This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

The first half of 2014 rounded out with over $3.9 billion invested into private food tech and media companies through equity raises ($1.2b) and acquisitions ($2.7b disclosed). In June, eight acquisitions and seventeen notable financings funneled $237 million into the ecosystem (excluding $7.9 billion between the Micros and OpenTable acquisitions). Delivery and brand marketing were both dominant themes, and earlier-stage companies were prominent with nine of the funding rounds at the seed or series A stage.

The big news in June was of course the acquisition announcements of two significant food tech incumbents: OpenTable and Micros Systems (by Priceline and Oracle, respectively). Both acquirors are outside of what anyone would define as the food tech ecosystem, which is relevant because it signals that the sector is further evolving towards increased institutionalization and consolidation as heavyweights in the tech industry look to the food system to increase market share and layer in new revenue streams. This is why it is important to be in tune with the industry dynamics and strategy of the tech and media players on the periphery of food, because if they don’t already have a strategy around food tech, it’s very likely that many will develop one.

On that note, last month both Jawbone and Fitbit announced updates to incorporate food in a deeper way, and we learned that Jawbone quietly acquired a food and nutrition app last summer. Google threw down the gauntlet to beat Amazon in the same-day delivery war, and Amazon rolled out a food takeout service to directly compete with the likes of GrubHub, Seamless and DeliveryHero. The Street speculated that Yahoo may be considering a food tech acquisition, and Go Daddy filed to raise up to $100m in an IPO. Also on the IPO front, China’s Yelp-Like Dianping has more than 100 million active users for its reviews and discounts for food and entertainment, and is reportedly working with Goldman Sachs to prepare for a U.S. IPO.

M&A

Delivery Hero Acquires Controlling Stake in PedidosYa. The Uruguay-based online food ordering platform currently operates a network of 12,000 partner restaurants in nine countries (Argentina, Brazil, Chile, Colombia, Mexico, Peru, Puerto Rico, Venezuela, Uruguay) and will bolster Delivery Hero’s expansion in Latin America, as well as it its mobile app capabilities. PedidosYa will remain an independent brand, and the acquisition is expected to increase Delivery Hero’s representation to 20 countries spanning four continents.

Announced: 6/26/14 Terms: Not Disclosed Previous Investment: $2m Series C, $3m Series B, $2m Series A, $500k Seed Founded: October 2009

FoodPanda Acquires Delivery Club. The Moscow-based online food delivery service aggregator was acquired by FoodPanda, a competitor which is planning aggressive international expansion, expecting to reach 50 countries by 2015. The combined companies will provide access to over 2,500 restaurants in Russia, and Delivery Club will continue to operate under its own brand. Like other Rocket Internet properties, TechCrunch notes that foodpanda “has focused on emerging markets in Eastern Europe, Asia, Latin America, and parts of Africa, where launching a new business is not only relatively inexpensive, but also gives them a chance to build a customer service and logistics network that can help Rocket Internet’s businesses in other verticals.”

Announced: 6/18/14 Terms: Not Disclosed Previous Investment: $8m Series C, $4m Series B, $1m Series A, $400k Seed Founded: September 2009

Priceline Announces Acquisition of Opentable. The San Francisco-based online restaurant reservation company will add 15 million users to the Priceline platform while diversifying the travel giant’s offerings to include restaurant marketing and local business services, and the adding potential for new local e-commerce offerings as well. In turn, Priceline plans to utilize its sophisticated ecommerce infrastructure to help fuel OpenTable’s global expansion and cross-market it with its existing booking customers.

OpenTable will continue to operate as an independent business, based in San Francisco, led by its current management team within Priceline. Given OpenTable’s recent prominence as a strategic acquirer in its own right, it will be interesting to see if the reservation platform will be maintain some control over the purse strings in terms of future acquisitions.

For a deep behind-the-scenes look into the bidding process and acquisition, I’d recommend reading Skift’s solid coverage of OpenTable’s courtship of Priceline, as well as the additional disclosure around the bidding process that surfaced afterwards in satisfying the settlement of a shareholder lawsuit. Other thoughtful reads on the broader trends surrounding deal are at Street Fight Mag and PandoDaily.

