This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

February was an exceptionally lucrative month for the food tech and media industry, with a reported $1.8 billion invested into the sector through 19 acquisitions and thirteen private capital raises. Impressively, this figure doesn’t even include thirteen deals which had undisclosed terms.

Rocket Internet and its newly formed “Global Online Takeaway Group” dominated the activity with an acquisition tear (twelve acquisitions were related to Rocket Internet), representing an aggregate of $856 million invested (still less than half of the total reported influx). But in fact, platform plays were reflected in many of the M&A deals in February. Consolidation was seen both through newly created platforms such as Under Armour’s UA Record, or the merging of older legacy businesses into new platforms, such as Grubhub’s two delivery acquisitions and Heartland’s two POS acquisitions.

Of the many significant developments in the online ordering and delivery sector this month, I’ll begin with Rocket Internet’s substantial strategic move to “create the biggest Internet-based food-ordering service outside of China.” The publicly-traded Berlin-based e-commerce and investment group has been funding the rapid global consolidation of the food delivery sector over the years through its numerous holdings, and now has made a significant move to consolidate its own investments in the sector (now including foodpanda, Delivery Hero, Talabat, La Nevera Roja, Pizzabo and Yemeksepeti) to form the “Global Online Takeaway Group.”

There were a series of transactions that accomplished this feat (this press release goes into further depth), however two of the cornerstone transactions involved the 30% minority acquisition of Delivery Hero (in March it was further increased to approx. 40%), and the increased direct ownership in foodpanda to 52% (as a result of primary and secondary transactions in a new fundraise announced in March). Further acquisitions and funding details are detailed in the M&A and Funding sections below.

I definitely recommend spending some time with Rocket Internet’s presentation discussing its investment thesis in the food sector to gain a clearer understanding of the vision behind the consolidation – some great industry stats in there as well. Notably, although HelloFresh is key to Rocket Internet’s thesis on investing in the food and grocery sector, HelloFresh is not part of the newly created “Global Online Takeaway Group.”

As mentioned above, Grubhub also made some news in February with its foray into food delivery through the acquisition of two 25+ year old companies who provide restaurant delivery and corporate catering services. Grubhub said the move was intended to expand the total addressable market from restaurants that already offer delivery, and would create both economic and service advantages for a Grubhub over a third-party logistics strategy.

This could be a game changer for Grubhub, and Dan Primack at Fortune notes it may make it an attractive acquisition target in its own right if Grubhub can own the restaurant delivery business, but Street Fight also points out that it’s “unclear whether Grubhub’s scale between markets actually improves the economics or quality of a delivery network in a given market.” Street Fight goes on to discuss the potential liabilities that come with operating its own proprietary network through a contract labor model, and further notes, “If delivery is [purely] a commodity… then the company would be better suited to maximize reach and reduce liability by leaving the operations to third parties. If not, then the move will help Grubhub enter a potentially massive market.”

On that note, it is interesting that Yelp, which previously developed its online ordering network through partnerships with third party companies as part of its Platform initiative, made a move in stark contrast to this strategy by acquiring Eat24 to now operate its own proprietary ordering platform. While a Yelp spokesman told Street Fight that the company expects its “online booking and ordering partners to continue as Platform partners,” it’s fair to assume that partners’ revenue streams will be impacted, as Eat24 will now likely hold precedent over other companies. Read below for additional details and thoughts on the acquisitions.

M&A

JustEat Acquires SinDelantal.Mx. The Mexico-based online ordering platform will add 3,000 restaurants in Mexico, and a Latin American presence to the London-based, publically traded JustEat. TechCrunch reports that the acquisition is “thought to be one of the largest, if not the largest, online company exits in Mexico.”

Announced: 02/16/15 Terms: Estimated to be “north of $20 million” Previous Investment: $3.2m Founded: January 2012

Heartland Acquires Dinerware and pcAmerica. The payments processor and a provider of merchant business solutions continued it shopping spree in the hospitality and retail POS markets through the acquisition of both Dinerware and pcAmerica, two leading point-of-sale companies focused on the restaurant, hospitality and retail sectors. The company reported that these two cloud-based POS systems will overlap with what is being developed by Leaf (which Heartland acquired in August 2014), and consequently it will stop POS development and write down related POS assets at Leaf, though “certain elements of Leaf’s capabilities will become part of Heartland Commerce.”

