Partners, SIG China Previous Investment: $10.0 million Founded: 2009

Munchery Raises $85m. The San Francisco-based meal delivery service offers prepared meals, created by its own chefs, which are delivered cold for customers to heat up. This strategy enables Munchery to deliver a large quantity of meals over a wide geography without high risks of food spoilage. Munchery currently operates in San Francisco, New York, Seattle and Los Angeles, and will use the funds to expand into more regions, expand service in existing cities, and diversify menu options. Notably, unlike the majority of on-demand app-based services, Munchery’s staff of drivers is comprised of full-time employees with benefits.

Announced: 05/22/2015 Valuation: Approximately $300m Stage: Series C Participating Institutional Investors: Menlo Ventures (lead), Sherpa Ventures (lead), NorthGate Capital, 137 Ventures, Mousse Partners, e.ventures, Greycroft Partners Previous Investment: $32.7 million Founded: April 2011

Chef’d Raises $5.25m. The El Segundo, CA-based recipe and ingredient delivery service provides pre-portioned ingredients for meals that are created in partnership with food publications and celebrity chefs. Notably, the funding came from the founders, not venture capital, and as such, TechCrunch notes that this allows the team to eschew a subscription service in favor of letting customers buy meals individually. The company has plans to open a fulfillment center in Philadelphia to increase the number of delivery days available on the East Coast.

Announced: 05/22/2015 Stage: Angel Participating Investors: Kyle Ransford, Chris Growney Previous Investment: $95k Founded: 2013

Mode Media Raises $30m. The Brisbane, CA-based lifestyle media and ad tech platform provides users with a personalized stream of articles and videos based on the content producers and topics they follow. The company owns the vertical social network Foodie.com, which features stories, photos, and videos on recipes, restaurant and dish reviews, and food related products. The company, previously an IPO candidate before changing its name from Glam Media, has refocused its business as a destination platform where content producers go to promote their content (video in particular). According to Venture Beat, going forward the company “aims to work with mainstream TV, music, magazine and newspaper companies to promote their content too”. The company intends to use the funding to pay off some of its debts and continue investing in its technology platform.

Announced: 05/21/2015 Stage: Series G Participating Institutional Investors: Hubert Burda Media Previous Investment: $214.6 million Founded: September 2011

Drizly Raises $13m. The Boston-based on-demand alcohol delivery service enables users to shop for alcohol online and have their purchase delivered in 20 to 60 minutes. Pando Daily notes the Drizly app’s ease of use for customers and delivery partners, in addition to its proprietary ID verification technology, which help alcohol retailers extend sales while complying with alcohol sales and delivery laws that vary for towns across the nation. Drizly will use the new capital towards product development, sales and marketing, operations, and global distribution.

Announced: 05/18/2015 Stage: Series A Participating Institutional Investors: Polaris Partners (lead), Fairhaven Capital Partners, Suffolk Equity Partners, First Beverage Group Previous Investment: $4.75 million Founded: July 2012

Hungryroot Raises $2m. The New York-based provider of stovetop ready meals has developed six recipes that pair organic vegetable noodles with all-natural, chef-designed sauces, toppings, and optional pre-roasted proteins to create low calorie meals that are gluten and GMO-free. According to PE Hub, meals are sealed with proprietary packaging technology that maintains freshness for up to 10 days without preservatives, which gives Hunryroot a competitive advantage in the packaged meal industry. Hungryroot products are available for delivery in 23 states and the District of Columbia. New funding will be used to expand Hungryroot’s meal offering and enable delivery nationwide.

Announced: 05/12/2015 Stage: Seed Participating Institutional Investors: Lerer Hippeau Ventures, Crosslink Capital, Brooklyn Bridge Ventures, KarpReilly, Quotidian Ventures, Zelkova Ventures, Mesa Ventures Previous Investment: Not Disclosed Founded: 2015

Winnow Raises $900k. The London-based startup addresses food waste in the hospitality sector through their product, the Winnow smart meter. Comprised of a set of smart scales and accompanying tablet app, kitchen staff can use the smart meter to log in the waste thrown away into a connected tablet. Winnow’s algorithm will then analyze and transform the information into a report, providing chefs with insight to make appropriate operations adjustment. The company claims customers have seen 2 to 6 percent improvement in gross margins after using its system.

