This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

The momentum continues with six acquisitions in the month of February, and eight investments totaling $75.9m. Grocery was a dominant theme among the acquisitions, with four of the deals adding heft to technology platforms in the grocery sector, while restaurant ordering/delivery was overwhelmingly prevalent among five of the eight investments (perhaps reflecting the anticipation of the upcoming public market debuts). Despite the recent talk of an impending Series B crunch, all but two investments were Series B and beyond, with an average deal size of $9.5m across all deals.

The past couple of weeks have continued to signal there is solid public market appetite for this sector. Coupons.com debuted on the NYSE at $16 per share and closed up 88% at $30 a share on the first day of trading, with a market capitalization of $2.2 billion. Grubhub set the share price range for the IPO at $20 to $22 a share, which would value GrubHub at more than $1.7 billion at the midpoint. And in London, Just Eat is gearing up for an IPO which is expected to value the company at £700m to £900m ($1.2b to $1.5b).

To boot, there is a ton of activity happening in the hyperlocal search sector between Yahoo, Yelp, YP, Grubhub, Opentable, Foursquare, Microsoft, Google, and more. Check out the “Partnerships” section at the end for more color.

M&A

Walmart acquires Yumprint. The Seattle-based startup built recipe search technology that understands recipe semantics, matches ingredients to advertisements, understands consumer taste preferences, calculates nutritional information and prepares shopping lists from recipes, according to the company’s website. The startup will be folded into Walmart’s e-commerce division, @WalmartLabs, and Walmart plans to use Yumprint’s recipe technology for its grocery delivery efforts on Walmart.com and Walmart To Go.

Announced: 2/26/14 Terms: No Disclosed Previous Investment: Not Disclosed Founded: 2011

MyFitnessPal Acquires Sessions. The San Francisco-based behavioral health startup pairs people with personal coaches who train via smartphones. According to the Wall Street Journal, the team will join MyFitnessPal, although the current Sessions app will be discontinued, and the “startup’s team [will] build a new one as part of MyFitnessPal’s larger offering.”

Announced: 2/19/14 Terms: Not Disclosed Previous Investment: Seed Founded: 2012

Kroger Acquires YOU Technology. The San Francisco-based coupon technology company serves digital coupons for more than 20 retail clients including Kroger, representing a network that includes over 10,000 retail stores. Its retailer-centric, cloud-based platform bridges the gap between online engagement and in-store purchases, creating a measurable way for retailers and brands to drive consumer purchase decisions. You Technology will operate as an independent company within the Kroger organization, and will continue to serve existing and future retail customers. In the release, Kroger mentioned its plan to expand its presence in Silicon Valley, and alluded to future potential acquisitions; “Kroger’s accelerated growth strategy includes targeted capital investments to … strengthen its connection with customers through the growing digital and mobile channels.”

Announced: 2/11/14 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2008

Datalogix Buys Spire Marketing. The Monroe, CT-based shopper-marketing firm uses analytics from grocery loyalty card data, point-of-sale purchase data, and trade-level data to power in-store marketing initiatives which drive spontaneous purchases. The company handles shopper analytics for 24 regional supermarket retailers, who have a combined 30 million households in their loyalty-card database, or roughly a third of U.S. households. This acquisition adds a powerful new dimension for Datalogix, which examines the offline sales impact from ads on Facebook and Twitter for retailers and CPG clients, as CEO Eric Roza reports to Advertising Age; “We think there’s going to be some really interesting cross pollination, which no one really has tried to do, between mid-size specialty retailers and mid-size grocers, which are two groups of retailers who’ve had nothing to do with each other historically, but we think they share a lot in common.”

Announced: 2/11/14 Terms: Undisclosed (cash and stock) Previous Investment: Undisclosed Founded: 2007

MyWebGrocer Acquires Buy4Now. The Dublin, Ireland-based software company provides grocery and retail clients with e-commerce solutions, including customized web storefronts, merchandising, fulfillment, ERP integration, customer communication and more. This acquisition builds upon MWG’s earlier acquisition of Buy4Now’s U.S. subsidiary in 2008. In the release, MWG notes that an integration of Buy4Now’s capabilities, including multi-currency and multilingual platforms, will position the company to accelerate international expansion. Buy4Now will operate as a subsidiary of MyWebGrocer.

