This is a monthly guest post, by consulting firm Rosenheim Advisors, which highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

This month brought in $420 million of private capital across twenty two global companies, half of which were based in the U.S. There were some sizable deals moving the needle, with ten companies raising more than $10 million and of those, six raising more than $35 million. The five M&A deals hinted at increasing consolidation in the restaurant technology sector, while the funding activity also skewed towards restaurant tech and (of course!) delivery concepts ranging from meals to logistics.

While some “restaurant platforms” are being formed through acquisitions, other companies in the space made news in September by unveiling new seamless experiences for restaurants. Olo launched a delivery platform, called Dispatch, which enables restaurant operators to offer food delivery at scale. Swipely wants to “provide the operating platform that restaurants run on”, creating a one-stop-shop where they can manage all of their tech and service providers. Lightspeed POS raised $61 million around it universal omnichannel platform, and expects to use part of the funds to make acquisitions in the space. And both Delhi-based Zomato and Indian startup Tinyowl announced plans to launch full stack tech platforms for restaurants and kitchens. As technologists strive to create an elegant “integrated solution,” this is an area that will continue to swell, whether driven by M&A or internal innovation.

M&A

WalmartLabs Acquires PunchTab. The Palo Alto, CA omni-channel engagement and insights platform will be used by WalmartLabs to enhance its customer relationship management tools and leverage its software platform to provide targeted offers on the Sam’s Club app and website. Punchtab, which is WalmartLabs’ 15th acquisition in four years, is a multi-channel loyalty and engagement platform that enables agencies, brands, and enterprise organizations to incentivize user behavior and drive business success. As part of the acquisition, six PunchTab technologists will join WalmartLabs. Future plans include applying what it learned through Sam’s Club to other businesses, including Walmart.com.

Announced: 09/22/15 Terms: Not Disclosed Previous Investment: $11.5m Founded: 2011

Velocity Acquires Cover. The New York-based mobile payments app is the first major acquisition of Velocity, an international digital hospitality service, and will enable it to expand its global hospitality platform as part of its strategy to connect venues with tastemakers and hospitality spenders. Rather than taking on additional capital, the company decided to join a larger platform. As Cover’s founder commented to Re/code, “payments is really a hard business.” Re/code elaborates on this point by pointing out how hard it is to “build sustainable payment-processing businesses without enormous transaction volume, and why even much bigger payments startups such as Square and Stripe are diversifying their product offerings to beef up profit margins and create new e-commerce markets.”

Announced: 09/22/15 Terms: Not Disclosed Previous Investment: $7.0m Founded: 2013

Jugnoo Acquires Bistro Offers and Yelo. Bistro Offers, the Chandigarh-based deal discovery platform, and Yelo, the Bangalore-based mobile peer-to-peer service networking platform will enable Jugnoo to be a comprehensive service aggregator, according to Inc42. Jugnoo is a ten month old startup providing apps for both auto rickshaw rides and food delivery. The acquisition will enable Jugnoo to strengthen its position in the hyperlocal marketplace. Jugnoo is currently involved in 10,000 daily transactions, and plans to expand to 40 cities by the end of the year.

Announced: 09/16/15 Terms: $1 million cash and stock Previous Investment: Not Disclosed Founded: April 2014 (both companies)

ShopKeep Acquires Ambur. The Buffalo, NY-based iPhone and iPad POS system, which caters to dining establishments including restaurants and food trucks, will add 1,500 customers to ShopKeep’s merchant base, bringing it to 20,000 across the U.S. and Canada. TechCrunch notes that ShopKeep will keep the product alive as it integrates it. While ShopKeep has its own restaurant product, the acquisition enables the company to further its reach into the restaurant industry and expand overall market share among independent merchants.

Announced: 09/18/15 Terms: Not Disclosed Previous Investment: NA Founded: September 2010

Restalo Acquires Restaurantes.com. The Madrid, Spain-based restaurant reservation platform had been a local competitor of Restalo, another restaurant reservation platform, prior to the acquisition. Restaurantes.com currently partners with 6,000 restaurants in 600 cities across Spain, and the merged entities will operate under the brand of Restaurantes.com, and according to TechCrunch, the merged platforms makes Restaurantes.com a leader in Spain. Following the merge, the companies will launch a new website and app, as well as new benefits programs for users, including the ‘My €uros’ loyalty program in which users can earn up to 4€ per reservation.