Announced: 6/13/14 Terms: $2.6b (Cash, $103/share) Stock Premium: 53% (over previous average stock price in the prior 20 days) Founded: 1998

NGB Markets Acquires Local Food Systems. Local Food Systems developed an electronic platform that allows wholesale food buyers to indicate the type, number of units, and required timeframe of products they need and indicate a preferred price. The wholesale food order management software will expand the NGB Markets platform to include locally-sourced food, and deliver end-to-end online price quotes, ordering data, and market data through integration with NGB’s QuoteMatrix platform, an online service that aggregates vendor price quotes for buyers as well as electronic purchase order submission.

Announced: 6/18/14 Terms: Not Disclosed (Cash and Stock) Previous Investment: $425k Seed Founded: February 2011

Oracle Announces Acquisition of Micros Systems. The publicly-traded Columbia, MD-based restaurant and retail point-of-sale hardware and software company provides enterprise applications, services and hardware in 180 countries worldwide, and is expected to position Oracle as a leader in retail POS software. The combined companies are estimated to account for 19% of the retail POS software installation base. Micros is expected to help boost Oracle’s slowing growth in the application software market, and reflects the growing market size for restaurant technology as businesses adapt to new demands around services offerings, efficiency and security compliance. Despite the increased market share in the space, there are mixed opinions on whether the deal will impact the POS market for smaller restaurants and retailers. The deal is subject to approval by antitrust regulators, which is expected on August 29.

Announced: 6/23/14 Terms: $5.3b (Cash, $68/share) Stock Premium: 27% (over previous average stock price in the prior 20 days from unofficial announcement on 6/16/14) Founded: 1977

InfoScout Acquires Capigami (Out Of Milk). The San Francisco-based developer of the Out of Milk mobile shopping and productivity app allows consumers to build and collaborate on shopping lists as well as manage to-do lists. Users also receive location-based mobile coupons and other promotional offers. As AdAge notes, previously InfoScout relied on consumers who use two shopping apps, Receipt Hog and Shoparoo to scan their grocery receipts in exchange for cash back and other rewards like donations to a school of their choice. Now InfoScout will be able to utilize Out of Milk to bolster its access to supermarket purchase data.

Announced: 6/20/14 Terms: Not Disclosed (Cash) Previous Investment: Undisclosed Seed Founded: 2010

Groupon Acquires SnapSaves. The Toronto-based grocery coupon app allows shoppers to snap a picture of their grocery receipt and receive money back on selected items through a check in the mail. SnapSaves also offers shoppers instant cash back if they’ve paid more at the store for a grocery item than the price shown in the daily deal. As BetaKit points out, “the real value comes from the data that’s being collected. Once a photo of the grocery receipt is uploaded, SnapSaves receives an insight into the shopping habits of thousands of users, such as what store the user shopped at, day of the week, time of day, basket size and type of payment.” It appears the app will continue to operate under its own brand, however the Groupon acquisition will expand the types of offers, and open up the service to Groupon’s 52 million active customers.

Announced: 6/16/14 Terms: Not Disclosed Previous Investment: Not Disclosed Launched: August 2013

Apple Acquires Spotsetter. The San Francisco-based social map app and search engine platform combines location data from sources like Yelp and Zagat with user content across Facebook, Instagram, Twitter and Foursquare to help people discover and decide on new local places to go. As TechCrunch points out, the app will be shutting down, but “the technology, which involves layering social data on top of a maps interface could be used to beef up Apple Maps with features competitor Google lacks.”

Announced: 6/06/14 Terms: Not Disclosed Previous Investment: $1.3m Seed Founded: 2011

FUNDING

TechCafe Raises $450k. The New York, NY-based hospitality tech platform and marketplace is built around helping restaurants to discover and integrate restaurant technologies. The platform includes over 500 technology vendors listed in the online marketplace, which allows restaurants to compare and evaluate the most relevant software to their business. For tech vendors that are encumbered by the high cost of user acquisition, TechCafe serves as a targeted marketing channel that provides high quality leads in a cost effective manner.