Announced: 2/06/14 Terms: Not Disclosed Previous Investment: €3m Series A Founded: August 2000

OpenTable Acquires Ness Computing. The Los Altos, CA-based personalized restaurant recommendations app will be discontinued in April, and its technology will be incorporated into Open Table’s restaurant reservation platform. The team will join OpenTable’s San Francisco headquarters. In conjunction with the announcement, OpenTable announced it would be launching a pilot of a mobile payments service in San Francisco. Although the deal was announced to be worth $17.3 million, the $5m in cash that Ness had on its balance sheet means the net value was actually $11.3 million.

Announced: 2/06/14 Terms: $17.3m (cash) Previous Investment: $5m Series A, $15m Series B Founded: October 2009

FUNDING

Dash Raises $1.2m. Brooklyn-based mobile payment platform for restaurants, bars and clubs allows patrons to check-in, view, split, and pay their tab from their smartphone. The company intends to use the funds to expand in NY and launch in Chicago. In conjunction with the announcement, the company released a iOS 7 update for the app which includes iBeacon integration.

Announced: 2/27/14 Stage: Seed (extension) Participating Institutional Investors: New York Angels, Caerus Ventures Previous Investment: $700k Seed Founded: January 2011

Granular Raises $4.2m. The San Francisco-based provider of a cloud software and analytics platform for farmers, formerly known Solum, delivers functionality around four core areas: planning, production, marketing and accounting. The solution captures critical production and financial data from each cropping cycle and uses advanced analytics to suggest opportunities for financial, operational and agronomic optimization. In conjunction with the raise, the company announced it sold its soil science business to Monsanto Company. The proceeds from financing (and the sale to Monsanto) will be used to expand the company’s engineering team, as well as the sales and customer support teams across the U.S.

Announced: 2/24/14 Stage: Venture Round Participating Institutional Investors: Andreessen Horowitz, Google Ventures, Khosla Ventures Previous Investment: $2m Seed, $4.5m Series A, $17m Series B Founded: 2009

Postmates Raises $16m. The San Francisco-based online delivery service is a developer of consumer-facing logistics software that dispatches and guides couriers through major metropolitan areas to deliver local goods including prepared food, groceries and retail goods. The company operates in San Francisco, Washington, D.C., Seattle, and New York, and has partnered with grocers including Whole Foods. Postmates intends to use the funds to grow its operations, design and engineering teams and expand geographically. Of note, in between this round and the Series A, Postmates also added three high profile investors last November for an undisclosed amount to “help to advise as it scales up and continues expansion into even more markets going forward.”

Announced: 2/18/14 Stage: Series B Participating Institutional Investors: Spark Capital (lead), Matrix Partners, Crosslink Capital, SoftTech VC Previous Investment: $750k Angel, $1.2m Seed, $5m Series A Founded: May 2011

iFood Raises $2m. The São Paulo, Brazil-based online delivery platform facilitates the ordering of food online and through mobile apps for iOS and Android, and operates in all major cities in Brazil. In conjunction with the raise, the company also announced the acquisition of rival food delivery platform Central do Delivery (no financial terms were disclosed), which consolidates most online food ordering in Brazil to a central portal ahead of the World Cup and the Olympics. Beyond the expansion of iFood, the most interesting component to this story involves the growth plan of the strategic investor behind the deal, Movile, the largest mobile content and commerce platform in Latin America and Brazil. According to TechCrunch, “Movile’s investment is part of a broader strategy to work closely with and invest in startup companies across the Americas,” and the company is “negotiating with five other undisclosed startups in seed investments ranging from $100,000 to $3 million.” More specifically, as TechCrunch reports, “the company is angling to back companies developing transportation, e-commerce around fashion, and healthcare and lifestyle applications.”

Announced: 2/06/14 Stage: Venture Participating Institutional Investors: Movile Previous Investment: $1.6m Series A, $2.6m Series B Founded: May 2011

Tapingo Raises $10.5m. The San Francisco-based mobile food ordering platform, which is currently focused on university campuses, enables location-aware discovery for consumers and immediate order fulfillment through operational integration for merchants. The service is live at 25 universities, including New York University, University of Arizona and the University of Southern California, and the company will use the funding to build out its network to more campuses.

