This is a monthly guest post, by consulting firm Rosenheim Advisors, which highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

The month of October featured two mega-deals, with First Data’s $2.56 billion IPO (valuing it at $14 billion) and the merger of China’s competing firms Meituan and Dianping, reportedly valued at $15 billion (or potentially even $20 billion).

On top of these deals, globally over $373 million was invested across 18 deals into the private food tech sector, with a majority of the cash influx going to companies in China and India. Online ordering, meal delivery and the grocery sectors were dominant themes, with the restaurant tech sector grabbing most of the headlines (including Heartland’s acquisition of Digital Dining).

M&A

Grofers Acquires Townrush. The Bangalore, India-based business-to-business logistics service was acqui-hired by Grofers, a food delivery startup. The deal follows a similar acqui-hire for Grofers with the healthy meal app, SpoonJoy. Both Townrush and SpoonJoy will cease independent operations.

Announced: 10/27/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: June 2015

Rocket Internet (Hellofood Middle East) Acquires Otlob.com. The Egypt-based website for food delivery will expand its services and become more user-friendly through Hellofood’s acquisition. The company currently operates in six cities across Egypt and provides consumers with access to over 500 restaurant menus for delivery. For more details, you should read Wamda’s accounting of the company’s ups and downs and recent turnaround story since the founding in 1999.

Announced: 10/28/15 Terms: “As low as $12m” Previous Investment: Owned by Accelero Capital Founded: 1999

Heartland Acquires Digital Dining. The Springfield, VA-based software company, which provides handheld point of sale systems for restaurants, will allow Heartland to enhance its Commerce division. With the acquisition of Digital Dining, Heartland will evolve its restaurant customers’ point of sale systems into secure commerce centers.

Announced: 10/30/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 1984

Meituan and Dianping Merge. The Beijing, China-based Meituan, which is probably the closest to a ‘Groupon for China’, will merge with its competitor, the Shanghai, China-based Dianping, which is a restaurant review and group discount mobile app. According to a Reuters report, the two companies will retain their respective brands and management structure and independently operate their businesses. It is estimated that the merged company will be valued at $15 billion or more.

Announced: 10/08/15 Terms: Not Disclosed (estimated to be $15 billion or more) Previous Investment: Meituan: $1.0 billion; Dianping: $1.1 billion Founded: Meituan: 2010; Dianping: 2003

FUNDING

Qraved Raises $8m. The Jakarta, Indonesia-based online dining guide provides diners with a restaurant directory as well as service reviews, ratings, and photos. The directory includes information for over 25,000 restaurants in Jakarta and Bali. The company will use the proceeds to enhance its online and mobile apps and expand its presence in Indonesia.

Announced: 10/30/15 Stage: Series B Participating Institutional Investors: Gobi Partners (lead), Richmond Global (lead), 500 Startups, Convergence Ventures, GWC, M & Y Growth Partners Previous Investment: $1.3 million Founded: 2013

TinyOwl Raises $7.5m. The Mumbai, India-based food ordering app provides users with a location-based listing of nearby restaurants from which they can order food. In addition, TinyOwl Homemade allows users to order food from local chefs. The funds will be used in the restructuring of the company—continuing plans that included laying off over 100 employees and closing 4 sites earlier this year. Currently only TinyOwl’s Mumbai and Bengaluru sites remain open.

Announced: 10/30/15 Stage: Series C Participating Institutional Investors: Matrix Partners (lead), Sequoia Capital Previous Investment: $19.0 million Founded: 2012

Gobble Raises $10.75m. The Palo Alto, CA-based delivery service provides dinner kits for home cooking. Kits include a 3-step-recipe as well as all of the preparations for a one-pan, ten-minute meal. Gobble will use the proceeds to fund its engineering team.

Announced: 10/29/15 Stage: Series A Participating Institutional Investors: Trinity Ventures (lead), Fenox Venture Capital, Initialized Capital Previous Investment: $1.2 million Founded: 2010

9now.cn (Meiwei Buyongdeng) Raises $79m. The Shanghai, China-based mobile app offers users a queuing service which includes reservations, real-time line status, and an alert when the table is ready. Users can also place orders through the app. The company will use the funds to expand online reservation services, improve queuing services and grow the network. The company currently has 30,000 merchant partners using their queue and reservation services.

Announced: 10/28/15 Stage: Series C Participating Institutional Investors: Dianping, Baidu, Matrix Partners China Previous Investment: $20.0 million+ Founded: 2013

Leaping Caravan Raises $150k. The Guragon, India-based online food delivery service delivers Indian foods to corporate customers. The company currently operates in Guragon and Delhi, and has recently seen an increase from 30 to over 100 orders per day. The proceeds will be used to grow the business, including plans for two new kitchens in Delhi.

Announced: 10/23/15 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: September 2013

Frsh.com Raises Angel Funding. The Guragon, India-based meal delivery service allows consumers to have healthy meals delivered within an hour. Frsh currently operates in Guragon, Delhi, and Noida. Funds will be used to expand to Bangalore and Mumbai.

