This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

Ending on a strong note, the deal activity for December was spread across many distinct industries, including food and meal distribution and delivery, mobile wallets and payments, hyperlocal marketing, content, indoor farming and even the connected kitchen. There were eight notable acquisitions – seven of which were early-stage startups) – six early-stage investments (totaling $11.7 million) and two later-stage investments (totaling $43 million).

Over the month a number of large players made some interesting announcements about their growth in the food and restaurant categories. Apple, which hasn’t participated much in this space beyond its App Store as a distribution platform and the growing adoption of iPads for restaurants, took a more definitive step into the food tech arena as it filed a patent for an ordering and reservation system for restaurants. Apple also filed a patent for a new type of “layered” map that could have implications for the local discovery space. MasterCard announced that its Big Data division will be building a restaurant reviews site that is built on customer payment data with the plan of representing, “how people are voting for restaurants with their wallets.” In supporting Urbanspoon’s quest to focus more deeply on high quality editorial content (as we discussed in July), the company hired a new executive to focus on rejuvenating the Urbanspoon brand. Amazon is said to be launching Pantry to offer bulk CPG items, and Microsoft updated the Bing Food & Drink platform.

M&A

Coupons.com Acquires Yub. The San Francisco-based card-linked loyalty company enables restaurants and merchants to promote in-store sales through online offers, and will enable Coupons.com to offer better tracking of online offers and sales, according to the Wall Street Journal. Yub was spun out in early 2013, from TrialPay, a larger company which helps websites and app developers sign up new users by dangling promotions. The deal is a fast payout for investors, as Yub just closed a round in November, and a number of them also received shares as part of the spin out.

Announced: 12/31/13 Terms: $30m Previous Investment: $12m Series A Founded: January 2013

Cookpad Aquires Allthecooks and Mis Recetas. Japan’s top recipe site, which is publicly traded on the TSE, is making a serious push towards global expansion with the acquisition of San Francisco-based cooking app Allthecooks, and the Alicante, Spain-based recipe website Mis Recetas. Cookpad launched an English site earlier this year, and the company intends to bring its service to each major language. According to the press release, Cookpad has acquired all of the equity interest of Allthecooks, which was developed by Mufumbo Labs, and was ranked #1 in Google Play’s recipe category.

Announced: 12/20/13 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: Allthecooks – October 2012; Mis Recetas – January 2001

OpenTable Acquires Quickcue for $11.5m. The Chattanooga, Tennessee-based restaurant technology startup offers an iPad-based restaurant wait list, reservation, text message notification and table management system that helps restaurants manage wait lists and collect data on customer preferences to personalize service and offers. OpenTable will discontinue the existing Quickcue app and create a new one that will incorporate features from both companies. Quikcue’s nine team members will continue to operate out of Chattanooga. Given Quickcue’s focus on the casual end of the market, it will be interesting to see if OpenTable will use the service to broaden its client base to include more walk-in establishments.

Announced: 12/16/13 Terms: $11.5m (cash) Previous Investment: $2.7m Seed Founded: 2011

Lifelock Acquires Lemon for $42.6m. The Palo Alto-based digital wallet platform, which allows users to store their ID, payment, loyalty cards and other information on their smartphone, was acquired by identity theft protection service LifeLock (NYSE: LOCK) to expand the company’s mobile capabilities. Lifelock will be launching a new application called “LifeLock Wallet,” which is based on Lemon Wallet Plus technology. President Hilary Schneider says the acquisition will allow LifeLock to “accelerate our product roadmap, add additional functionality and data to our platform, expand our market opportunity, better serve our members, and develop a more meaningful relationship with a broad set of consumers.”

Announced: 12/12/13 Terms: $42.6m (cash) Previous Investment: $8m Series A Founded: July 2011

Sysco Acquires US Foods for $8.2b. North America’s largest food distributor to restaurants announced it will acquire rival US Foods, which will give Sysco greater geographical reach and new brands, as well as create cost-savings. This should be especially noteworthy to all restaurant-related tech companies, as Sysco has been building up its suite of restaurant technology offerings in order to leverage its salesforce to further monetize its relationships and become more integral to the operations of its customers. With this acquisition it will now have the ear of approximately 25 percent of restaurants in the US. The combined foodservice company will operate under the Sysco name.