Announced: 2/05/14 Stage: Series B Participating Institutional Investors: Khosla Ventures (lead), Carmel Ventures Previous Investment: $3.5m Series A Founded: January 2012

Foodpanda Raises $20m. The Berlin-based food delivery company foodpanda and its affiliate hellofood continue rapid expansion. The new capital will enable foodpanda, which now partners with 22,000 restaurants, to expand its delivery marketplace for restaurants by launching in over 40 new markets. Foodpanda hopes to gain an edge over competitors in the space, like Delivery Hero and Just-Eat, by directing its attention towards Eastern Europe, Asia, Latin America, and part of Africa, where launch costs are relatively inexpensive. Expanding in these markets will also give “Rocket Internet a chance to build a massive customer service and logistics network that it can then leverage to grow startups in other verticals, reports TechCrunch.

Announced: 2/04/14 Stage: Venture Round Participating Institutional Investors: Phenomen Ventures, Investment AB Kinnevik Previous Investment: Rocket Internet (Accelerator), $20m Series A, $8m Venture Round Founded: 2012

Noom Raises $7m. The New York-based mobile app developer creates health and wellness apps that provide intelligent nutrition and exercise coaching. Noom plans to use the funds to enhance its products, and expand its audience. Of note, the company was also recently awarded a grant from the National Institutes of Health (NIH) to fund a study in conjunction with Mt. Sinai Hospital on the impacts of smartphone technology in eating disorder treatment.

Announced: 2/04/14 Stage: Series A Participating Institutional Investors: RRE Ventures (lead), Harbor Pacific Capital, Qualcomm Ventures, Recruit Strategic Partners, Scrum Ventures, TransLink Capital Previous Investment: Seed, $2.5m Venture Round Founded: September 2007

Foursquare Raises $15m. The strategic investment and partnership, which gives Microsoft access to Foursquare’s deep location-based tracking data (see “Partnerships” below), will augment Microsoft’s contextually-aware experiences for Bing and its mobile operating system. The investment was added to the $35 million round Foursquare announced in December, which valued the company at about $650 million. In addition to the $15m, Wired reports that with the license agreement, Microsoft will also “make regular payments to Foursquare that the startup characterizes as a ‘substantial addition’ to its revenue stream” which goes “beyond an advertising share.”

Announced: 2/04/14 Valuation: $650m Stage: Series D (extension) Participating Investor: Microsoft Previous Investment: $1.35m Series A, $20m Series B, $50m Series C, $41m Debt, $35m Series D Founded: March 2009

PARTNERSHIPS

Microsoft Signs an Extensive Licensing Deal with Foursquare to Power Location Context For Windows And Mobile. The multi-year agreement gives Microsoft access to Foursquare’s new tracking system which passively monitors users’ physical movements and preferences among real-world shops, restaurants, and bars. As Wired reports, using this data, the company can personalize search results (and better target ads) on its Bing search engine. Also, as reported by The Verge, Microsoft will use Foursquare location data in Cortana, a personal digital assistant designed to rival Siri and Google Now, for Windows Phones that will launch this spring.

Yahoo Partners with Yelp to Add Listings and Reviews to Improve Local Search Results. Yahoo closed a deep content licensing deal to bring local data into its search experience, both mobile and desktop. Although this will be deeply beneficial to Yahoo – local search apparently makes up about 25% of Yahoo’s search traffic – Yahoo is still playing catch-up, as TechCrunch notes this partnership comes 2 years after Micorsoft’s Bing partnered with Yelp for a co-branded relationship in Bing’s Local search pages. Yahoo also began integrating OpenTable reservations more deeply into its local search results, however re/code reports this is as a result of a redesign on Yahoo’s part versus a new partnership with OpenTable.

Fortune published a thoughtful article entitled, “What Does the Yahoo-Yelp Partnership Mean for Foursquare?” – it is definitely worth a read. Some highlights: It’s not clear why the Yahoo chose Yelp over Foursquare, though a person familiar with Foursquare says the startup walked away because Yahoo was not interested in the strategic investment part of the deal. And the Foursquare-Microsoft data partnership is not exclusive, so Foursquare could theoretically revisit the topic with Yahoo. Still, this partnership seemed like an easy layup for Foursquare.