Announced: 6/30/14 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: $300k Angel Round Founded: 2013

Crowdtwist Raises $9m. The New York-based SaaS intelligence data platform provides omnichannel loyalty and analytics solutions which are used by brands including Pepsi, Nestlé Purina and others. The white label loyalty program enables brands to gain a deeper understanding of how customers engage across various channels in order to build more targeted and active relationships with customers. The company intends to use the funds to scale and grow the business.

Announced: 6/26/14 Stage: Series B Participating Institutional Investors: StarVest Partners (lead), Bertelsmann Digital Media Investments, TechStars, KBS+P Ventures, SoftBank Capital, Fairhaven Capital Partners Previous Investment: $6m Series A, $750k Seed Founded: August 2009

Tastemade Raises $25m. The Santa Monica, CA-based digital media company provides food-focused video content through the Tastemade technology platform and community. Tastemade will use the new capital to continue developing its platform and community, as well as expanding content partnerships with leading brands to reach millennial consumers interested in exploring new ways to share and celebrate food. Strategic lead investor Scripps was particularly interested in Tastemade’s younger audience, international presence (specifically in Latin America and Europe), and mobile initiatives, such as their restaurant review app launched last year.

Announced: 6/26/14 Stage: Series C Participating Institutional Investors: Scripps Networks Interactive (lead), Comcast Ventures, Redpoint Ventures, Liberty Media, Raine Ventures Previous Investment: $10m Series B, $5.3m Series A, Undisclosed Amount from YouTube Founded: 2012

Deliveroo Raises £2.7m. The UK-based restaurant delivery service focuses on marketing, selling and delivering meals from premium restaurants that do not usually offer takeout. The company intends to use the funds to further strengthen its logistics technologies and delivery platform.

Announced: 6/26/14 Stage: Series A Participating Institutional Investors: Index Ventures (lead), Hoxton Ventures, JamJar Investments Previous Investment: Not Disclosed Founded: February 2013

InfoScout Raises $16m. The San Francisco-based shopper-research firm provides real-time analytics derived from mobile shopping apps that gives brands a comprehensive view of customer behavior, by item, across all retailers. Leading consumer goods companies such as Procter & Gamble, Anheuser-Busch, PepsiCo & Unilever leverage InfoScout’s data and analytics to monitor changes in shopper behavior and better understand the ‘why behind the buy.’ The company will use the infusion of capital to grow its consumer panel to one-million participants and expand into key international markets through the acquisition of the shopping list app, Out of Milk (see M&A section above).

Announced: 6/19/14 Stage: Series B Participating Institutional Investors: MHS Capital, Horizon Partners, Bain Capital Ventures Previous Investment: $5m Series A, $400k Seed Founded: October 2011

Hellofresh Raises $50m. NYC and Berlin-Germany-based subscription meal kit company provides a weekly delivery box containing three to five “ready-to-make meals” with recipes and pre-portioned ingredients. The company also announced expansion to seven new states: Texas, North Dakota, South Dakota, Oklahoma, Minnesota, Nebraska, Louisiana, and reported it ships over a million meals per month in the U.S. The company intends to use funds to continue to increase its marketing presence in the US, as well as expand globally.

Announced: 6/18/14 Stage: Series D Participating Institutional Investors: Insight Venture Partners (lead), Phenomen VC Previous Investment: $7.5m Series C, $10m Series B, Undisclosed Series A Founded: January 2012

Instacart Raises $44m. The San Francisco-based on-demand grocery delivery service connects customers with crowd-sourced personal shoppers who buy their groceries in order to earn a commission (based on the number of items and the number of orders they deliver). Currently offering delivery in 10 U.S. cities, the company essentially serves as a third party home delivery fleet for grocery stores, with relationships and partnerships varying between retailers. The financing round will be used to fuel aggressive expansion to new cities (up to a total of 17 by the end of 2014), continued improvements to the customer experience and the proprietary technology, as well as experimentation around new and innovative models for delivery.