Announced: 09/16/15 Terms: “Mid-single million euro” (Up to $5.65m) Previous Investment: Not Disclosed Founded: 2009

The Priceline Group Acquires AS Digital. The Melbourne, Australia-based restaurant reservation platform serves clients from casual eateries to Michelin starred restaurants in over 40 countries, mostly in Australia and the Asia Pacific, and following the acquisition, AS Digital will be integrated into OpenTable. The company’s table reservation and management software, ResPAK, helps restaurants manage front-of-house operations while its brand bookarestaurant.com powers mobile apps, widgets, and websites. According to Skift, OpenTable has been revamping its back-end consumer and business technology platforms, and recently experienced double-digit growth in dining reservations in the U.S. domestic market. The acquisition is part of its strategy to expand OpenTable’s operations into Australian, Japanese, and Asia Pacific markets.

Announced: 09/03/15 Terms: Not Disclosed Previous Investment: NA Founded: January 1983

Dineout Acquires inResto. The Bangalore-based restaurant management software suite will enable Dineout, a table reservation platform, to offer an end-to-end B2B restaurant management platform to restaurants. Following the acquisition, inResto’s entire team will be joining Dineout. According to YourStory, the new product will be marketed as nresto by Dineout, and provide restaurants one dashboard to manage everything from table reservations, home delivery, takeaways, customer feedback, mobile payments, and loyalty programs.

Announced: 09/01/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: Not Disclosed

FUNDING

Ibotta Raises $40m. The Denver, CO-based couponing and loyalty app allows users to earn rebates and cash rewards at over 500,000 stores for interacting with brands and retailers by responding to polls, watching videos, reading about new products, and other game-like activities within the app.. The company will use the funds to scale the platform, grow the userbase, and triple the size of its team, hiring up to 300 new employees. According to TechCrunch, Ibotta is also focusing on new lines of business, including media businesses and “Ibottalytics,” an analytics service offering consumer insights and market snapshots.

Announced: 09/30/15 Stage: Series C Participating Investors: Jim Clark (lead), Tom Jermoluk, Great Oaks, Thomas Lehrman Previous Investment: $33.0 million Founded: January 2011

Farmigo Raises $16m. The Brooklyn-based online marketplace and platform connects consumers directly to local farm-fresh food that is harvested or made-to-order, then customers pick them up from local “food communities,” such as a nearby school or office. The company says it’s selling to more than 15,000 families and adding about 2,000 new families each month. The company plans to expand to Seattle following the raise.

Announced: 09/30/15 Stage: Series B Participating Institutional Investors: Formation 8 (lead), Benchmark Capital, Sherbrooke Capital Previous Investment: $10.0 million Founded: August 2009

Peppertap Raises $36m. The Guragon, India-based mobile app allows users to order groceries and vegetables to be delivered in two hours, with the option to either pay cash-on-delivery or through the platform. This is the company’s third round of investment this year, and the new funds will be used to expand from its 17 current to 75 cities across India. The company is also reporting it plans to close an additional $20 million by the end of the year.

Announced: 09/29/15 Stage: Series B Participating Institutional Investors: Snapdeal (lead), Sequoia Capital, SAIF Partners, ru-Net, JAFCO, BEENEXT Previous Investment: $11.2 million Founded: November 2014

InnerChef Raises $1.66m. The Guragon, India-based “kitchen-as-a-cloud” and food delivery service brings ready-to-eat and ready-to-cook meals to customers in Guragon and South Delhi. Ready-to-make meals include ingredient portions selected, washed, and chopped by professional chefs and can be prepared in under 20 minutes. The company will use the investment to expand its services to Delhi, Bangalore, and Mumbai—launching 10 new kitchens. Funds will also be used to build and launch Indulge, a dessert delivery service, in South Delhi and Guragon.

