From home cooking to the restaurant experience, technology-focused food startups are enhancing the way consumers engage with food. These startups are creating significant value for consumers and notable opportunities for restaurants and brands to better understand and provide value to their customers. As the food tech sector matures, we are seeing an increasing number of these companies being funded or acquired by industry players. This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, e-commerce, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

July was a busy month as four prominent industry players – Apple, Dropbox, Yelp and OpenTable – acquired companies in the Food Tech & Media space, and ten companies raised over $315 million. There was a heavy focus on the restaurant vertical with 11 of the 18 deals highlighted in this report relating to recommendations, reservations and delivery, as well as marketing and analytics, payments and workforce optimization. In addition to those deals, Foursquare and Google launched new location-based restaurant and merchant advertising features.

Foursquare’s new self serve ad platform will allow smaller local restaurants and merchants the ability to employ location-based advertising campaigns on a cost-per-action basis – a service that was previously only available to larger chains, like Chipotle and Taco Bell. Foursquare expects to drive sizeable revenue from this initiative ($20m-$40m annually), estimating 10 percent to 20 percent of the million venues using Foursquare would utilize the service. Although some critics think that estimate is generous, the initiative will still be a major contributor to the top line as the company’s monetization strategy continues to evolve.

Google overhauled its local apps and content with a revamped version of Google Maps (for both Android and iOS) and a relaunch of Zagat, which removes the paywall and registration requirements to see reviews. The updated Google Maps interface features an Explore tab to find local recommendations in categories like Eat, Drink and Shop with each location displaying a newly simplified 5-star rating system next to it, which is comprised of both Google+ and Zagat reviews. Similar to Foursquare’s new self-serve location-based ads, the Google Map update allows local advertisers, through AdWords, to target Maps users with a prominent, contextually and geographically relevant ad box under the map screen, immediately after they’ve performed a search.

Another development worth noting is related to the newly unlocked Zagat content and reviews. The Zagat site and app currently cover just nine cities, and although they say they will add 50 locations in the coming months, it appears they are decreasing the scope of the Zagat empire. They will be making up for that, however, by launching a new, Elite Yelper-style program called Google City Experts to encourage more high-quality local business ratings and reviews on Google+. But even this program is limited to 14 cities at launch. As TechCrunch points out, this is part of the “All-Roads-Lead-to-Google+” strategy that has been under way for a while to bolster the power of the social network, but it will be interesting to see if users embrace the new Zagat hybrid – especially during a time when other crowdsourced review sites are investing in curated editorial to increase credibility.

M&A

OpenTable Acquires Rezbook. By purchasing Urbanspoon’s restaurant reservation management system, OpenTable will add approximately 2,000 restaurants as clients, and dramatically increase its reach as it will now power restaurant reservations across all of Urbanspoon’s properties through a new partnership (read more in “Partnerships” section below). Given OpenTable’s increased focus on mobile (see last month’s acquisition of JustChalo), the partnership will be particularly beneficial as it gives OpenTable exposure to Urbanspoon’s large mobile audience. Urbanspoon, which was just moved under the Ask.com umbrella amid massive layoffs at CityGrid Media, announced the divestiture would allow the company to focus more deeply on high quality editorial content, perhaps seeing an opportunity as Zagat begins to lose its reign.

Announced: 7/31/13 Terms: Not Disclosed Previous Investment: Not Disclosed (Developed by Urbanspoon, (an IAC company)) Founded: 2011

Dropbox Acquires Endorse. The mobile loyalty app, which focused on closing the online-to-offline purchase loop by promoting consumer brand loyalty through rewards after purchase, was acquired a month after shuttering its service. TechCrunch maintains this was not an acqui-hire, however it is unclear how Dropbox plans to incorporate the loyalty service and 17 employees, the majority of whom will be joining the Dropbox team in the acquisitio, into the Dropbox product. Endorse’s partners included Procter & Gamble, Mondelez, Pepsico, General Mills, McCormick and Popchips.