Announced: 12/09/13 Terms: $3.5bn ($500m cash and $3b stock) plus assumption of US Foods’ net debt ($4.7b) Previous Investment: Acquired for $7.1b in 2007 by Clayton, Dubilier & Rice, Inc. and Kohlberg Kravis Roberts & Co. L.P. Founded: 1989

Amazon and DoubleBeam Acquire Gopago. The San Francisco-based mobile POS-provider was divvied up between Amazon, which acquired the company’s technology and engineering team, and DoubleBeam, which acquired GoPago’s business and existing merchant relationships (but not the remaining members of the team, according to Business Insider). DoubleBeam, a provider of white-labeled mobile payments services, announced it will use the GoPago acquisition to add integrated mobile POS payments to its existing services, which include mobile-based eCheck and remote deposit capture. Amazon, on the other hand, has been tight lipped about when and how it will use GoPago’s technology, but TechCrunch surmises it could be related to either Amazon’s plan for a Square competitor – its “Log In and Pay with Amazon” feature – or a built-in payment loop between consumers and merchants for its to-be-announced Amazon mobile phone or all three.

Announced: 12/16/13 Terms: Not Disclosed Previous Investment: Undisclosed amount from JP Morgan Chase Launched: 2009

Square Acquires Evenly. The San Francisco-based payment solution Evenly allows users to split bills and other expenses will shut down its app in early 2014. Although Square has also made a push into peer-to-peer payments this year with the release of Square Cash in October, the company announced the acqui-hired team will instead be working on Square’s seller initiatives.

Announced: 12/11/13 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: October 2012

FUNDING

Foursquare Raises $35m. Eight months after raising $41 million in debt financing, the location-based social networking software brought in two new investors as it continues to refine the product: DFJ Growth (which is contributing a board member, former AOL CEO Barry Schuler) and the Capital Group’s Smallcap World Fund. Earlier in the month, the company released a new version of its app that includes passive tracking, which serves up recommendations without a user having to check in. The new passive tracking is integral to Foursquare’s new location-based recommendation feature, which checks a user’s location every few minutes to determine whether they should receive a recommendation. CEO Dennis Crowley has “always dreamed of” Foursquare’s ability to alert you to “tucked-away bars as you strolled a neighborhood, sale items as you entered a boutique, or popular appetizers as you sat down for dinner at a new restaurant.” Although the company isn’t currently trying to sell the user location data for analysis, Digiday notes that Foursquare can use this passive data tracking to show advertisers shopping trends and more, which will be all the more powerful now that they don’t have to rely on check-ins. The company will use the funds to continue to grow sales and engineering and expand further internationally, in places like Turkey, Russia and Brazil.

Announced: 12/19/13 Stage: Series D Valuation: $600m+ Participating Institutional Investors: DFJ Growth, Smallcap World Fund Previous Investment: $41m Debt, $50m Series C, $20m Series B, $1.35m Series A Founded: March 2009

Delivery Club Raises $8m. The Moscow-based online food delivery service aggregator has established itself in the Moscow region and plans to use the funds to continue building its presence in the rest of the Russian market and enhance the company’s IT platform. Notably, the investors are particularly bullish on the international delivery market as AddVenture recently invested in food delivery service Chefmarket, while Phenomen Ventures’ portfolio already includes German companies Delivery Hero and FoodPanda.

Announced: 12/18/13 Stage: Series C Participating Institutional Investors: Phenomen Ventures, Guard Capital, AddVenture Previous Investment: $4m Series B, $1m Series A, $400k Seed Founded: September 2009

The Orange Chef Raises $1.2m. The San Francisco, CA-based smart kitchen products company sells accessories for the digitally connected cook such as the Cutting Board with iPad Stand, the Dishwasher Safe iPad Stand, and the soon to be released Prep Pad(TM), a iOS enabled bluetooth food scale which provides real-time nutritional information for all raw ingredients and scannable food items. The company intends to use the funds to continue to grow the team and ramp up product development by expanding its offering of smart kitchenware.