Announced: 6/16/14 Stage: Series B Participating Institutional Investors: Andreessen Horowitz (lead), Canaan Partners, Sequoia Capital, Khosla Ventures Previous Investment: $8.5 Series A, $2.3m Venture Round Founded: July 2012

GatheredTable Raises $2m. The Seattle-based weekly customized menu planning service. In an interview from earlier this year with the Seattle Times, the company stated that it may receive commissions from grocery sales made through the site, a service it plans to launch in the fall, but it doesn’t plan to sell advertising or get sponsorships from food manufacturers. Instead it’s counting on subscriptions to provide most of its revenue. The company expects to use the new funds for a national launch of its consumer software service.

Announced: 6/10/14 Stage: Seed Participating Investors: Geoff Entress (Voyager Capital), Howard Schultz (Starbucks) Previous Investment: $1.8m Founded: 2013

Ibotta Raises $20m. The Denver-CO-based mobile couponing and loyalty app allows users to earn rebates and cash rewards for interacting with brands by responding to polls, watching videos, reading about new products, and other game-like activities within the app. The rebates are then sent directly to users’ PayPal account after verifying their purchases by taking a picture of their receipts. For brands and retailers, Ibotta positions itself as “a pay-per-sale” advertising platform, which only charges if their ads end in a sale. According to TechCrunch, Ibotta plans to use the funding to scale its business and engineering teams, grown its user base, and expand its saving and offers into the offline affiliate market.

Announced: 6/11/14 Stage: Venture Round Participating Investors: Jim Clark, Tom Jermoluk Previous Investment: Undisclosed Series A Launched: 2012

Love with Food Raises $1.4m. The Foster City, CA-based monthly snack discovery service and food marketing data platform helps brands connect with “foodies” who pay a monthly fee to discover new, organic, all-natural products and submit product feedback. Clients include General Mills, Nestle, Green and Blacks Organic Chocolate, SoyJoy, and Lindt Chocolates. The company plans to use the funds to attract more customers and expand the team to further improve its consumer insight offerings.

Announced: 6/11/14 Stage: Seed Participating Institutional Investors: 500 Startups, Angel List, El Dorado Ventures, Ironfire Capital, Kapor Capital, Scrum Ventures, TEEC Angel Fund, Juvo Capital Previous Investment: $695k Seed Founded: 2012

Kitchfix Raises $300k. The Chicago-based healthy meal delivery service targets busy professionals and families by creating and delivering “chef-crafted” ready-to-eat meals using locally sourced, organic, gluten, soy and dairy-free ingredients. The company intends to use the funds to move into a new commercial kitchen, expand its team and operations and accelerate growth.

Announced: 6/11/14 Stage: Seed Participating Investor: Ken Leonard Previous Investment: Not Disclosed Founded:2012

Yext raises $50m. The New York-based cloud-based geomarketing software company provides online-marketing tool for SMB brick-and-mortar businesses. Yext’s product allows marketers to manage their local content, listings, store pages, social pages, campaigns and more through its integrated GeoMarketing Cloud. Listings on multiple sites can be edited at one time, social pages can be synced simultaneously, and Web pages can be built without support. As the company moves closer to a likely IPO in 2015, this new funding will support global expansion and new product development.

Announced: 6/04/14 Valuation: $525m Stage: Series F Participating Institutional Investors: Insight Venture Partners (lead), Institutional Venture Partners, Marker, Sutter Hill Ventures Previous Investment: $27m Series E, $10m Series D, $25m Series B/C, $3.5m Series A, $250k Seed Founded: 2006

Siftit Raises $4m. The Atlanta-based mobile ordering platform makes it easier for restaurants and wholesale suppliers to connect more efficiently, and offers more control of the ordering and spend-management process. The company intends to use the funds to grow in current markets.

Announced: 6/04/14 Stage: Series A Participating Institutional Investor: TechOperators Previous Investment: Not Disclosed Founded: January 2013

Urban Remedy Raises $5m. The San Rafael, CA-based nutrition delivery service sells certified-organic, vegan, raw and ready-to-eat meals, snacks and premium juices direct to consumers via online/mobile and a limited number of Urban Remedy branded storefronts. The company will use the new capital to open a new manufacturing facility, hire more e-commerce and food talent, and accelerate marketing efforts. According to the Wall Street Journal, the marketing initiatives could include direct-response campaigns on television and new branded storefronts, along with possible pop-up shops, and store-in-store retail efforts at gyms, universities or airports.