Announced: 10/23/15 Stage: Angel Participating Investors: Kae Capital, Mayank Bhangdia Previous Investment: $0.6 million Founded: 2014

Honestbee Raises $15m. The Singapore-based grocery delivery service allows users to choose groceries from their favorite stores for on-demand delivery within the hour. The grocery service aims to cut down shopping time—which averages over 4 hours for many—and provide part-time shopper jobs for people whose domestic roles do not permit full time employment. Honestbee is available in Singapore and Hong Kong, with plans to expand to Taiwan and Japan. The company will use the investment for hiring and expansion throughout Asia.

Announced: 10/21/15 Stage: Series A Participating Institutional Investors: Formation 8 (lead), Pejman Mar Ventures Previous Investment: Not Disclosed Founded: January 2014

Mouth Raises $5.5m. The New York, NY-based online store offers a wide selection of craft foods, wine, and spirits. Monthly subscriptions are also available. All products sold by Mouth are specialty, indie food products. The company will use the proceeds for executive hiring and corporate sales.

Announced: 10/20/15 Stage: Series A Participating Institutional Investors: KarpReilly (lead), Vocap Ventures Previous Investment: $1.8 million Founded: 2010

MealHopper Raises $100k. The Guragon, India-based platform for homemade meals connects users with home cooks via mobile app. Currently fifty home cooks prepare meals, which are then marketed, packaged, and delivered by MealHopper. The company will use the investment to expand, with plans to grow its team and operate in three new cities by March 2016.

Announced: 10/20/15 Stage: Seed Participating Investors: Alok Bajpai, Rajnish Kumar Previous Investment: Not Disclosed Founded: 2015

First Data Raises $2.56 billion in Initial Public Offering. The New York, NY–based commerce solutions company began moving away from payment processing in 2013 when a new CEO was brought in to turn around the company. According to the prospectus, future growth will be “driven by focusing on helping our clients grow their businesses by providing them with a suite of new commerce-enabling technologies as well as our broad set of existing solutions.” Proceeds from the offering will be used to pay down First Data’s debt, which totaled $21 billion at the end of June, largely a result of the 2007 leveraged buyout by KKR.

NYSE Listing Date: 10/15/15 Valuation at IPO: $14 billion Stage: IPO Founded: 1989

ShopWell Raises $3.4m. The San Carlos, CA-based mobile app provides personalized nutrition information for users. The app suggests healthy alternatives for items on users’ shopping lists and incorporates user preferences and dietary restrictions. Previously acquired by Harvestmark in 2013, the company became independent again when Harvestmark was acquired by Trimble. The funds will be used for company growth and to increase investment in partnerships with retailers, food manufacturers, and other members of the food system.

Announced: 10/13/15 Stage: Series C Participating Institutional Investors: Finistere Ventures, Fairhaven Capital, Munich Venture Partners, S2G Ventures, ATA Ventures Previous Investment: $8.0 million Founded: 2008

Bucketkart Raises $150k. The Bangalore, India-based online grocery store allows consumers to easily buy groceries for delivery. The store currently takes online orders, and mobile app ordering will be available soon. Funds will be used to expand the company to five new cities in the next 2 months. Bucketkart also plans to close a $1million investment soon.

Announced: 10/13/15 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: December 2014

Womai Raises $200m. The Beijing, China-based e-commerce business for food allows consumers to purchase groceries online. Deliveries are made to 31 Chinese regions and are provided within 48 hours of order. Womai will use the funding to develop the company’s cold-food logistics.

Announced: 10/12/15 Stage: Series C Participating Institutional Investors: Baidu, Taikang Life Insurance Previous Investment: $110.0 million Founded: 2008

Thistle Raises $1m. The Berkeley, CA-based meal delivery service allows consumers to choose meals from a selection of healthy foods and juices. Proceeds will be used to implement the company’s newly launched subscription service business model, which requires purchase of a regularly scheduled delivery service.

Announced: 10/12/15 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: 2013

Zeppery Raises Angel Funding. The Delhi, India-based mobile app allows customers to pre-order food from restaurants. Users can browse photo menus, select their choice, and check status updates. The investment will be used to launch and market the app.

Announced: 10/09/15 Stage: Angel Participating Investors: Suyash Sharma Previous Investment: Not Disclosed Founded: 2015

Gratafy Raises $4.3m. The Seattle, WA-based gifting app allows users to purchase and send food and drinks from restaurants and bars as gifts to friends. Gift receivers use the app to redeem their item at the restaurants or bar where it was gifted to them. The company will use the investment to expand and accelerate sales.

Announced: 10/09/15 Stage: Undisclosed Participating Investors: Rudy Gadre, Greg Enell, Acorn Ventures Previous Investment: $3.0 million Founded: May 2011

ZuperMeal Raises $2m. The Mumbai, India-based mobile app allows users to order home-cooked meals for on-demand delivery. Through ZuperMeal, home chefs can sell their signature dishes, which are aggregated on the app for consumer purchase. The investment will be used to expand the company’s locations in India.

