From home cooking to the restaurant experience, technology-focused food startups are enhancing the way consumers engage with food. These startups are creating significant value for consumers and notable opportunities for restaurants and brands to better understand and provide value to their customers. As the food tech sector matures, we are seeing an increasing number of these companies being funded or acquired by industry players. This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, e-commerce, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

There is an interesting race heating up in the payments and POS arena, with major players including Square, Paypal and Groupon unveiling new solutions to own the register of the local merchant. As Mobile Commerce Daily points out, although mobile is key for the future of payments, these companies are all “looking to gain a foothold in physical locations with traditional point-of-sale solutions because their mobile POS strategies are growing slowly.”

Square announced the Square Stand, new hardware that turns an iPad into a digital POS system plus additional accessories like a cash drawer and receipt printer, which creates an opportunity for the company to gain a stronger foothold in restaurants (esp. higher-volume ones) and the big brick-and-mortar commerce ecosystem. Conversely, rather than building its own new hardware, Paypal has taken a collaborative approach with its Cash For Registers program which was launched to encourage merchants to switch to PayPal-powered point-of-sale solutions and leverages the POS partnerships it has been building over the past year. Paypal gave its program a jump start by covering the processing fees for the first six months of the program. Groupon re-branded its merchant payments offering to be called Breadcrumb POS, which broadly expands the restaurant-focused tablet POS system that Groupon acquired last year (previously called just Breadcrumb, the more robust restaurant-specific app will now be called Breadcrumb Pro). The new Breadcrumb POS is a free iPad app, and as TechCrunch notes, in addition to luring new merchants with competitive commission and deposit rates, the company is also bundling the app with a variety of relevant physical hardware (stand, cash drawer, etc.), called the “Bread Box.”

As seen in the deals detailed below, there has been an overall flurry of activity in the crowded payments space as pressure increases for companies to expand and accelerate growth through partnerships and capital deployment. Incumbents have been looking to startups to add new features and functionality to legacy systems such as loyalty, marketing and data insights to secure merchant relationships, while young companies have benefited from the immediate scale and ability to piggyback on an established sales force.

M&A

Seamless and GrubHub announce merger. The combined platform of the two food-delivery services providers will have over $100m in revenues, and serve diners and companies in more than 500 American cities from more than 20,000 local takeout restaurants. It is reported that GrubHub’s CEO will assume the CEO role of the combined company, and shareholders in both companies will have significant representation in the combined company’s Board of Directors. Once fully integrated, the new company will be well-positioned for an IPO, which would further validate the space among investors. Additionally, as we discussed leveraging existing systems last month, an open API and additional technology could position this new company as a powerful platform for other innovators in the food tech landscape looking to tap into a huge restaurant network (without the expense of a huge sales force).

Announced: 5/20/13 Terms: Not Disclosed Previous Investment: GrubHub – $84.1m. Institutional investors include: Origin Ventures, Leo Capital Holdings, Amicus Capital, Lightspeed Venture Partners, Benchmark, DAG Ventures, Greenspring Associates, Mesirow Financial. Seamless – Not disclosed (since spin-out from Aramark in October 2012). Institutional investors include: Goldman Sachs Capital Partners, CCMP Capital Advisors, J.P. Morgan Partners, Thomas H. Lee Partners, Warburg Pincus, Spectrum Equity Partners (which invested $50m in June 2011). Founded: GrubHub – 2005; Seamless – 1999.

HarvestMark acquires ShopWell Solutions. In order to create a direct channel to reach to grocery shoppers and drive insights on shopper behavior and preferences, YottaMark, the parent of the fresh food traceability platform HarvestMark, acquired substantially all the assets of ShopWell Solutions, the personalized food recommendation app which had over a million downloads.

Announced: 5/30/13 Terms: Not Disclosed Previous Investment: $4m. Institutional investors included: New Venture Partners, IDEO. Founded: 2008

FUNDING

FarmersWeb Raises $1m. The NY-based online B2B food marketplace and platform connects local farmers and producers with wholesale buyers, such as restaurants, corporate kitchens, private schools and retailers. The company provides the payment and commerce platform, while the farms/producers provide all fulfillment and logistics after the order is placed. In addition to the public wholesale marketplace which is currently focused on the NY metro area, FarmersWeb also offers an eCommerce solution for farms/producers who prefer to sell directly from their own websites vs. the marketplace. The proceeds will be used to expand metro areas as well as the technology platform.

Announced: 5/31/13 Stage: Seed Participating Institutional Investors: Individual angels Previous Investment: None Founded: 2011

LoyalBlocks Raises $9m. The NY- and Israeli-based provider of local marketing solutions offers customer loyalty programs by allowing brick and mortar businesses to automatically reward customers when they enter the restaurant/store through a branded app and an in-store base station. The platform is also integrated with Facebook and other social media and review sites. The use of proceeds will go towards expanding U.S. operations and developing the SMB platform.