Announced: 7/20/13 Terms: Not Disclosed Previous Investment: $4.25m, Institutional investors included: Accel Partners, SV Angel. Founded: 2010

Apple Acquires Locationary. The Toronto-based crowdsourced local business data company will serve to beef up Apple’s mapping service, which took a hit after breaking up with Google Maps. Locationary uses data submitted by users worldwide and a federated data exchange platform called Saturn to collect, merge and continuously verify a massive database of information on local businesses, like restaurants, to keep an up-to-date list of addresses, whether the business is still open, etc. In addition to its own database, Locationary also works with data providers, enterprises and mobile app developers to help parse and clean up their own business data, which as TechCrunch notes, “points to how Apple can use Locationary’s technology to also improve and enhance its own SDKs for apps as well as its wider push into services focused on enterprises.”

Announced: 7/19/13 Terms: Not Disclosed Previous Investment: $2.5m, Institutional investors included: Trellis Capital, Extreme Venture Partners, Plazacorp Ventures, MaRS Investment Accelerator Fund. Founded: September 2009

Yelp Acquires SeatMe. The web and app-based restaurant and nightlife reservation platform provides a low-cost offering that targets operators who still rely on pen-and-paper to manage their reservations. Some journalists have commented that this is a clear move to take on OpenTable, which has powered Yelp’s integrated restaurant reservations since 2010, however given that SeatMe doesn’t seem to be built for higher-end restaurants, it is likely the OpenTable relationship will still be relevant. Yelp noted that it also plans to utilize SeatMe’s team and technology to expand their time-slotting offerings to other local businesses (like salons or dentists), which is highly complementary to the company’s new “Yelp Platform” (discussed further in the “Partnerships” section below).

Announced: 7/18/13 Terms: $12.7m ($2.2m in cash, 263k shares of stock) Previous Investment: Not Disclosed, Institutional investors included: Khosla Ventures, Maveron. Founded: March 2011

FUNDING

NatureBox Raises $8.5m. The healthy snack subscription commerce company charges a monthly subscription fee for home-delivery of an assortment of healthy snacks, as well as recipes and ideas for nutritional eats. As covered by Danielle Gould at Forbes, Naturebox uses direct sales, analytics and iterative development to get its products to market faster and cheaper than its incumbents. Rather than sourcing from large CPG companies, NatureBox produces all the food itself and tries to source ingredients from local growers and independent food producers. The funding will be used for user acquisition, expansion of the engineering team to improve the data analytics and the algorithm which matches products to customers’ preferences, as well as an increased investment on product and marketing.

Announced: 7/23/13 Stage: Series A Participating Institutional Investors: General Catalyst Partners, SoftBank Capital Previous Investment: $2m Seed Founded: January 2012

Viableware Raises $6.5m. The Kirkland, WA-based restaurant payment platform, named RAIL, replaces a server’s leather-backed billfold with a touchscreen that allows guests to control payment transactions by splitting the bill, calculating the tip, emailing the receipt and self-swiping their credit card. Rather than similar table side payment products, RAIL is aimed at higher end restaurants and is designed to complement the waiter’s role rather than replace it. The proceeds will be used to implement more RAIL systems nationwide, as well as build the company’s sales and tech teams.

Announced: 7/23/13 Stage: Series B Participating Institutional Investors: Swiftsure Capital Previous Investment: $950k Founded: 2011

RetailMeNot Raises $191m. The Austin-based online coupon marketplace RetailMeNot (formerly WhaleShark Media) debuted on the New York Stock Exchange in July (Ticker: SALE), with its IPO stock priced at $21 per share (midpoint of the $20-$22 range), for an initial market cap of approximately $1.05 billion. The stock has performed well, trading at 35% above the IPO price at the close of the month. The company aggregates digital coupons from consumer brands and retailers, and is built on a pay-for-performance model, where it makes commissions from retailers after a purchase. The company launched as an online coupon rollup play in June 2010, making its first acquisition of Australia’s RetailMeNot later that year, with four other international acquisitions since. It intends to use the proceeds to “increase traffic and monetization, growth depth of paid relationships with retailers, invest in technology and innovation, expand internationally, and pursue strategic acquisitions.”