Announced: 10/08/15 Stage: Seed Participating Investors: Ravi Saxena, Sanjeev Kapoor Previous Investment: Not Disclosed Founded: 2015

EzCater Raises $15m. The Boston, MA-based online catering marketplace provides on-demand catering for businesses. The company serves 23,000 cities in the United States, working with over 40,000 restaurants and caterers. EzCater will use the investment for nationwide expansion.

Announced: 10/06/15 Stage: Series C Participating Institutional Investors: Insight Venture Partners Previous Investment: $18.5 million Founded: August 2007

PARTNERSHIPS

Food & Wine Partners with Drizly to allow users to purchase cocktail ingredients for on-demand delivery.

Delivery.com Partners with UberRUSH to optimize food delivery.

ChowNow Partners with UberRUSH to make delivery more efficient.

AmazonFresh Partners with Hungryroot to deliver ready-to-eat, healthy meals.

Mozido Partners with TabbedOut to enhance customer dining experience and hospitality.

Instacart Partners with Allrecipes to allow recipe browsers to purchase ingredients for delivery.

Blue Apron Partners with Yummly to deliver recipes and ingredients for home cooking.

Target Corp Partners with MIT’s Media Lab to research the future of food.

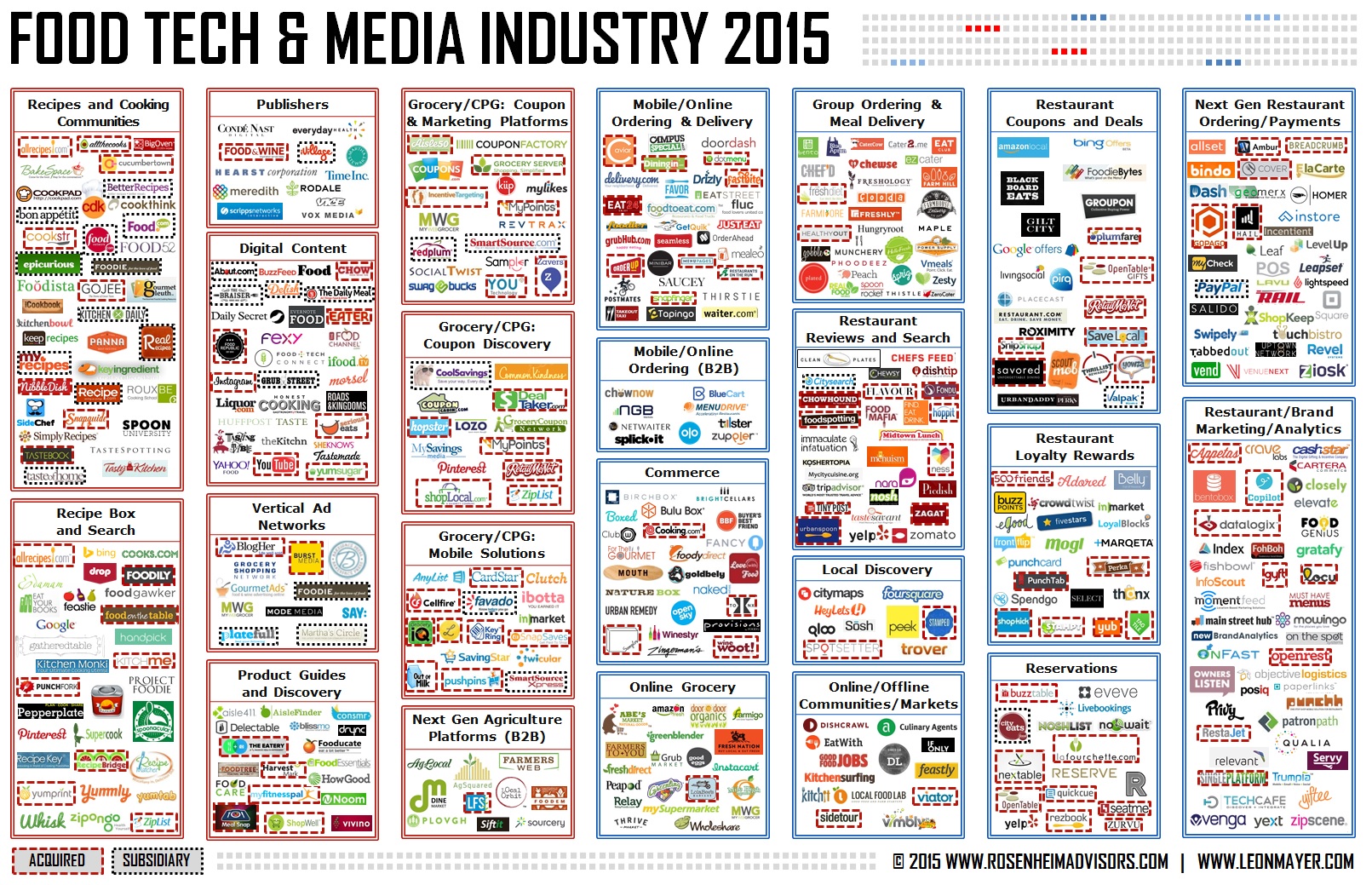

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.