Every year, Food+Tech Connect dives into the trends that are transforming the way our food is produced, sold and consumed. Earlier this week, we published a roundup of the year’s 10 most far-out, futuristic trends. And now we examine Phil Lempert’s, CEO of The Lempert Report and author of SupermarketGuru.com, food industry foresights for 2014 to see how they relate to technology. As in years past, his predictions are aligned with many topics we’ve explored over the past year, including healthy snacking, alternative proteins and consumer demand for greater transparency when it comes to our food.

Every year, Food+Tech Connect dives into the trends that are transforming the way our food is produced, sold and consumed. Earlier this week, we published a roundup of the year’s 10 most far-out, futuristic trends. And now we examine Phil Lempert’s, CEO of The Lempert Report and author of SupermarketGuru.com, food industry foresights for 2014 to see how they relate to technology. As in years past, his predictions are aligned with many topics we’ve explored over the past year, including healthy snacking, alternative proteins and consumer demand for greater transparency when it comes to our food.

Below is a summary and analysis of some of his ideas for the coming year. Quotes are from Lempert’s summary on Supermarket Guru. You can read his complete list of trend predictions here.

#1. The Emergence of the “IndieWoman”

“Almost 31 million strong, the “IndieWoman” is 27 and older, lives alone and has no children and spends $50 billion on food and beverages each year. They have no time, so look for more brands to offer more semi-homemade meals that use fresh, high-quality ingredients.”

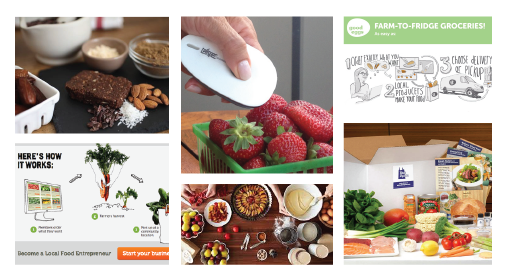

There’s been an explosion of meal kit subscriptions, which garnered a lot of buzz and investment this year. These companies often target young professionals who can afford the $10+ price tag per meal, making them ideal for the “IndieWoman” who has limited time but has the means to spend more on fresh, healthy, easy-to-prepare food.

This year, we’ve followed a number of startups that are working to make home dining more accessible, easy and healthy through dinner kits and dinner delivery. They include:

Blue Apron offers flexible meal plans and delivers pre-measured ingredients and step-by-step recipes directly to your door. The leader in the space, it has received $8 million in funding and currently serves 80 percent of the country.

Real Food Works partners with local (Philadelphia-only for now) restaurants that prepare meals according to the company’s taste and nutrition standards. The company recently raised $175 thousand from Benjamin Franklin Technology Partners and $200 thousand from the city of Philadelphia’s Startup PHL Seed Fund.

My Power Supply works with experienced chefs to create locally-sourced, uber-healthy meals and sells them through its e-commerce platform. Power Supply targets “activated communities” and leverages local gyms and yoga studios as distribution centers.

Sprig the San Francisco-based healthy meal delivery startup, prepares chef-made, locally-sourced meals to customers. And unlike other meal deliveries that require users to place orders days or hours in advance, with this service they can place orders at any time and the company delivers meals within 20 minutes.

Plated delivers weekly-changing recipes, along with all the fresh ingredients you need to prepare them directly to your door, for $12 per person per plate. The TechStars backed company raised a $1.4 million seed round led by ff Venture Capital last May.

#2. Better for You Snacking

“The NPD Group found that as snacking increased, so did an individuals’ overall diet quality. Healthy options are on the rise. Look for supermarkets to replace high-sugar, high-fat snacks at the checkout with healthier on-the-go offerings.”

As food-related health problems persist and people become increasingly concerned with what they eat, companies big and small are working to find innovative ways to help them eat more healthfully, such as un-processed, minimal-ingredient snacks.

NatureBox, one such snack game-changer, produces nutritionist-approved snacks and uses the subscription box model to sell them direct to consumer. This distribution channel allows the company to circumvent retailers and to establish a direct relationship with its customers. Last year, the company launched 60 products and shipped 50,000 boxes. This year, it projected it will add over 100 unique products and ship over 1 million boxes. And its average product development life cycle is 3 months. It’s been so successful that it raised $10.5 million in just 7 months.

Healthy snack marketplace Love With Food offers subscription boxes of unique, hard-to-find natural and organic snacks for as little at $10 a month. The platform combines an e-commerce platform with its sampling subscription to create an innovative distribution channel. It also collects useful data regarding customer preference for the food brands it carries.

But not everyone has been successful with this model. Earlier this year, Walmart shuttered its snack subscription box.