Priced: 7/18/13 Stage: IPO Previous Institutional Investors: Austin Ventures, Norwest Venture Partners, J.P. Morgan, Institutional Venture Partners, Adams Street Partners, Google Ventures Previous Investment: $300m Founded: June 2010

Objective Logistics Raises $5.3m. The Cambridge, MA-based “talent optimization” software provider uses game dynamics to incentivize wait staff to perform better and in the process add to a restaurant’s bottom line. The company’s software platform is called MUSE, which creates a competitive environment by ranking wait staff on a leader board and rewarding them with their choice of shifts and other prizes. The company will use the proceeds to grow its customer base both within the restaurant vertical, and into new verticals including retail.

Announced: 7/18/13 Stage: Series A Participating Institutional Investors: Atlas Venture, Google Ventures, Next View Partners Previous Investment: $1.4m Debt Round, $1.5m Venture Round, $800k Seed Founded: January 2009

Dash Raises $700k. The NYC-based mobile payments app allows restaurant or bar patrons to open, modify, settle and pay their tab directly from their phone. The iPhone app integrates directly with bar and restaurant payment systems, so once users have stored their payment info in the app, they don’t need to supply their credit card to the restaurant. Dash will launch the service in August, beginning with NYC, and plans to expand to other U.S. cities in the next six months. The company also plans to release an Android app before the end of the year.

Announced: 7/18/13 Stage: Seed Participating Institutional Investors: New York Angels, Caerus Ventures, Brooklyn Incubator Previous Investment: Not Disclosed Founded: January 2011

Vivino Raises $10.3m. The Danish image-based wine app helps users discover and rate wines, claiming to be the most downloaded wine app in the world as well as the highest-ranked wine app in the United States. Users snap a photo of a wine label which is then matched against a database of over 1 million wines to present the bottle’s producer, brand, country, varietals and where to buy it locally. Vivino will use the new capital for product and business development, as well as for marketing throughout Europe and North and South America.

Announced: 7/17/13 Stage: Series A Participating Institutional Investors: Balderton Capital, Creandum, Seed Capital, Janus Friis Previous Investment: $1m Founded: 2009

Liquor.com Raises $3.1m. The San Francisco-based digital media property focused on cocktails, mixology and spirits has been growing steadily, with an average of 1.3 million monthly uniques and over 5 million monthly readers across all of its channels. In addition to providing award-winning content, the company has created a savvy integrated marketing platform for spirits companies, which typically have deeper pockets for marketing than food brands. The company announced that the growth capital will be used to expand and scale Liquor.com’s platform capabilities, with a focus on extending audience reach online across social media and mobile platforms.

Announced: 7/17/13 Stage: Series B Participating Institutional Investors: Suffolk Equity Partners (Lead), Typha Partners Previous Investment: $1.4m Series A Founded: 2009

Privy Raises $1.7m. The Boston-based online marketing platform for local businesses enables businesses to list “chalkboard specials” (limited and targeted promotions) online to attract customers who turn to the web before buying locally. The company has recently changed its focus from independent local businesses to multi-unit regional and national chains, namely where a marketing manager is already in place to utilize the self-service platform. Privy plans to use the financing to grow its engineering, marketing and sales teams, as well as to further develop its product.

Announced: 7/15/13 Stage: Seed Participating Institutional Investors: Atlas Venture, 500 Startups, Sierra Maya Ventures and Genie Bottle Ventures Previous Investment: Not Disclosed Founded: 2011

Instacart Raises $8.5m. The San Francisco-based same-day grocery-delivery service relies on a fleet of company-trained personal shoppers (“anyone with a smartphone and a car is eligible to apply”) to travel to the different stores – Safeway, Trader Joe’s, Whole Foods, Costco – to complete a customer’s order. Founded by a former Amazon.com supply-chain engineer, the company recently announced an “Express” service option for $99/year, which, akin to Amazon’s Prime, gives customers free deliveries. The company plans to use the investment to fund expansion, with a goal of being in at least 10 major cities across the U.S. by the end of 2014.