Announced: 02/13/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: Dineware – 2000; pcAmerica – 1985

Yelp Acquires Eat24. The San Bruno, CA-based food delivery platform will expand Yelp’s services to include food ordering. As Street Fight points out, Yelp has spent the past 18 months developing partnerships with online ordering and booking services as part of its Platform initiative, which included Eat24 as well as other delivery partners like Delivery.com, in order to allow integration within Yelp’s listing pages so that users can book and order food without leaving the search page. In terms of the larger industry implications, Street Fight comments that Yelp has now essentially become Grubhub’s largest competitor other than Google, and “reflects an ongoing verticalization of the search industry driven by a mobile consumer who increasingly expects to find and buy in the same app.” This may be the case on the consumer-facing side of the business, however Grubhub’s deeper integration via its new delivery network may create stronger ties to infrastructure and margin improvements for restaurants that Yelp can’t provide.

Announced: 02/10/15 Terms: $134m ($75m stock, $59m cash) Previous Investment: Not Disclosed Founded: March 2008

Rocket Internet’s “Global Online Takeaway Group” Acquires Talabat. The Kuwait-based food delivery portal operates in Middle Eastern countries including Kuwait, Saudi Arabia and the United Arab Emirates with over 1,300 partner restaurants, and will be part of the newly created Global Online Takeaway Group.

Announced: 02/11/15 Terms: $169.9m Previous Investment: Not Disclosed (but this article discusses the company’s growth and investors through the years) Founded: January 2004

Foodpanda Acquires Six Companies in Asia, One Company in the Middle East. Shortly after a series of acquisitions in Europe, Latin America and India, the foodpanda group (now a part of Rocket Internet’s “Global Online Takeaway Group” – see above) continues to acquire market share through the addition of six more companies in seven countries across Asia, including the takeover of JustEat’s India operations, which complements the recent TastyKhana acquisition. According to The Economic Times, JustEat had relinquished its majority stake to 49.9% in its India entity in November 2013, when Axon Partners Group and Forum Synergies India invested an undisclosed amount. The other acquired companies and countries include: Room Service, a brand of Food Runner, in Malaysia and Singapore; City Delivery, also a brand of Food Runner, in the Philippines; EatOye in Pakistan; Koziness in Hong Kong, and in Thailand, foodpanda entered into a partnership with Food By Phone. Separately, foodpanda acquired 24h.ae, an online food ordering marketplace in the United Arab Emirates founded in 2011.

Announced: 02/06/15 and 02/11/15 Terms: Not Disclosed

Rocket Internet’s “Global Online Takeaway Group” Acquires La Nevera Roja and Pizzabo. The two ordering and delivery startups, La Nevera Roja, an online food ordering platform providing delivery and takeaway service, and Pizzabo, a Bologna, Italy-based delivery platform for takeaway pizzas and other food, will be part of the newly created Global Online Takeaway Group.

Announced: 02/06/15 Terms: Not Disclosed Previous Investment: La Nevera Roja – $14.3m; Pizzabo – Not Disclosed Founded: La Nevera Roja – January 2011; Pizzabo – 2009

Grubhub Acquires DiningIn and Restaurants on the Run. In an effort to build its own delivery network and preempt on-demand delivery aspirants, Grubhub acquired Brighton, MA-based DiningIn and Aliso Viejo, CA-based Restaurants on the Run – both of which focus on restaurant delivery and corporate catering services. As Street Fight notes, the move marks “a transition in the company’s strategy from a focus on moving an existing delivery market online to using the web to expand the delivery market as a whole.” The company said the deals will give the company a combined relationship with over 3,000 restaurants over 15 markets in the U.S. Street Fight also reports that the company said it plans to essentially break even on the delivery service, and use additional cost savings to reduce delivery fees paid by customers, while merchants will also pay a nominally higher commission rate for deliveries operated by Grubhub. Dan Primak at Fortune further discusses the competitive implications and dynamics of the acquisitions, it is worth a read.

Announced: 02/05/15 Terms: Approximately $80m for the two deals combined Previous Investment: Not Disclosed Founded: DiningIn – 1988; ROTR – January 1993

Under Armour Acquires MyFitnessPal and Endomondo. With the goal of creating a global digital health and fitness community, the sports performance company acquired MyFitnessPal, a San Francisco-based service for letting users track and share calorie intake and other health and wellness data, and Endomondo, a Denmark-based social fitness network and activity tracker. The two acquisitions complement the 2013 acquisition of MapMyFitness, and will provide Under Armour with additional technology for its recently launched UA Record fitness tracking app and website, which will be connected with 120 million unique global consumers. Notably, as Mobile Health News reports, Under Armour’s strategy no longer includes the plan to build its own wearable tech or digital tech platform (Apple HealthKit, Google Fit, etc.), rather, the company is focused on building the community to integrate with all the active players in the space.