Announced: 6/04/14 Stage: Series A Participating Institutional Investors: Venture51 Previous Investment: $1m Seed Founded: 2010

Fresh Nation Raises $1m. The Stamford, CT-based online marketplace for farmers markets enables consumers to order food directly from their local markets and have it delivered to their home by personal shoppers. The Fresh Nation marketplace digitizes the product offerings across a broad network of neighboring farmers markets, allowing for the purchase, sale and delivery of fresh products from different locales through a single platform. Furthermore, as PandoDaily explains, “unlike other food delivery businesses, Fresh Nation is actually incredibly capital efficient. The company doesn’t need to invest in storage or purchase product in advance.” In conjunction with the funding, the company announced it had just launched in its first West Coast metro, the Los Angeles area, and will use the cash infusion to expand to other locations in California.

Announced: 6/03/14 Stage: Seed Participating Institutional Investors: Lerer Ventures, Lightspeed Venture Partners Previous Investment: Not Disclosed Launched: June 2013

Dinner Lab Raises $2.1m. The New Orleans-based membership-based supper club produces pop-up dining events and gathers customer feedback from those sessions to inform ideas for new restaurants. According to TechCrunch, Dinner Lab helps local chefs better understand how well their food and concept resonated with guest via an online dashboard that tells them things like how they scored in different areas, how they compare with other chefs in the area, how well they did with the different demographics. Since launching in New Orleans, Dinner Lab has expanded to nine other cities, including San Francisco, L.A., New York, Atlanta, Washington, D.C., Miami, Chicago, Nashville and Austin. According to The Times Picayune, the company will use the funds to help it expand its operation into more cities and grow the data team to gather more market data for the food industry.

Announced: 6/03/14 Stage: Seed Participating Investors: Dr. John B. Elstrott (Chairman of Whole Foods), angels Previous Investment: Not Disclosed Founded: 2011

Brightfarms Raises Additional $2.4m. The New York-based urban agriculture company develops hydroponic greenhouse farms at urban supermarkets and grocery retailers. In addition to growing local produce nationwide, the company also finances, builds and operates local greenhouse farms, eliminating time, distance and costs from the food supply chain. The company signs long-term purchase agreements with supermarkets that feature fixed prices and minimum volume commitments. The round, which now amounts to $7.4m, will enable the company to build commercial-scale greenhouses to meet the increasing demand from the supermarket industry for locally grown produce. As part of the financing, Gregory Oberholtzer will join the Board of Directors at BrightFarms.

Announced: 6/03/14 Stage: Series B extension Participating Institutional Investors: WP Global Partners, Emil Capital, NGEN Partners Previous Investment: $4.9m Series B, $4.3m Series A Founded: January 2011

PARTNERSHIPS

Ibotta partners with Constellation Brands, Mike’s Hard Lemonade Co. and VEEV to drive sales using cash rebates. Customers will be able to use the Ibotta app to purchase both alcoholic and non-alcoholic drinks from a range of retail outlets including BevMo, Specs, and even select local liquor stores. The partnership will help the brands drive customer engagement, reward loyal customers, and increase sales via mobile cash rebates.

EatStreet Partners with Yelp to bring online ordering to more of Yelp’s restaurants and their customers. Customers can now order food directly from many more restaurant pages on Yelp, through EatStreet’s integration into the Yelp platform.

Time Inc.’s online food portal MyRecipes.com utilizing Roku partnership to launch a streaming channel. The MyRecipes channel on Roku is the first in a new distribution partnership between Time Inc. and Roku that was announced in May, and will feature 250+ videos across 12 categories.

aisle411 and Google partner to launch 3D-mapped shopping solution. Through a partnership with Google’s Project Tango, the in-store mobile marketing firm is prepping to launch an in-store solution that enhances the shopping experience through fully interactive 3D maps. A device will be able to determine what section a consumer is shopping in, even what side of the aisle and which products a shopper is browsing at any given time.