Announced: 09/24/15 Stage: Seed Participating Institutional Investors: TA Ventures and angels Previous Investment: Not Disclosed Founded: April 2015

Beequick raises $70m. The Beijing-based one-hour delivery service launched with the aim of delivering fresh produce and daily necessities to residents of Beijing. The company has expanded its operations to a dozen major Chinese cities, with 5 million registered users, and processes over 100,000 daily. Beequick does not have warehouses, distribution hubs, or delivery staff, and instead trains owners of mom-and-pop corner shops to complete the last mile delivery. The company plans to use the funding on market expansion in addition to investments in logistics infrastructure.

Announced: 09/23/15 Stage: Series C Participating Institutional Investors: Hillhouse Capital, Eastern Bell Venture, Tiantu Capital, Sequoia Capital Previous Investment: $40.0 million Founded: June 2014

Allset Raises $1.5m. The San Francisco, CA-based mobile app lets users pre-book, -order, and -pay for sit down meals at restaurants during the lunch rush. The app has been tested at 12 restaurants and the company reports it has been shown to save users up to 40 minutes by providing diners with their lunch upon arrival. Every time a reservation and order is made using the Allset app, a flat rate of $1 is charged to both the diner and the restaurant. The company will use the funds to expand operations and publicly launch the app.

Announced: 09/22/15 Stage: Seed Participating Institutional Investors: SMRK VC Fund Previous Investment: Not Disclosed Founded: April 2015

DishCo Raises Angel Funding. The Mumbai, India-based mobile marketplace allows users to book restaurant tables and discover signature dishes. In addition, users can rank dishes and receive location-specific coupon deals. According to Inc42, DishCo offers listing and ranking service for free and only has a fixed subscription fee for restaurants who opt for booking tables, offering coupons and other value-added services. Funds will be used to expand the company—which currently operates in Mumbai, Pune, and Goa—to Delhi, Hyderabad, and Bengaluru.

Announced: 9/21/15 Stage: Angel Participating Investors: Anand Mahindra, Uday Punj, Ashish Hemrajani, Sanjeev Mehra Previous Investment: Not Disclosed Founded: 2015

GrubMarket Raises $10m. The Newark, CA-based online farmers market allows users in the San Francisco Bay Area to purchase fresh and perishable organic, local foods, and nationwide users to purchase natural and organic (non-perishable) products. According to TechCrunch, the company recently shifted the growth strategy, by ceasing fresh product delivery outside of the Bay Area, however the team may reintroduce fresh delivery in certain markets going forward. The company currently has home delivery services for the San Francisco Bay Area as well as mail-order delivery for the continental US states.

Announced: 09/18/15 Stage: Series A Participating Institutional Investors: Fosun Capital Group, Y Combinator, Battery Ventures, GGV Capital, AME Cloud Ventures, Great Oaks Venture Capital Previous Investment: $2.1 million Founded: February 2014

Bueno Foods Raises $600k. The New Delhi, India-based meal delivery service lets customers choose from a menu spanning close to ten cuisines, with “ambitions to build a one-stop global food shop”. Bueno also provides bulk orders and catering services, and currently operates in Guragon and the National Capital Region. According to Deal Street Asia, the new funds will be used for talent acquisition, technology upgradation, operations, data analytics and expansion. Bueno Foods is also planning to build a network of 8-10 satellite kitchens for faster delivery.

Announced: 09/17/15 Stage: Angel Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: 2013

Servy Raises $800k. The New York, NY-based mobile app pays users to give restaurants private feedback. Customers take surveys, which are customized by the restaurants, and are reimbursed 5% to 75% of the price of their meal. According to TechCrunch, the company has an algorithm that uses demand to determine how much reimbursement is offered to diners. The proceeds will be used to expand the company, which currently operates in 80 restaurants in New York City.

Announced: 9/17/15 Stage: Seed Participating Institutional Investors: Riverpark Ventures, DreamIt Ventures, SOSV, FOOD-X, Beacon Funding Corporation Previous Investment: $40k Founded: September 2014

HelloFresh Raises $84.7m. The New York, and Berlin, Germany-based subscription meal kit company delivers boxed “ready-to-make meals” containing with recipes and pre-portioned ingredients on a weekly basis. The company operates in seven different countries in Europe, the U.S., and Australia, and in the third quarter, HelloFresh delivered 13 million meals to its 530,000 active subscribers, up from 3.2 million meals and 115,000 subscribers in the year-earlier period. This is likely the last capital raise ahead of an expected IPO in Frankfurt this fall, Germany, with the company using the capital injection to consolidate its position.

