Every week we track the business, tech and investment trends in CPG, retail, restaurants, agriculture, cooking and health, so you don’t have to. Here are some of this week’s top headlines.

Another big week for the plant-based meat industry, with news of Beyond Meat‘s aims to raise $183.8 million for its IPO. Amid rising tensions, Tyson Foods announced that it was selling its 6.5% stake in the company, with no word on the sale price or buyer. Clara Foods has closed its Series B led by Ingredion.

In other news, Unilever has acquired Olly for an undisclosed sum. Walmart plans to create a supply chain for its Angus beef, bypassing Tyson.

Check out our weekly round-up of last week’s top food startup, tech and innovation news below or peruse the full newsletter here.

_______________

1. Beyond Meat Prices Its Public Offering – TechCrunch

The company is looking to raise roughly $200m in the stock sale for its portfolio of burger, chicken and sausage replacements. This would value Beyond Meat at more than $1b.

2. Tyson Foods Sells Stake in Beyond Meat Amid Rising Tensions – Axios

Tyson had a 6.5% ownership stake in Beyond Meat when the company filed for its IPO last November, having invested a total of $23m. The sale price and buyer is unknown.

3. Unilever Gives Supplements Another Chance with Olly Acquisition – Nutra Ingredients

Financial details were not disclosed. Olly’s combination of product offerings, from protein snack to beauty supplements, made it a good fit for Unilever.

4. Clara Foods Secures Series B Financing Led By Ingredion – Forbes

This round of financing will fast-track commercialization of its animal-free egg protein, expand research and development capabilities and broaden the product road-map. Financial terms were undisclosed.

5. Walmart Creates an Angus Beef Supply Chain, Bypassing Tyson – Bloomberg

The nation’s biggest grocer has partnered with a Texas cattle rancher and other industry-related businesses to provide a steady supply of no-hormone-added Angus beef to 500 of its US stores beginning later this year.

6. Private Label Sales Exploding at Mass Retail – Storebrands

Private label dollar volume in the mass retail channel surged 41% over the last five years, compared to a gain of only 7.4% for national brands. Store brands volume climbed by 33.2%.

7. Rethinking Protein

Join us on Tuesday, April 30, 2019 in New York City to hear from Founders and CEOs that are creating sustainable alternatives to protein at our April Food+Tech Meetup, Alternative Protein. We’ll be joined by Courtney Boyd Meyers of AKUA, Gavin McIntyre of Ecovative and Brian Rudolph of Banza.

8. Ninjacart Raises $89M from Tiger Global in India’s Largest-Ever Farm Tech Deal – AgFunder

Funding will help Ninjacart expand to 10 new cities, add 200 distribution centers across India, improve the supply chain infrastructure and strengthen its product and tech team.

9. India: Omnivore Raises $97M for Its Second Fund – Economic Times

Investors included CDC Group, FMO, Swiss Investment Fund for Emerging Markets and more. Omnivore has made five investments ranging from $500k to $4m thus far.

10. Cultivian Sandbox Closes 3rd Fund on $135M with Bevy of Food & Ag Corporate LPs – AgFunder

Investors include Archer Daniels Midland, Corteva Agriscience, Ecolab, Elanco, Griffith Foods and more. Funding will be used to invest in Series A and B deals, covering technologies that advance crop production, animal health and protein production.

11. Mondelēz Invests In Hu Kitchen and Products – Nosh

Financial terms were undisclosed. Hu just debuted a line of gluten-free crackers that will now be able to scale faster and reach a more accessible price with the investment.

12. Cava Sets Its Sights on Bigger National Presence After Zoes Kitchen Acquisition – CNBC

Cava Group completed its $300m acquisition of Zoes Kitchen. The company is working on bringing Cava Grill to new markets and bring Zoes dips into Whole Foods nationwide.

13. Salesforce CEO Marc Benioff Invests in $25M Round for Naveen Jain’s Microbiome Startup Viome –GeekWire

The new capital will be used to fund research into the link between the human microbiome and chronic diseases including diabetes, autoimmune disorders and Parkinson’s, as well as cancers.

14. After 8 Years of Legal Battles, Quest for Food Stamp Data Lands at Supreme Court – Argus Leader

In 2011, reporters decided to request data about the government’s food assistance program. Eight years later, they are still fighting for that data.

15. Women, Women of Color & Gender Non-Conforming Innovator Database

We created this open-source list to increase representation, support and investment in women, women of color & gender-nonconforming innovators in food. Join the list & help us spread the word using #womxninfood

Our newsletter is the absolute easiest way to stay on top of the emerging sector, so sign up for it today and never miss the latest food tech and innovation news and trends, Already signed up? Share the love with your friends and colleagues!

Related Posts

Beyond Meat Has Top IPO of 2019, 1M Species at Risk of Extinction + More

Beyond Meat Has Top IPO of 2019, 1M Species at Risk of Extinction + More Target Buys Shipt for $550M, Mario Batali, Johnny Iuzzini and Ken Friedman’s Sexual Misconduct Allegations, Target Buys Shipt for $550M + More

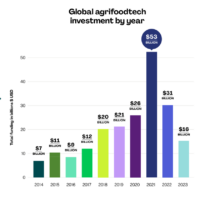

Target Buys Shipt for $550M, Mario Batali, Johnny Iuzzini and Ken Friedman’s Sexual Misconduct Allegations, Target Buys Shipt for $550M + More Agrifoodtech Startup Investment Drops 50%, Ron Desantis and Florida Turn on Cultivated Meat + More

Agrifoodtech Startup Investment Drops 50%, Ron Desantis and Florida Turn on Cultivated Meat + More