MyFitnessPal Announced: 02/04/15 Terms: $475.0m Previous Investment: $18.0m (at a valuation of $108m) Founded: 2005

Endomondo Announced: 02/04/15 Terms: $85.0m Previous Investment: $8.2m Founded: 2007

TripAdvisor Acquires ZeTrip. The San Mateo, CA-based mobile app company is the creator of Rove, a travel inspiration-themed personal journal app, which provides a travelogue of users’ movements based on their GPS coordinates and other data. ZeTrip’s three-person team will be integrated into TripAdvisor’s mobile team, and it is unclear if the Rove product will continue to operate as a standalone offering. TechCrunch notes that TripAdvisor has been focused on acquiring businesses that help pick up data about how consumers travel, which allows it to extend its lifecycle with its customers by serving a more relevant role during and after the trip, and ultimately, potentially feeding TripAdvisor’s bigger business by leveraging strategies for advertising and other marketing services.

Announced: 02/02/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: November 2011

FUNDING

Grofers Raises $10m. The Gurgaon, India-based online mobile delivery app delivers produce and other goods from local stores on-demand. Grofers currently works with vendors from Mumbai and Delhi, and processes over 30,000 deliveries every month. According to TechCrunch Grofers will use the capital to expand into more cities and improve technology so that stores can more easily manage orders, track inventory, and upload new products by themselves.

Announced: 02/26/15 Stage: Series A Participating Institutional Investors: Sequoia Capital, Tiger Global Previous Investment: $0.5 million Founded: December 2013

Chefs Feed Raises $4m. The San Francisco-based food media and technology platform showcases restaurant recommendations by chefs, and considers itself the antithesis of Yelp for restaurants and food discovery. The company aims to help chefs and their restaurants regain the ability to shape the narrative supporting their brand and food. As an example, in order to help chefs build their personal followings, Chefs Feed generates specialized content, including behind-the-scenes videos of restaurants, which are then featured on sites like Foursquare, Food & Wine and Urbanspoon. The company will use the new funding to expand its development team, execute new outreach campaigns, extend to more cities, and debut new products.

Announced: 02/26/15 Stage: Series A Participating Institutional Investors: ARTIS Ventures, Structure Capital, Haas Portman, Subtraction Capital Previous Investment: $3.2 million Founded: 2011

TinyOwl Raises $16m. The Mumbai, India-based food ordering service allows customers to order take-out via its iOS and Android apps. The funding will be used for national level expansion and innovating on the products, focusing on user experience. TinyOwl’s services are currently available only in Mumbai, but the company plans to expand to 50 cities in India.

Announced: 02/26/15 Stage: Series B Participating Institutional Investors: Nexus Venture Partners, Sequoia Capital, Matrix Partners Previous Investment: $3.0 million Founded: 2012

Chewse Raises $700k. The Los Angeles-based B2B group delivery/catering platform focuses on serving offices, and distinguishes itself by presenting only high quality restaurants/dishes that it curates for its corporate clients rather than aggregating all catering options available in the area. In conjunction with the fundraise, Chewse announced it has served 100,000 meals, and plans to use the funding to expand its catering service.

Announced: 02/23/15 Stage: Seed Participating Institutional Investors: Rocketship.VC Previous Investment: $1.0 million Founded: July 2011

Main Street Hub Raises $20m. The Austin, TX-based “do-it-for you” local marketing platform offers an integrated social, web, and email marketing solution designed to help local restaurants and merchants drive more customers. The company will use the proceeds to expand the teams in its Austin and New York City offices, especially focusing on the engineering and product teams.

Announced: 02/22/15 Stage: Debt Financing Participating Institutional Investors: Silicon Valley Bank Previous Investment: $20.9 million Founded: June 2009

Pocket Concierge Raises Seed Funding. The Tokyo, Japan-based restaurant booking platform focuses on high end-restaurants, allowing Pocket Concierge users to bookmark popular restaurants with long waiting lists. In the event of an unexpected cancellation, the restaurant will email users with bookmarks to fill vacancies. The undisclosed amount of funding was provided by strategic investor Line, an international messaging app, which had just disclosed its establishment of a $42 million fund for startup investments. Line announced that it aims to integrate services like Line Pay and Line Taxi into Pocket Concierge and its partner restaurants.