Announced: 09/16/15 Valuation: $2.9 billion Stage: Series F Participating Institutional Investors: Baillie Gifford Previous Investment: $193.5 million Founded: 2011

Lightspeed POS Raises $61m. The Montreal-based provider of apps and services helps retailers manage and sell inventory across online and offline shopfronts. The company currently processes $10 billion annually in transactions from 25,000 customers across 100 countries, and reportedly has grown 745 percent year-over-year in Europe, largely due to the company’s restaurant product launch and European payment processing regulations requiring restaurants to upgrade their POS systems. The company will use the funding to grow internationally, make acquisitions to grow its omnichannel sales model, build and scale its infrastructure, expand eCommerce offerings, and support its customer base.

Announced: 09/16/15 Stage: Series C Participating Institutional Investors: Caisse de Depot et Placement du Quebec (lead), Investissement Quebec (lead), iNovia Capital, Accel Previous Investment: $65.0 million Founded: March 2005

Quiqup Raises “Multi-million” Series A Funding. The London-based on-demand pickup service lets customers order anything on-demand for delivery to homes or other premises with an hour. The company currently operates in Central London and employs couriers known as Quiquees to go into a store or restaurant to make the purchase, enabling brick and mortar retailers to compete in e-commerce. Since its launch, Quiqup has fulfilled over 100,000 orders. Funding will be used to increase its market share in the UK as well as expand into further markets. TechCrunch notes that since the investors also operate in the delivery space, Quiqup can capitalize on the synergies between its two investors.

Announced: 09/15/15 Stage: Series A Participating Institutional Investors: Delivery Hero, Global Founders Capital Previous Investment: Not Disclosed Founded: September 2014

HappyFresh Raises $12m. The Jakarta Pusat, Indonesia-based food delivery service allows consumers to shop for groceries online. All items are picked by a personal shopper and arrive within an hour. The company currently serves users in Indonesia, Thailand, Malaysia, and Taiwan and will use the investment to expand HappyFresh across Southeast Asia. In addition, the company plans to launch HappyRecipe, a recipe platform within HappyFresh that will give consumers recipe suggestions for their shopping items.

Announced: 09/14/15 Stage: Series A Participating Institutional Investors: Sinar Mas Digital Ventures, Asia Venture Group, BEENEXT, Ardent Capital, 500 Startups, Cherry Ventures, Vertex Venture Holdings Previous Investment: Not Disclosed (“Multi-million dollar seed round”) Founded: October 2014

Sun Basket Raises $4.5m. The San Francisco-based delivery service provides recipes and pre-portioned ingredients for home-cooked meals focuses on easy-to-prepare recipes and sustainably sourced, organic ingredients. The raise will be used to bring on a COO/CFO, as well as expand the service to other states and build a larger facility in the San Francisco Bay Area. The San Francisco-based company serves the western United States and expanded to seven states, including Arizona.

Announced: 09/13/15 Stage: Series A Participating Institutional Investors: PivotNorth Capital (lead), Baseline Ventures (lead), Vulcan Capital, Tyler Florence Group, Rembrandt Venture Partners, Roth Capital, Correlation Ventures, Relevance Capital Previous Investment: Not Disclosed Founded: April 2014

Zomato Raises $60m. The Gurgaon, India-based restaurant technology platform recently introduced food delivery services in India and Dubai, and will be rolling out food ordering services in Australia and South Africa this month. The company also launched a service that enables restaurants to create white-labeled apps. Funding will be used to push into new verticals, including food delivery, payments, and table reservations.

Announced: 09/07/15 Stage: Series G Participating Institutional Investors: VY Capital, Temasek Previous Investment: $163.8 million Founded: August 2008

Holachef Raises Additional Angel Funding. The Mumbai-based web and mobile app for food delivery operates in Mumbai and Pune, where it has seen substantial growth, The Times of India reports. The company states that the guidance of Ratan Tata, the round’s investor, will enable the company to become a leader in the food-tech space.