Announced: 5/23/13 Stage: Series A Participating Institutional Investors: General Catalyst Partners (lead), Founder Collective, Gemini Israel Funds Previous Investment: $3.2m Venture Round Founded: 2011

Swipely Raises $12m. The data-driven payments company has developed a platform that provides local merchants similar tools that e-commerce companies use to better understand customers through shopping data. The platform doesn’t require new equipment for merchants, and works with all credit and debit cards. The team expects to double head count to 80 by the end of the year, and proceeds will be used to expand its network of merchants and to accelerate its nationwide growth.

Announced: 5/21/13 Stage: Series B Participating Institutional Investors: Shasta Ventures (lead), First Round Capital, Greylock Partners, Index Ventures Previous Investment: $7.5m Series A, $1m Seed Founded: October 2009

Marqeta Raises $14m. The loyalty company provides both branded and white-label prepaid loyalty cards, allows multiple loyalty accounts to function on a single card, and also (as revealed in the announcement) powers the technology behind recently launched Facebook Card. As PandoDaily points out, the Facebook partnership is a tremendous coup in terms of scaling in the loyalty rewards space, as “there’s nowhere else you can go to immediately get access to 1 billion consumers, and their real identities.”

Announced: 5/16/13 Stage: Series A Participating Institutional Investors: Greylock Partners (lead), Granite Ventures, Commerce Ventures Previous Investment: $5.6m Series A Founded: 2010

Foodpanda Raises $20m. The Berlin-based food delivery company continues its rapid expansion, focusing on emerging markets in South America, Asia, Africa, and Eastern Europe. This year alone Foodpanda (and its affiliated brand hellofood) have entered 15 new countries, and it is now active in 27 different worldwide markets. The capital infusion will power expansion to additional countries, additional build-out of more cities within existing countries, and customer/restaurant acquisition efforts.

Announced: 5/07/13 Stage: Series A Participating Institutional Investors: AB Kinnevik, Phenomen Ventures, Rocket Internet Previous Investment: Rocket Internet (Accelerator) Founded: 2012

Panna Raises $1.35m. The video cooking magazine on the iPhone and iPad allows users to cook recipes along with celebrity chefs in a format that resembles television programming, featuring step-by-step instructions, tips and recommendations. The company plans to use the funding to expand its team, produce new content and increase sales and marketing efforts. As TechCrunch notes, before venture funding Panna used crowdfunding through Kickstarter, where hundreds of home cooks donated to get it off the ground.

Announced: 5/06/13 Stage: Venture Round Participating Institutional Investors: Anthem Venture Partners, Lerer Ventures, Crosslink Capital, Maveron, Advancit Capital, RSL Venture Partners, Launchpad LA, BoxGroup Previous Investment: None Launched: November 2012

PARTNERSHIPS

Food52 partners with Rap Genius to let users annotate recipes. Calling the tool “Food Genius,” the partnership will allow users of the crowd-sourced cooking site to annotate recipes and articles. As Food52 simply states, it “adds a crowd-sourced layer to the cooking process by allowing cooks to make small variations on and enhancements to recipes”.

VeriFone and CardSpring partner on card-linked services. The POS maker VeriFone teamed up with the loyalty and rewards startup to integrate the CardSpring web service platform to its payment gateway in order to enable developers to create card-linked services. The partnership will allow merchants to enable loyalty programs, point-of-sale discounts, and more using customers’ existing debit and credit cards.

Loyalty startup FiveStars partners with Canadian media firm Rogers to launch new loyalty service. With its first international play and first “Powered by FiveStars” alliance, the new program, called “Vicinity” is the same POS-integrated loyalty platform as FiveStars, and Rogers will offer the program to many of its existing clients, including small and medium-sized businesses that already use Rogers for its phone and Internet service.

Serious Eats partners with Conde Nast’s Ziplist to offer recipe organizing tools. With the partnership, thousands recipes from Serious Eats’ family of websites will be integrated into Ziplist’s recipe box and shopping list, and users will be able to see relevant local grocery deals as well.

MOGL and Hawaiian Airlines partner to offer a new dining rewards program to frequent flyers. The new partnership is MOGL’s second airline partner (after Virgin America), and allows Hawaiian Air’s frequent flyer members to earn cash-back when dining out in CA restaurants, while also donating meals to people in need.

LevelUp and NCR partner to bolster mobile payments in restaurant sector. The partnership will allow the top restaurant POS supplier to offer LevelUp’s mobile payment and loyalty solution seamlessly without requiring operators to implement a new system in order to accept mobile payments.

Tabbedout partners with Google Wallet. The restaurant mobile payments solution, which allows bar and restaurant patrons to pay for their check using an app on their smartphone, announced Google Wallet is now integrated into its mobile app, adding a new distribution vertical for Google’s payment platform and adding a new mobile payment option for restaurant patrons.