Announced: 02/17/15 Stage: Seed Participating Institutional Investors: Line Previous Investment: $0.6 million Founded: July 2011

Postmates Raises $35m. The San Francisco-based online delivery service is a developer of consumer-facing logistics software that dispatches and guides couriers through major metropolitan areas to deliver local goods including prepared food, groceries and retail goods. Most recently, Postmates launched its own API, through which third-party sellers and app developers can offer same-day delivery powered by Postmates. As TechCrunch points out, scale is the most important factor in the on-demand delivery industry, in which winners are determined by who has the most surface area and the lowest prices, thus the company intends to use the funds to expand operations.

Announced: 02/20/15 Stage: Series C Participating Institutional Investors: Spark Capital Previous Investment: $23.0 million Founded: 2011

Reserve Raises $15m. The New York-based digital concierge for diners and restaurants aims to address friction in the dining experience by combining reservations, feedback on service, and payment through its app. Reserve is currently partnered with restaurants in New York, Los Angeles, San Francisco and Boston and plans to use the funding to expand operations nationwide. In addition to institutional investors, funding also came from a few celebrities, including Jared Leto, Will.i.am, and Jon Favreau.

Announced: 02/11/15 Stage: Series A Participating Institutional Investors: Expa (lead), Human Ventures Capital (lead), Visionnaire Ventures, Venture51, SV Angel, SherpaVentures, Advancit Capital, Lowercase Capital, First Round Previous Investment: $2.3 million Founded: 2014

Delivery Hero Raises $324m from Rocket Internet; Rocket Internet Invests Additional $236m through Selling Shareholders (Secondary Sale). In creating its new Global Online Takeaway Group, Rocket Internet invested close to $560 million into the massive Berlin, Germany-based aggregator of online ordering/delivery services, and mobile food ordering technology for restaurants. The investment resulted in a minority stake of 30% for Rocket Internet, and values the company at $1.9 billion. As Bloomberg points out, the investment also “marks a departure from Rocket’s usual strategy, which consists of building businesses from the ground up.”

Announced: 02/06/15 Stage: Series H Valuation: $1.9 billion Participating Institutional Investors: Rocket Internet Previous Investment: $656.7 million Founded: September 2010

HelloFresh Raises $126m. The New York, and Berlin, Germany-based subscription meal kit company delivers boxed “ready-to-make meals” containing with recipes and pre-portioned ingredients on a weekly basis. The company currently serves customers across the United States and aims to become the leading brand in the grocery and meal delivery sector. Outside the US, the company is active in Germany, Austria, the United Kingdom, Netherlands, and Australia. According to TechCrunch, HelloFresh will use the funding towards hiring new staff, expanding facilities, and general improvements of the supply chain and customer experience. Notably, although HelloFresh is key to Rocket Internet’s thesis on investing in the food and grocery sector, HelloFresh is not part of the newly created “Global Online Takeaway Group.”

Announced: 02/06/15 Stage: Series E Participating Institutional Investors: Rocket Internet, Insight Venture Partners Previous Investment: $67.5 million Founded: 2011

YuMist Raises $1m. The Gurgaon, India-based startup offers a logistics and supply-chain-focused technology platform through which customers in the Gurgaon area can order food through a mobile app and receive deliveries in less than 30 minutes. YuMist employs its own chefs and uses a centralized kitchen to make homemade food from a predetermined menu. The company caters to office goers, and will use the proceeds to towards geographical expansion and furthering its production, technology, and delivery infrastructure.

Announced: 02/02/15 Stage: Seed Participating Institutional Investors: Orios Venture Partners Previous Investment: Not Disclosed Founded: October 2014

Frsh Raises $518k. The Gurgaon, India-based online meal service startup provides urban professionals access to a healthy food space for meal options. The company manages and operates its own production and supply chain within Gurgaon, and customers can choose meals, snacks, salads, and sandwich options from the Frsh website for delivery. Frsh will use the funding to upgrade its kitchen, launch an android app, update its website, and digitize the supply chain and delivery process.

Announced: 02/03/15 Stage: Seed Participating Institutional Investors: Kae Capital, India Quotient Previous Investment: $100k Founded: 2014

Hao Chushi Raises $800k. The Shanghai, China-based home catering app is a platform that connects users to nearby chefs who can be hired to cook in-home. Customers get the benefit of receiving a customizable home-cooked meal, while chefs have the freedom to choose their own work schedule and cook different kinds of cuisines, as opposed to preparing dishes from a set menu. The app currently serves Shanghai, Beijing, and Hangzhou. The funding will be used towards expansion into more cities and improving service quality.

Announced: 02/02/15 Stage: Seed Participating Institutional Investors: Angels Previous Investment: Not Disclosed Founded: September 2014

PARTNERSHIPS

JC Penney partners with Epicurious.com to exclusively sell Epicurious brand cookware, Epicurious’ first product line.