Announced: 12/11/13 Stage: Seed Participating Institutional Investors: Google Ventures (lead), SparkLabs Global Ventures (lead), Bertelsmann Digital Media Investments, Graph Ventures, Kima Ventures, Social + Capital Partnership Previous Investment: Not Disclosed Founded: April 2011

MomentFeed Raises $5.5m. The location-based analytics and campaign management enterprise platform is used by global brands and multi-store chains to both manage and understand all social media activity around their physical locations. According to StreetFight Magazine, the company hinted they are planning to explore the online and mobile presence of physical locations as a marketable asset. Customers include multi-store chains like 7-Eleven, JCPenney, The Coffee Bean & Tea Leaf and The Home Depot.

Announced: 12/11/13 Stage: Series A Participating Institutional Investors: Signia Venture Partners (lead), Draper Nexus, DFJ Frontier, Double M Partners, Daher Capital Previous Investment: $1.8m Seed Extension, $1.2m Seed Founded: April 2010

Freight Farms Raises $1.2m. The Boston-based indoor farming startup builds fully automated modular farming systems in recycled shipping containers by leveraging hydroponics, LED lighting, crop-monitoring software and vertical growing systems. The company will use the capital to expand its community of local food producers in North America and beyond and to development include a more elaborate community experience in the smartphone app. In its coverage, Pandodaily brings up a good point about investor mentality in this space (which many food tech companies can probably relate to): “The ironic thing about Freight Farms’ Series A round is, even though investors might complain about boring, ‘astoundingly unoriginal’ startups, investors don’t want to actually back up their words with cash… Because Freight Farms is different from your average social media or enterprise startup in nearly every way, it is a scary proposition to investors.”

Announced: 12/09/13 Stage: Series A Participating Institutional Investors: LaunchCapital, Rothenberg Ventures, Morningside Group Previous Investment: Undisclosed amount from Techstars Founded: 2011

Gousto Raises $2m. The London-based subscription meal kit delivery service provides chef-developed recipes and organic ingredients in exact proportions. The new funding will be used to grow Gousto’s network of chefs and nutritionists, improve its recipes and strengthen relationships with its farm suppliers and producers.

Announced: 12/09/13 Stage: Seed Participating Institutional Investors: MMC Ventures (lead), Angel CoFund Previous Investment: £500k Founded: June 2012

Power Supply Raises Undisclosed Equity Funding and $515k in Debt. The Alexandria, Virginia-based healthy meal subscription business partners with experienced chefs to create locally-sourced, healthy, ready-to-eat meals, which are then sold through its e-commerce platform. Customers order and pay for between 3 and 10 meals a week, and then pick up their meals from local gyms and yoga studios, which Power Supply outfits with branded commercial refrigerators. Danielle Gould wrote a thorough feature in December, check it out to learn more about Power Supply’s customer demand, distribution infrastructure, quality control and meal review analytics.

Announced: 12/06/13 Stage: Seed/Debt Participating Institutional Investors: Center for Innovative Technology’s GAP Funds Previous Investment: Not Disclosed Founded: 2010

Daily Secret Raises $1.25m. Headquartered in Athens, Greece and New York, New York, the company is a digital media brand that helps young and affluent professionals discover coveted bars, restaurants, shops and other hidden gems in 40+ destinations across the world through a daily email and website. The email also serves as a marketing channel for advertisers and venues that are featured.

Announced: 12/06/13 Stage: Venture Participating Institutional Investors: Not Disclosed Previous Investment: $1.85m Series A Founded: May 2010

PARTNERSHIPS

E La Carte Scores Partners with Applebee’s to provide 100,000 Presto Tableside Tablets to all U.S. Locations By Year-End 2014. The deal comes following a two-year pilot program where Applebee’s tested the tablets across 30 restaurants around the U.S, and will represent one of the largest tableside tablet rollouts to date in any private enterprise.

Food & Wine Magazine Partners with Drync Wine App to Offer Interactive Experience December 2013 Issue. The partnership enables readers to instantly buy any wine featured in the 2013 Essential Holiday Party Planning Guide by simply taking a photo of it in the magazine with the Drync app.