… and to complement the above reading (the last of my hidden reading list in this section) StreetFight published a great piece arguing that Yelp, Google and Grubhub are all on a collision course as the three firms look to wrangle local consumers who increasingly expect to search, compare and buy in a single keystroke. Another very worthwhile read.

Yelp Partners with Truecaller, a Caller ID and Reverse Phone Directory App. The partnership will allow Truecaller users to automatically verify business numbers that are calling on their mobile phone, see the Yelp ratings, and the pictures people have uploaded of it. Truecaller partnered with Twitter in December in a similar deal.

Square Partners with Whole Foods and Godiva (and other news). Square will offer its iPad cash register, the Square Stand, at several Whole Foods stores, making the grocer the second national retailer after Starbucks. Chocolatier Godiva will use the Square Register during peak times, such as in the run-up during holidays. In other Square news, the company began testing a Square Pickup app, so that users can order ahead from local restaurants. The company also acquired BookFresh, a San Francisco–based scheduling and appointment booking startup for local merchants.

BrightFarms and Giant Food Partner to Deliver Year-Round Local Produce to Giant Stores Throughout the Washington D.C. Metro Area. BrightFarms will supply Giant stores with produce grown at a 100,000-square-foot greenhouse in Washington, D.C., which will be designed, built, and operated by BrightFarms in partnership with the City’s Department of General Services and the Anacostia Economic Development Corporation.

eat24 Food Delivery Platform Partners with Urbanspoon. The new business venture will integrate Eat24’s platform into the Urbanspoon website and mobile app, allowing Urbanspoon users to order menu items, view personal order histories, and make one-click re-orders.

Revel Systems iPad POS Platform Adds Bitcoin Integration. Revel is working with Bitcoin wallet provider Coinbase to provide a hardware/software solution that allows users to seamlessly accept Bitcoin into the current Revel iPad POS. When a customer is paying with Bitcoin, a QR code will pop up on the POS screen of the Revel iPad POS. A customer will then scan this QR code with their smartphone using a Bitcoin wallet app, which completes the transaction.

CircleUp Partners with Virgin America Help Identify New Snacks and Drinks to Serve on Flights. Thus far, Virgin America has selected two CircleUp-funded companies, the French vintner Le Grand Courtage and San Francisco-based granola bar and snack food company 18 Rabbits. Other partners working with CircleUp include consumer goods giants General Mills and Procter & Gamble.

Google Partners with Singleplatform to Display Restaurant Menus in Search Results. This new feature, which started as a small test, displays the full menu directly in the search results, without needing to click through to an additional page. Search Engine Watch notes that the results also have multiple tabs, so if the menu is in sections (e.g., appetizers, main courses), then you can select any of the tabs to view that particular menu section.

Vice Media Partners with Production Company FremantleMedia to Target Millennial Foodies With New Video Channel. Tubefilter reports the channel doesn’t yet have a name or a specific URL, but will likely have its own YouTube home as well as a presence on the main Vice website.

Tastemade Partners with Ryan Seacrest Productions to Develop Food and Lifestyle Programming for Digital Platforms. Ryan Seacrest Productions has already ventured into food programming with the Emmy-winning reality series “Jamie Oliver’s Food Revolution” and re/code also notes that “RSP has become increasingly active in the digital arena, ranging from an investment in a keyboard for the Apple iPhone called Typo to talks with Yahoo’s Marissa Mayer about possible content partnerships.”

Levelup Partners with Foodler, Users Can Now Choose LevelUp to Pay for Takeout. In addition to giving users another way to pay, Levelup provides loyalty incentives to encourage customers to order more delivery. LevelUp tells the Boston Globe, “It’s the first time LevelUp will be powering online payments, bridging the gap between the real and virtual worlds.” The partnership is the result of LevelUp’s Developer Platform which allows third parties to add payment and campaign functionality to their apps via a free API/SDK. The Boston Globe also points out that the LevelUp partnership isn’t the first time Foodler is trying a new payments method, as it started accepting bitcoins last year.

IRI (Information Resources Inc.) and Technomic Partner to Create a Joint Service Offering Aimed at Providing a Holistic View of the Food Industry. The partnership will enable customizable, cross-channel analysis, as well as collaboration between manufacturers, retailers and restaurant operators.