Schedule101 partners with COMMLOG to integrate web-based employee scheduling within COMMLOG’s Virtual Manager Log.

Viggle partners with inMarket to deliver mobile advertising capabilities by providing offers and branded engagement to Viggle users based on context and users’ proximity to retail location.

Mars, Incorporated partners with UC Davis to launch Innovation Institute For Food And Health with the aim to advance new discoveries in sustainable food, agriculture and health.

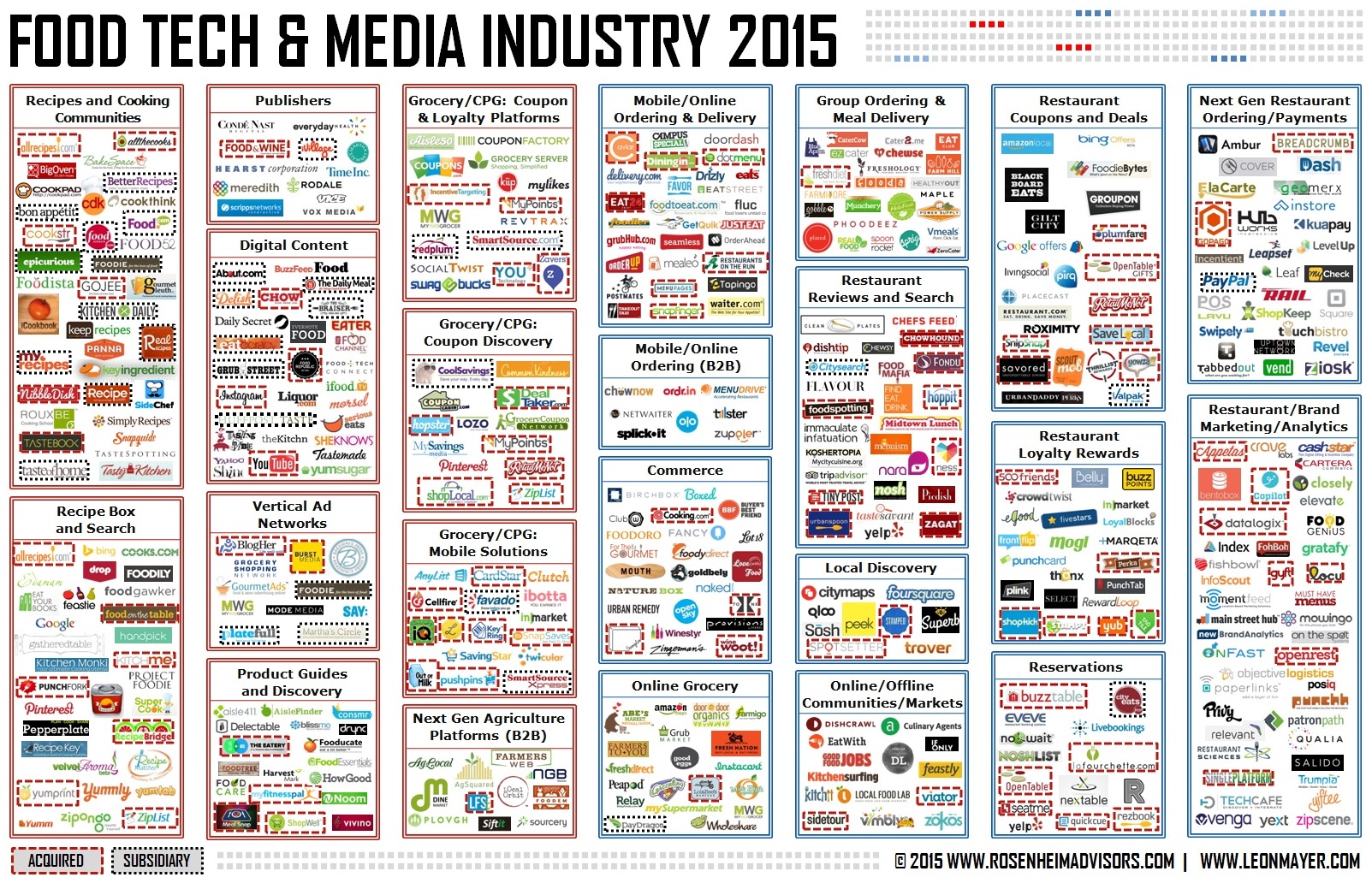

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out the 2014 Annual Report and last month’s round-up.