INDUSTRY LANDSCAPE

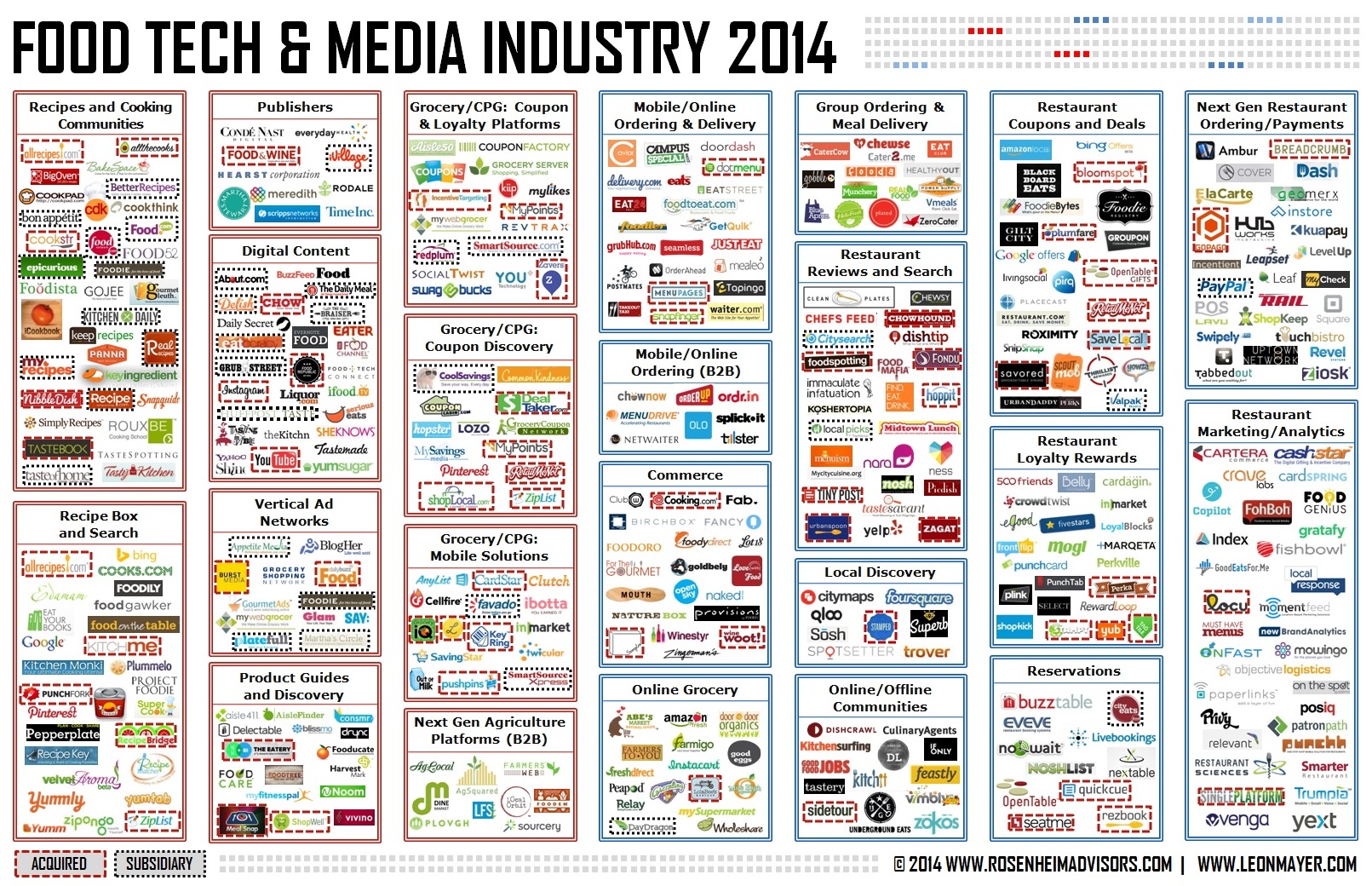

As The Food Tech & Media ecosystem continues to see rapid change, we created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape.

Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out last month’s round-up here.

Would you be interested in a round-up of agriculture-related funding, partnerships and acquisitions? Let us know in the comments below.