Announced: 7/10/13 Stage: Series A Participating Institutional Investors: Khosla Ventures, Canaan Partners, SV Angel, Paul Buchheit, Sequoia Capital, Haystack Previous Investment: $2.3m Venture Round Founded: July 2012

Fancy Raises $53m. After adding $15m to its coffers in May, the image-based social commerce company added an additional $53m from American Express and high net individuals, including Will Smith, and is now reportedly valued at over $600m. Although the site is often mentioned as a competitor to Pinterest, it feels more like a mash-up between Fab.com and Pinterest, as Fancy features a “cooler” selection of items and is more geared towards the transactions than Pinterest. The company also sells its own monthly curated subscription boxes by celebrities, including Ashton Kutcher and Tyler Florence, as well as a “Fancy Food Box,” which is likely a result of the Samplrs acquisition in February. Beyond the report that the financing will “aid the expansion” of the New York-based company, no other details have emerged about the use of proceeds.

Announced: 7/8/13 Stage: Venture Round Participating Institutional Investors: Will Smith, American Express, Len Blavatnik Previous Investment: $15m Venture Round, $26.4m Venture Round, $10m Series B, $6m Series A, $2m Angel Founded: 2009

Delivery Hero Raises $30m. The Berlin-headquartered global network of online food ordering marketplaces offers its services predominantly in Europe but has also expanded to Australia, South Korea, China, India and Mexico. The company confirmed it would reach profitability this year, and that it plans to use the proceeds “to build top technology and strengthen its position in existing markets.” As TechCrunch points out, it is unclear if that means expansion into new markets, or merely ramping up its existing operations.

Announced: 7/1/13 Stage: Series D Participating Institutional Investors: Phenomen Ventures (Lead), Team Europe, Kite Ventures, Ru-net, Tengelmann Ventures, Holtzbrinck Ventures, Point Nine Capital, Kreos Capital Previous Investment: $50m Series D, $33m Series C, $15m Series B, 5.6m Series A Founded: September 2010

PARTNERSHIPS

Yelp Partners with Delivery.com and Eat24 to Offer Food Delivery From Yelp Platform. The “Yelp Platform” feature will start out in San Francisco and New York, allowing Yelp to work with local delivery services so that customers don’t have to leave Yelp to place orders. Yelp will also take care of the entire ordering and checkout experience and process the payments. Yelp intends to add additional categories to the platform, including spas, yoga studios, salons and dentist appointments, which makes the SeatMe acquisition look even more relevant to this portion of the company’s growth strategy.

OpenTable Partners with IAC’s Urbanspoon to Power Reservations on Urbanspoon’s Website and Mobile App. In conjunction with OpenTable’s announcement that it acquired Rezbook, Urbanspoon’s reservation management system for restaurants, the company announced it will now provide the reservation platform for reservations through all of Urbanspoon’s properties. Presumably this partnership will impact Urbanspoon’s partnerships with international online reservation services Dimmi and Livebookings, which was announced last November. In a blog post announcing the deal, Urbanspoon said the deal will increase its coverage and enable it to sharpen its focus.

Asian Telecom Provider SingTel Licenses Nara Logistics’ Restaurant Recommendation Engine. SingTel has been wading deeper into the restaurant vertical, with last year’s acquisitions of restaurant review sites Hungrygowhere and Eatability, and a recently launched restaurant booking site called TableDB, and plans to use Nara’s technology to bolster the telecom’s presence in the hyperlocal lifestyle space. This deal is “financially significant” to Nara and positions the company to expand into vertical beyond restaurants. Forbes notes this, pointing out, “Nara is planning to move beyond dining into financial services and other commerce categories and sees SingTel as a way to do that.”

LevelUp Partners With POS Software Developer pcAmerica. The payment and loyalty solution will be integrated into pcAmerica’s retail and restaurant POS software, which means an additional 50,000 restaurants, liquor stores and convenience stores can now accept mobile payments. As part of the integration, retailers will also have the option to supply LevelUp with detailed, interpretable SKU-level data, which will lay the foundation for customized loyalty campaigns.