Announced: 05/11/2015 Stage: Seed Participating Institutional Investors: Mustard Seed, D-Ax Corporate Venture Capital Previous Investment: $236.4k Founded: 2013

Bulu Box Raises $1.5m. The Lincoln, NE-based discovery ecommerce company delivers vitamins, supplements and health snack samples to subscribing users. The company will use the capital injection to continue to grow Bulu Insights, software that uses data aggregated from consumer sample surveys, user profiles, and purchase behavior of Bulu Box customers to provide companies with actionable data. Brands partnering with Bulu Box can use Bulu Insights to view customer psychographics to anonymously compare their products against industry benchmarks.

Announced: 05/11/2015 Stage: Venture Participating Institutional Investors: Flyover Capital (lead), Dundee Venture Capital, Triompf Previous Investment: $2.6 million Founded: April 2012

Pinterest Raises $186m. The San Francisco-based visual search platform is available on the internet, Android, and iOS in over 30 languages. Re/code reports that along with the new funding, which is an extension of the Series G we reported in March, the company will allow employees whose options had vested by April 30 to cash in “a small portion” of their shares. This is the second time Pinterest has offered the option of a secondary sale to its employees, with the first being held in October 2012.

Announced: 05/08/2015 Valuation: Approximately $11 billion Stage: Series G Participating Institutional Investors: Wellington Management Company, Goldman Sachs, Andreessen Horowitz, Bessemer Venture Partners, FirstMark Capital, SV Angel, Valiant Capital Management, Fidelity Investments Previous Investment: $1.13 billion Founded: 2009

Box8 Raises $3.5m. The Mumbai-based on-demand food delivery startup has designed an all-in-one meal box, and processes over 2,000 transactions per day with reported growth of 10x in the past 15 months. Box8 plans to use the funds to further develop its mobile and Web platforms to improve customer experience.

Announced: 05/07/2015 Stage: Series A Participating Institutional Investors: Mayfield Previous Investment: Not Disclosed Founded: 2012

HeyLets Raises $1.65m. The San Francisco-based location discovery app differentiates itself by letting users pick from categories of interests to offer a personalized feed of recommendations. In an effort to keep reviewer information relevant, HeyLets lets users filter out reviews from people who do not have overlapping interests. The app currently features over 100,000 recommendations in 91 countries. The startup plans to use the funding for new hires, and product development, with the goal of enabling e-commerce transactions through the app.

Announced: 05/05/2015 Stage: Seed Participating Institutional Investors: BlueSky Funds Previous Investment: $1.54m Founded: 2011

NatureBox Raises $30m. The San Carlos, CA-based healthy snack subscription commerce company charges a monthly subscription fee for home-delivery of an assortment of snacks, as well as recipes and ideas for nutritional eats. Members can use ingredient, flavor, and dietary filters to choose from over 100 NatureBox-branded snacks. Since its last fundraising round, NatureBox has opened a new shipping center, diversified the types of products it offers, and partnered with American Airlines company to offer its products on some AA flights. The company will use the funds towards developing new products, raising product awareness, and striking more partnerships.

Announced: 05/05/2015 Stage: Series C Participating Institutional Investors: Global Founders Capital (lead), Neuberger Berman Private Equity Funds, Kensington Capital Holdings, Valley Oak Investment Partners, General Catalyst Partners, Canaan Partners, Softbank Capital Previous Investment: $28.5 million Founded: January 2012

SpoonJoy Raises $1m. The Bangalore, India-based delivery startup offers a subscription service as well as an on-demand lunch and dinner option to deliver custom-made meals to both office and residential customers. The company currently operates in Bangalore and processes close to 1000 orders a day. SpoonJoy intends to use the funding to upgrade its technological capabilities and launch in Delhi and Mumbai in the next two months.

Announced: 05/01/2015 Stage: Series A Participating Institutional Investors: SAIF Partners Previous Investment: Undisclosed Seed Founded: April 2013

And a few more from April that we missed:

Dmall Raises $100m. The Beijing-based grocery shopping startup offers services similar to InstaCart. Dmall’s technology consists of a website and mobile app connected to large supermarkets, through which customers within the service radius of each location can place orders. Dmall employees then purchase the items and deliver them to the customer within an hour. Dmall sells products at 5 percent below the supermarket price and to gain early traction, is offering free delivery for orders above $9.50. Founded by former Huawei executive Liu Jiangfeng, Dmall is currently in beta-testing in Beijing, and plans to expand into other large cities, including Shanghai, Shenzhen, and Guangzhou, later in the year.