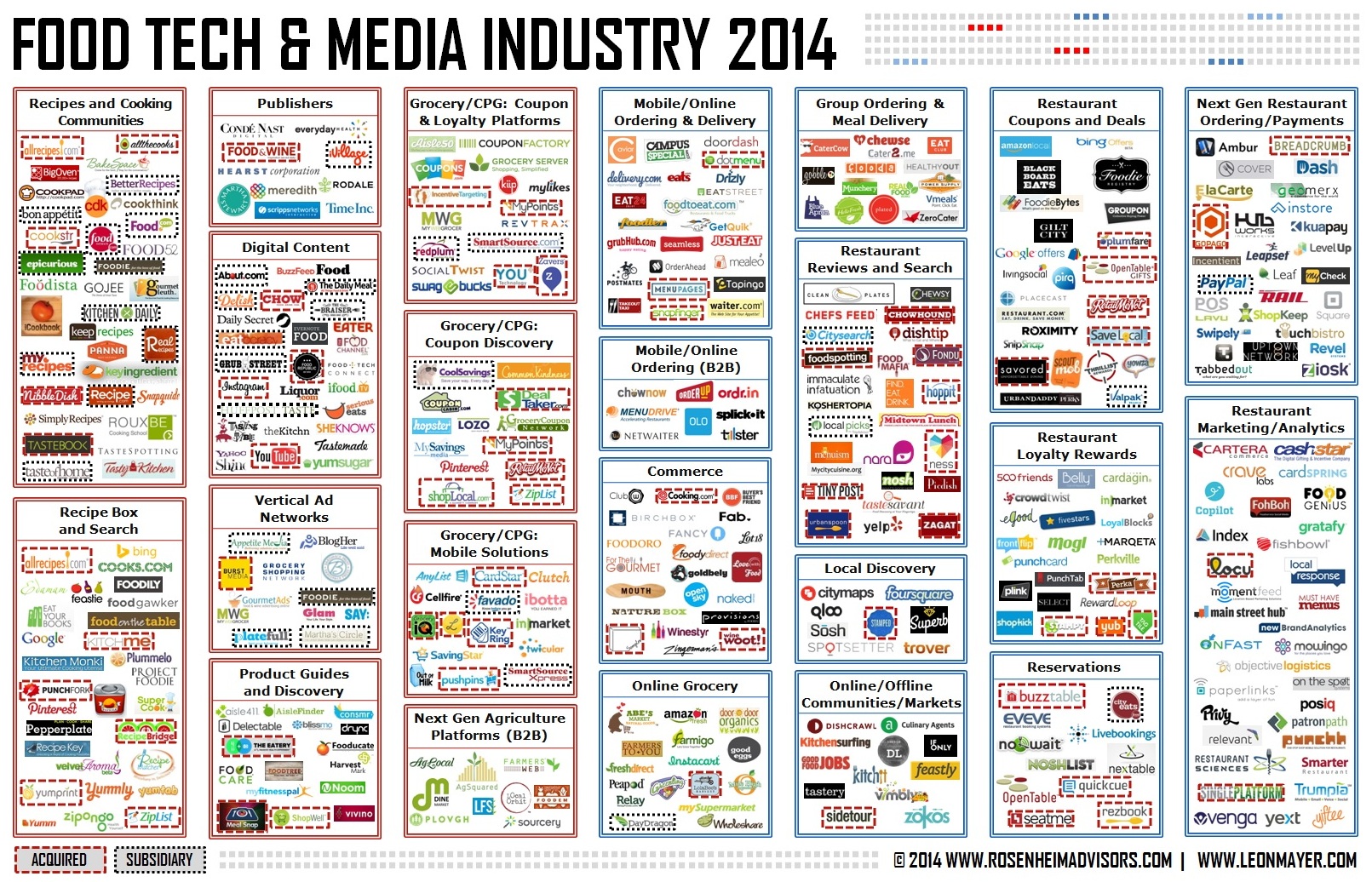

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape.

Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out the 2013 Annual Report and last month’s round-up.

Would you be interested in a round-up of agriculture-related funding, partnerships and acquisitions? Let us know in the comments below.