Announced: 09/02/15 Stage: Angel Participating Angel Investors: Ratan Tata Previous Investment: $3.4 million Founded: 2014

Bindo Raises $2m. The New York, NY-based cloud-based business management solution for brick-and-mortar merchants announced the beta launch of a new iPad point of sale system for restaurants, called “Bindo POS for Restaurant”. The system will allow restaurants to easily integrate telephone and online orders, table management, reservations, and ingredient level tracking. Bindo will use the investment to launch the new POS system globally, with fifty percent of the current bridge funding being used to support the company’s Asian operations, Hong Kong and Singapore in particular. According to e27, Bindo seeks to raise a more significant Series A round to “give its expansion into Asia an extra push and help the company launch a long-talked-about marketplace app Bindo Market in New York and Hong Kong”.

Announced: 09/02/15 Stage: Seed Bridge Participating Institutional Investors: Not Disclosed Previous Investment: $1.8 million Founded: December 2013

Yummly Raises $15m. The Redwood City, CA-based food discovery platform that uses patent-pending technology and proprietary data to understand food and taste. The company, which has almost 10 million registered users, partners with more than 6,500 companies through API and native mobile integrations including DuckDuckGo, Instacart, Jawbone, Nutrisystem, United Healthcare and Stanford University. Through partnerships with Instacart and Blue Apron, users can also order ingredients for on-demand delivery. The company will use the investment to increase its team, expand its products and enter new partnerships.

Announced: 09/01/15 Stage: Series B Participating Institutional Investors: Bauer Venture Partners Previous Investment: $8.4 million Founded: 2009

Saucey Raises $4.5m. The Los Angeles, CA-based 1-hour alcohol delivery service and mobile app currently serves users in San Diego, San Francisco, Los Angeles and with the new funding, Chicago. Saucey sets itself apart from competing delivery services by having its own couriers— which can reportedly make up to six deliveries per hour. The company will use the investment to expand Saucey’s services to Chicago, develop advanced purchasing tools within the app, build out personalization, and enhance data and advertising.

Announced: 09/01/15 Stage: Seed Participating Institutional Investors: Blumberg Capital (lead), Structure Capital, Altpoint Ventures, T5 Capital, Hashtag One LLC Previous Investment: Not Disclosed Founded: October 2013

Zomato Invests in Pickingo, Grab and Delhivery. Gurgaon-based Pickingo and Mumbai-based Grab are both hyper-local delivery services that allow dine-in only restaurants to outsource delivery services. Pickingo operates in six cities in India, employs over 700 “field executives”, and with the investment by Zomato, the company plans to leverage Zomato’s online ordering business and relationships with restaurants across India. Grab claims to have delivered over 8 million orders over the past 2 years, will use the funding to advance its last mile delivery technology. Delhivery is an e-commerce enablement company which offers last mile deliveries, third party fulfillment, warehousing services and software solutions such as channel integration software for sellers selling across multiple platforms.

Announced: 09/01/15 Stage: Venture Participating Institutional Investors: Zomato Previous Investment: Pickingo: $1.3 million; Grab: $1 million; Delhivery: $127.5 million Founded: Pickingo: 2014; Grab: 2012; Delhivery: 2011

PARTNERSHIPS

Foursquare Partners with OpenTable to allow users to see and book available tables via Button.

Revel Systems Partners with Apple to create point-of-sales system for the Apple iPad.

Target Partners with Instacart to launch same-day grocery delivery starting at $3.99.

MyCheck Partners with Marketing Vitals to share and integrate data to help restaurants further leverage insights.

Postmates Partners with Walgreens to offer same day delivery.

MyCheck Partners with Round It Up America to enable diners to donate to RIUA charities when viewing their bill via branded restaurant mobile payment apps.

Qualia Partners with Ibotta to deliver conversion data analytics to cross-platform marketers.

Zomato Parters with Delhivery to improve last-mile delivery experience for users placing orders through Zomato.