Announced: 04/30/2015 Stage: Angel Participating Institutional Investors: IDG Capital Partners Previous Investment: Not Disclosed Launched: 2015

SimplyCook Raises $1.1m. The London-based startup is a “food discovery” subscription service that provides customers with monthly recipe boxes containing four recipes and corresponding ingredient kits. Each meal costs between £2 and £6 and includes gluten-free options. Proceeds from the funding will be used to develop marketing initiatives and enhance SimplyCook’s data gathering processes to cater for each customer’s specific taste.

Announced: 04/28/2015 Stage: Ventures Participating Institutional Investors: Episode 1 Previous Investment: Not Disclosed Founded: 2013

Grab Raises $1m. The Mumbai-based food logistics startup provides hyper-local delivery services for restaurants and food enterprises. The company claims that its technology platform allows for pick-up in 15 minutes and delivery in 20 minutes. Grab employs over 500 delivery personnel in Mumbai and works with over 350 partner restaurants. The company will use the new funding to expand into Pune and has plans to increase its delivery staff to 800, in order to process 7,000 daily orders across 700 outlets.

Announced: 04/27/2015 Stage: Seed Participating Institutional Investors: Oliphans Capital Previous Investment: Not Disclosed Founded: 2012

Green Chef Raises $15.5m. The Denver, CO-based organic and seasonal meal kit startup delivers a weekly box with all the ingredients to cook three meals, via FedEx and UPS. According to BusinessDen, the company is quadrupling production space at a new facility in Aurora and will be opening a production hub in the mid-Atlantic region to serve the East Coast.

Announced: 04/14/15 Stage: Series A Participating Institutional Investors: New Enterprise Associates, Global Venture Capital Previous Investment: Not Disclosed Founded: September 2014

PARTNERSHIPS

OpenTable Partners with Aloha to integrate services and expand mobile payment availability.

Olo Partners with LevelUp to introduce the restaurant industry’s first fully turnkey mobile commerce app with built-in ordering, loyalty, and payment solutions.

Edamam Partners with The New York Times to provide nutrition information for The New York Times’ cooking app.

Google Partners with food delivery companies including Eat24 and Seamless to enable users to order food from its search page.

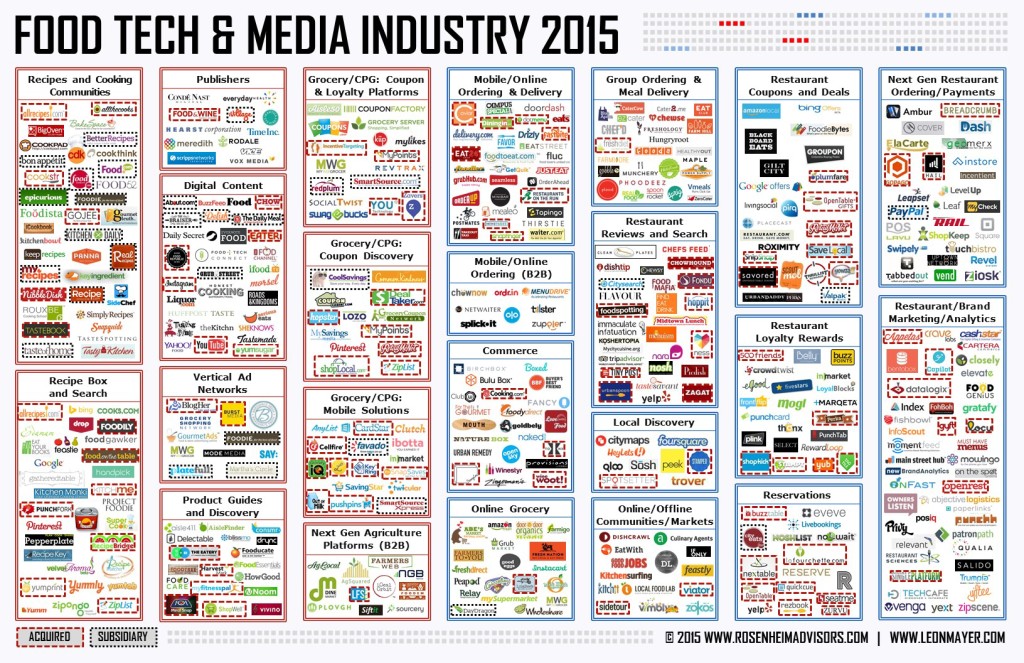

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out the 2014 Annual Report and last month’s round-up.

Love this monthly roundup? Please consider contributing, so we can continue bringing you the news, insights and community you depend on. Learn more HERE.