Secret Sauce: 10 Tips for Getting Your Product into Whole Foods is a guest series by the founders of Bandar Foods. Follow along as Dan and Lalit share their tips and tricks for starting and growing a specialty food company.

We’re almost there. We’ve spent a lot of time thinking about brand and scalability and… oh wait – forgot to tell you – you’re going to spend a lot of money. Chances are you’ve already spent a lot of money just getting to this point. Today we’re going to help you calculate how much you can realistically expect to make (or lose) bringing Grandma’s Pasta Sauce to market. We’ll keep this simple.

Let’s first think about your initial investment in the business. These are all the “one-time” costs you will incur just to get started, which include the costs of product design, testing, nutritional studies, incorporation costs, legal fees, etc. From an accounting standpoint, your one-time costs won’t matter in your year-to-year operations; these are essentially “sunk costs” that make up your initial investment in the business. However, as an entrepreneur, it’s very important for you to have a good understanding of the following two things before you get started:

- How much money you need just to get started

- Is this project going to be a good investment for you.

For number one, we unfortunately don’t have averages for initial investment, but we’ve heard a range of $1,000 to $1,000,000 in our discussions with other entrepreneurs. Clearly, take time to think this through before you start spending money. This is money you can’t get back.

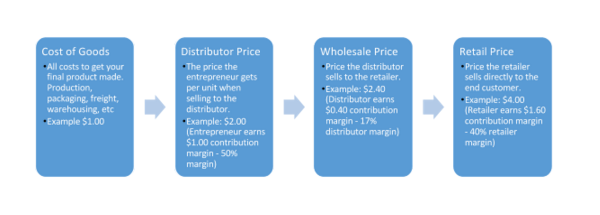

While you’re first determining whether your product can scale (Chapter Two) it’s important to think about the unit economics, the direct revenues and costs associated with your business model expressed on a per unit basis. Here’s an example:

General rule of thumb: the entrepreneur should try and earn at least a 40 percent contribution margin, the selling price per unit minus the variable cost per unit, though this completely depends on your product type. Once you start operating, the goal is to get to break even and then to get to a place where your revenues are greater than your operating costs, which is when you start earning a profit.

Forecasting Revenue For a Specialty Food Business

How do you forecast revenue for a specialty food business? It’s actually pretty easy. There are four numbers you need to multiply:

- Price per Unit: The price the entrepreneur makes per unit, either selling directly to a distributor, retailer or to the end customer.

- Number of Stores: The number of places you sell your product, which can include non-traditional types of distribution like online outlets.

- Number of SKUs per Store: SKUs are a stock keeping unit that acts as a unique identifier for each distinct product sold by business. For example, let’s say you produce marinara, garlic and basil, and four cheese pasta sauces, this means you have three total SKUs. How many, on average, do you have across all of your stores?

- Sales Velocity Per Store: In the food industry, the standard metric is units sold per SKU per store per week. This average completely depends upon product category, but it’s probably not as high as you might think. For dry grocery in the center of the store, this is typically between 1 and 3 (higher for high-turn items, lower for others).

So, let’s estimate your revenue. Let’s say you’re earning $2 per unit, you were ambitiously able to secure placement in 500 stores, with an average of 2 SKUs in any given store, and you are moving at 3 units per store per week. This means you are earning ($2 x 500 x 2 x 3) $6,000 per week in revenue, or roughly $300,000 per year. Okay not bad – and we’ll think through ways to improve this over time in a future article.

Forecasting Operating Expenses For a Specialty Food Business

Now, think through your operating expenses. If you are earning a 40 percent contribution margin, this is $120,000 per year in gross profit before trade spend and operating expenses. We’ll talk about “trade spend” in a few weeks as well, but assume that you will probably be spending between 10 and 20 percent of total revenue on sales and promotions to keep your product moving quickly. Then come operating expenses, which includes wages (including any salary you pay yourself or Grandma), marketing, sales, rent, ongoing legal, travel, etc. Subtract all these costs to get to your operating profit, or EBITDA (earnings before interest, taxes, depreciation and amortization).

Needless to say, many entrepreneurs are shocked going through this exercise. The sales velocity seems lower than expected and the initial costs and ongoing expenses are higher. Yeah, this is a tough business, and the smartest entrepreneurs are the ones that maximize revenue while lowering costs (duh). This is something we’re still figuring out at Bandar Foods. Now, take a deep breath. Ask yourself why you’re getting into this business and how much time you think it will take for you to become profitable. Make a financial model and play with your assumptions. What if you sell more than expected? Less? How can you be creative with your expenses? Do you have the financial ability to stick this out for years?

Take another deep breath. Assuming you want to keep going, now you’re ready to sell.

Don’t miss the earlier posts in our Secret Sauce series!

- Secret Sauce: 10 Steps to Getting Your Product into Whole Foods (Intro)

- 10 Steps to Getting into Whole Foods: #1 Ensuring Your Product Is Sellable

- 10 Steps to Getting into Whole Foods: #2 Can Your Recipe Scale?

- 10 Steps to Getting into Whole Foods: #3 Develop a Standout Brand

- 10 Steps to Getting into Whole Foods: #4 Finding Product-Market Fit

- 10 Steps To Getting Into Whole Foods: #5 Understanding The Players

- 10 Steps To Getting Into Whole Foods: #6 Setting Up Admin