DoorDash Partners with 7-Eleven to deliver drinks, food, and household goods in 45 minutes or less.

Amazon Partners with Fresh Nation to deliver farmers market produce.

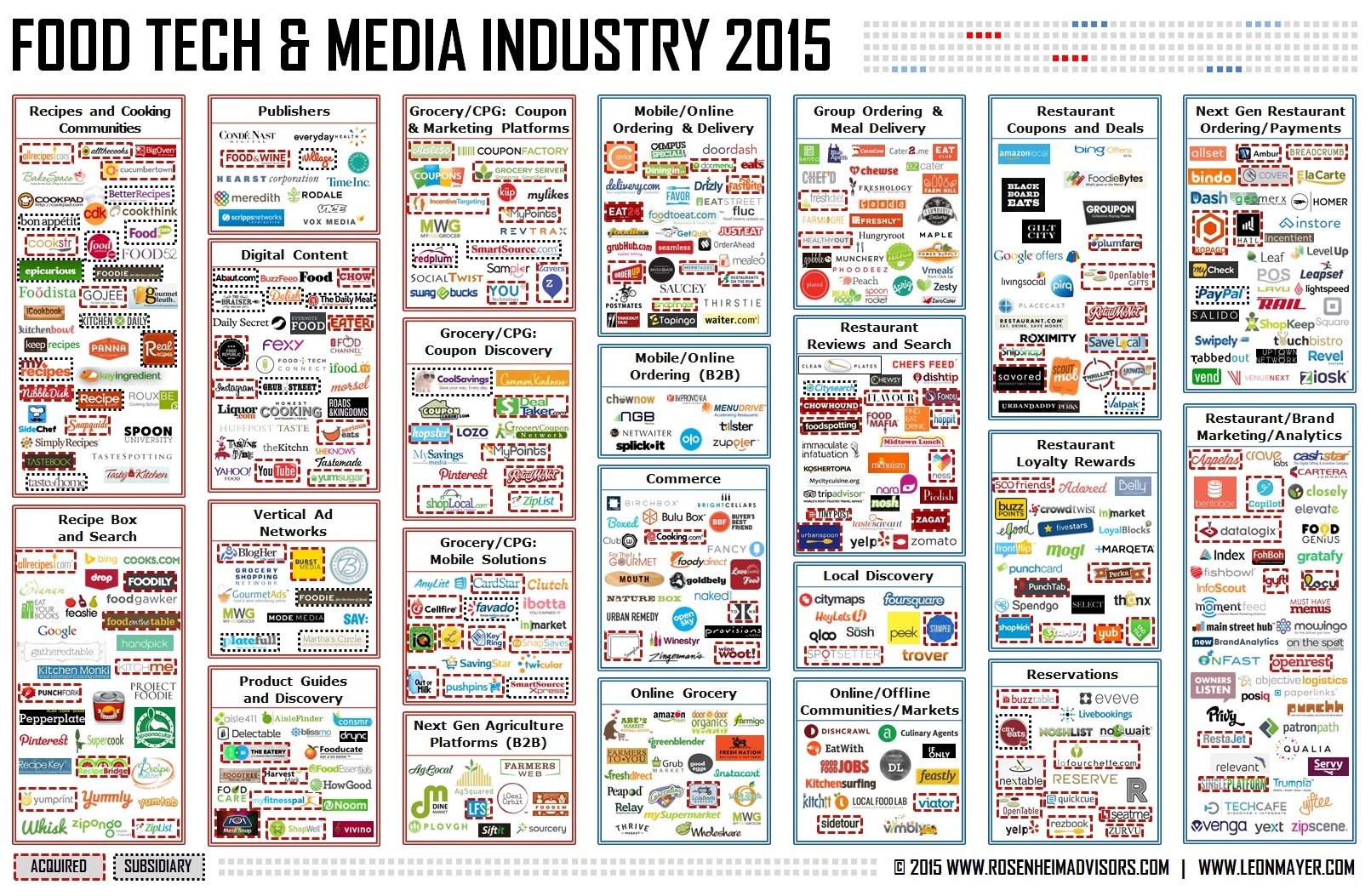

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.