#4. Click to Cook

“People rely more on their mobile phones when grocery shopping. Next: the ability to select a recipe, order ingredients and check-out directly from mobile devices or in-car touch screens and drive-through windows for quick order pickup.”

We’ve been talking about this trend for a while, but before consumers can seamlessly buy ingredients from recipes, the products needs to be available for purchase online. This year there are a bevy of startups that got us one step closer to streamlining the process from app to kitchen counter.

Same-day delivery service Instacart, for example, has trained personal shoppers who will pick up and deliver customers’ groceries in just 1 hour. Currently available in San Francisco, Boston and Chicago, the shoppers can get over 70,000 items from Costco, Whole Foods and Safeway. Whole Foods is testing out online ordering with a new ‘click and collect’ system at a store in Pennsylvania. And Amazon is reportedly launching an online wholesale store called “Pantry,” which will sell 2,000 items. Additionally, Amazon Fresh, Amazon’s same-day and next-day delivery service, expanded into Los Angeles and San Francisco this year, and delivery by drone may only be a few years out.

A number of companies who leverage technology to make it easier for eaters to buy directly from small farmers and producers expanded their operations this year. They include:

Farmigo, originally a community supported agriculture (CSA) management software company, pivoted this year and now boasts a network of social entrepreneurs that leverage the company’s platform to run their own food communities. The Champions initiative, as it’s called, is basically an Avon for food, and supports aspiring food entrepreneurs in addition to farmers.

Good Eggs strives to sustain local food systems world-wide and offers an online farmers market to customers in San Francisco, Los Angeles, New York and New Orleans, currently. The company recently raised $8.5 million in Series A funding to grow its existing marketplaces and launch new cities in 2014, which put it on equal financial ground with others in the space like Relay Foods and Greenling. .

#7. Rise and Shine – The New Way to Start Your Day

“Breakfast remains one of the most important meals of the day. In 2014, consumers will look to add more protein to their first meal, to live a healthy lifestyle without compromising taste and indulgence. Look for more protein-rich and convenient breakfast options.”

Protein continues to be a food industry buzz word. And as Lemphert predicted last year, alternative proteins have garnered lots of attention and investment in 2013. So as consumers look to beef up their breakfasts in 2014, protein alternatives such as a plant-based “scrambled egg” from Hampton Creek Foods will most likely be available on Whole Food’s shelves. Our list of far-out food tech and food science trends contains a couple more wacky proteins too look out for in 2014.

Our online series Hacking Meat explored how we can leverage information and technology to make meat more sustainable, profitable and healthy for all. Andrew Gunther of Animal Welfare Approved writes a call to action for expanding the network of conscious consumers and Mark Post of Maastricht University gives us a glimpse at the lab-grown beef of our future. You can read the complete list of protein-focused submissions here.

#8. Packaging Evolves to Share More with Consumers

“Consumers want more information, but the area of the package is limiting. Using a mobile device, shoppers will learn more about an ingredient or health claim by simply focusing the device on the label to tell where the ingredients come from, who prepared the food, the company’s history and even offer other customer reviews and ratings.”

Consumer apps like Fooducate, ScanAvert, ShopWell, and Buycott are working to demystify food labels, help consumers make healthier choices, and bring more transparency to food production. Newbie on the food transparency scene, TellSpec, goes beyond the label and analyzes any food’s calories, nutrients and allergens. It combines a hand-held device with a laser and a spectrometer with an algorithm in the cloud and a blue-tooth enabled app. TellSpec can detect chemicals that the FDA does not require to be labeled, like mercury and potentially harmful artificial food dyes such as Yellow #5.

#9. Millenials Make the Supermarket Social

“57 percent of Pinterest, is made of food related content with one-third saying they have purchased food or cooking items after seeing them on site, according to a survey by PriceGrabber. Next up: “click to buy” for consumers looking to purchase ingredients for a recipe on Pinterest and have them delivered to their homes.”

We definitely agree with this prediction and have seen the click-to-buy option extend into food media sites this year, as well. One prime example is Food52’s 2013 launch of Provisions, the recipe communities’ e-commerce arm.

The food media landscape has done a 180 in the digital age and companies have to experiment with new business models and utilize innovative content distribution to stay in the game. At our panel “Food Media Re-imagined: E-commerce & Digital Strategies” angel investor Joanne Wilson, managing editor of Bon Appetit Stacey Rivera and Hesser spoke about the changes they’ve seen in food media and the challenges they’ve faced. Wilson named the proliferation of social media as the single greatest catalyst for brands to create more user engagement and game-changing content. It will be interesting to see the impact a potential click-to-buy partnership with Pinterest (and other visually based social sites) could have on food commerce companies.