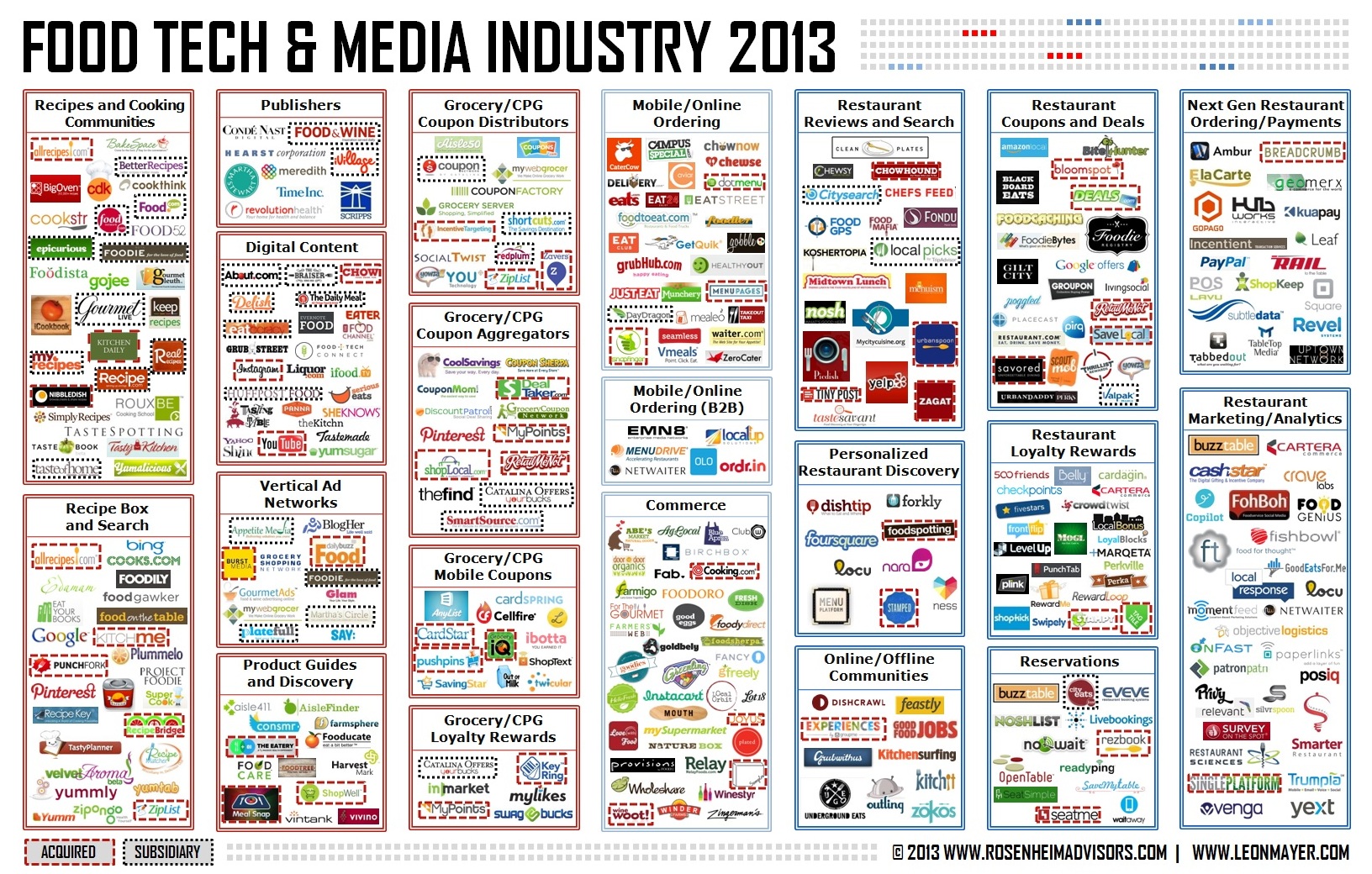

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, we created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape.

Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out last month’s round-up here.

Would you be interested in a round-up of agriculture-related funding, partnerships and acquisitions? Let us know in the comments below.