OLO partners with CorFire to create an integrated mobile commerce solution for restaurants. The mobile and online ordering platform for restaurants has recently repositioned itself as a digital commerce engine for restaurants (and accordingly, also announced an investment from Paypal in January), thus this new partnership with CorFire, a provider of mobile commerce technology solutions, provides OLO the ability to offer more sophisticated mobile commerce functionality such as mobile ordering, mobile local offers, mobile payment, mobile gifting, mobile loyalty, and mobile social check-ins.

INDUSTRY LANDSCAPE

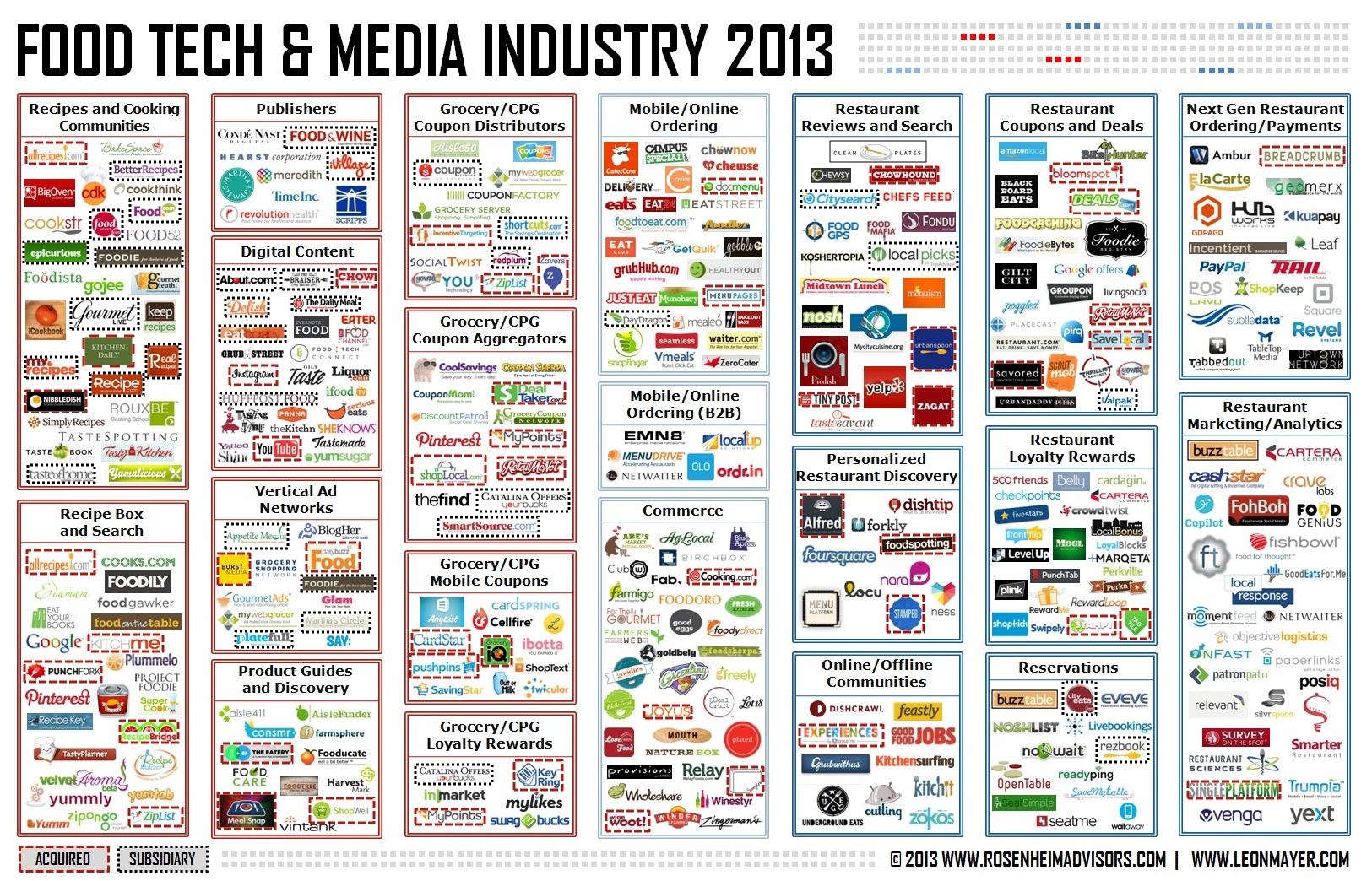

As The Food Tech & Media ecosystem continues to see rapid change, we created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape.

Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out last month’s round-up here.

Would you be interested in a round-up of agriculture-related funding, partnerships and acquisitions? Let us know in the comments below.