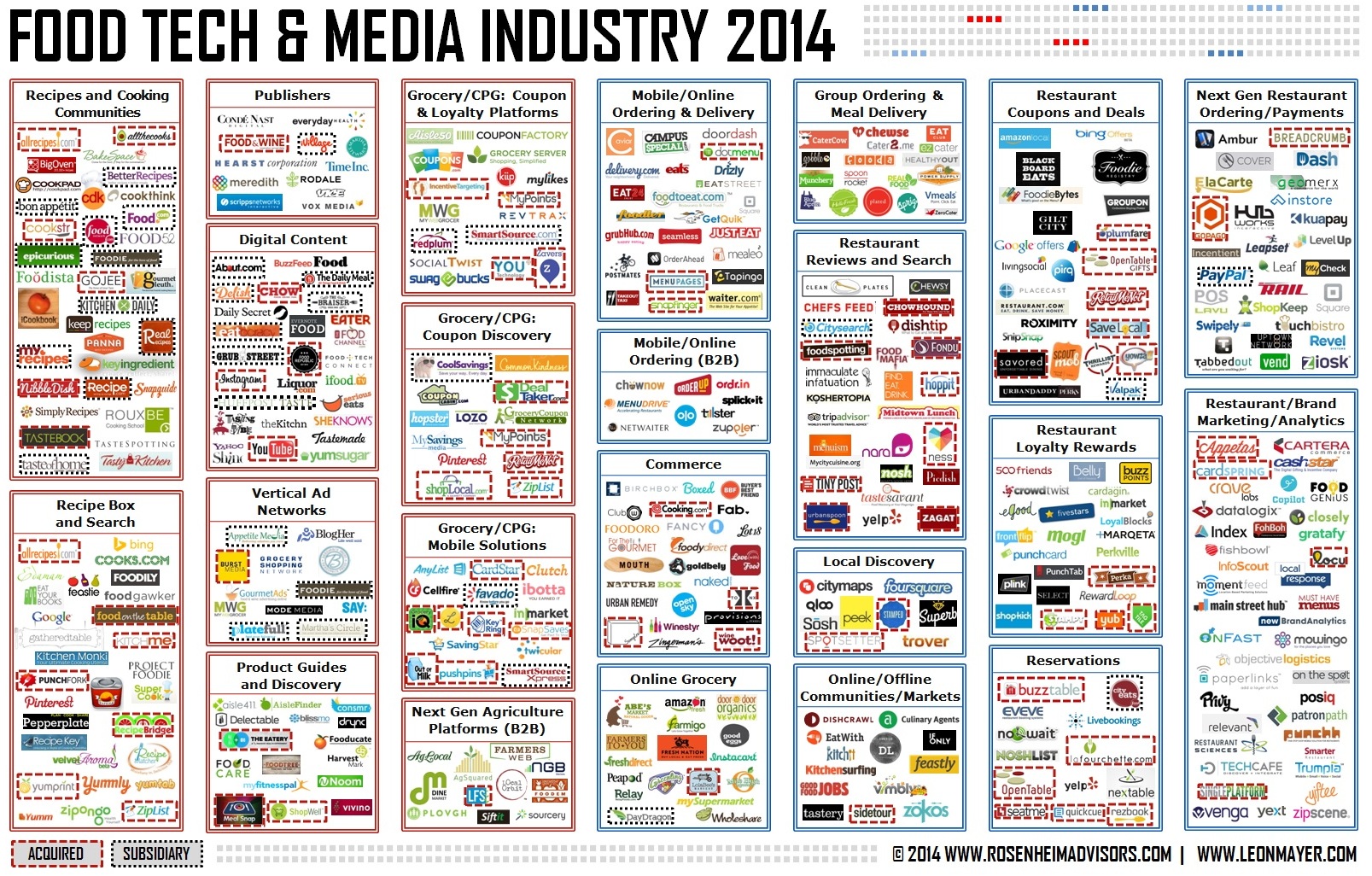

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape.

Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out the 2013 Annual Report and last month’s round-up.

Would you be interested in a round-up of agriculture-related funding, partnerships and acquisitions? Let us know in the comments below.