This monthly column highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

There were a ton deals in June, with eleven acquisitions (mainly small) and sixteen fundraises (all shapes and sizes), rounding out to over $460 million of global investment into the food tech and media space. As we have been seeing for a while now, delivery and online ordering were represented in spades, but we also saw an influx of digital content deals – ranging from recipes to restaurants – which hasn’t been the case in a while. The average size between the Series A and Series B rounds was $9.4 million, and, signaling that sectors within this industry are increasingly crossing the threshold into the growth equity category, there were five deals sized over $20 million.

While we are far from IPO-mania, the industry is very rapidly accumulating well-capitalized players, and new talk of IPOs among pure-play food tech companies has begun to surface (vs. tech incumbents with a wider focus like Yelp, Coupons.com, Groupon, etc.).

As Delivery Hero padded up with $110 million from “leading public market investors” in June, some have speculated it may be the company’s last private round ahead of going public. Also from the Rocket Internet portfolio, it has been reported that HelloFresh may be considering an initial public offering this year and is in dialogue with Morgan Stanley and Goldman Sachs about advising. On the (much) smaller side of the spectrum, the Wall Street Journal noted that TabbedOut’s recent funding in June would “be its final funding round before going public,” however it is unclear if that would be a near-term event (I would be surprised if that is the case). And while not a pure play food tech company, Square has reportedly filed confidentially for an IPO, which could provide additional acquisition currency to layer in additional services within the local SMB market, many of which are restaurants and food retailers.

In the beginning of 2014 I framed the expansion into the public markets as a “rising tide” phenomenon for startups, in that investors will continue to increase their stake into this sector as the opportunity for successful exits (via acquisition) are more prominent. However now that the industry has begun to mature, there is substantially more buy-in from investors, consumers and businesses on the food tech space.

And as we are now witnessing, great success is no longer necessarily tied to riding on a larger tech company’s coattails – which is quite a shift in dynamics from even 18 months ago. Acquisitions will still be a critical component to a thriving ecosystem however, as many of the current products and technologies – especially those focused on fragmented markets – may find they can create the most impact by joining a larger platform with more substantial resources.

M&A

Love With Food Acquires Taste Guru. The Denver-based gluten-free subscription box service delivers to customers a monthly box of gluten free snacks, and will enable Love With Food to expand its customers and offerings in the growing market. Taste Guru is the second gluten-free themed acquisition in the past year by Love With Food, a snack discovery service focusing on organic, all-natural products.

Announced: 06/24/15 Terms: Not Disclosed Previous Investment: $120k Founded: July 2012

Deliv Acquires WeDeliver. The Chicago-based same day delivery platform, which provides delivery local services for over 100 Chicago-area companies, will help Deliv compete in the same-day delivery space as it continues towards national expansion. Following the acquisition, WeDeliver’s brand will be discontinued as its merchants – including grocery and food retailers – and “delivery specialists” transition to Deliv’s platform. As I have discussed a number of times, The Chicago Tribune notes that as the same-day delivery space continues to heat up with both small and large participants (including Amazon, Google and Postmates), consolidation appears to be an obvious next step.

Announced: 06/24/15 Terms: Not Disclosed Previous Investment: $800k Founded: January 2013

Hello Curry Acquires Fire42. The Hyderabad, India-based restaurant management platform provides restaurants with inventory management, order management, trend tracking, loyalty and billing services, among other tools, and will allow Hello Curry to introduce real-time analytics and point of sale (POS) services to Hello Curry’s technology as it gears towards expansion. Medianama reports that it is unclear whether Fire42 will continue to offer its services independently.

Announced: 06/22/15 Terms: Stock and cash Previous Investment: Not Disclosed Founded: 2012

Farmhouse Delivery Acquires Bento Picnic. The Austin-based startup prepares lunchbox meal kits modeled after the bento tradition of Japanese homemakers and will enable Farmhouse Delivery, which provides in-state groceries, to expand its brand beyond grocery delivery and cater to customers such as local office workers.

Announced: 06/19/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: 2015

Groupon acquires Venuelabs. The Seattle-based provider of location-based monitoring, measurement and engagement solutions allows local retailers to examine aggregated social media chatter about their businesses across dozens of platforms, including Foursquare, Twitter or Instagram. With the acquisition, Groupon will integrate Venuelab’s technology into its “Pages” service, where customers visiting Groupon can find information about the merchant.

Announced: 06/18/15 Terms: Not Disclosed Previous Investment: $2.6 million Founded: March 2009

Cookpad acquires Cucumbertown. The Mountain View, CA and Bangalore-based recipes blog publishing network enables users to host their own food blogs, engage with fans, build an identity and, with the acquisition, hopes to help them monetize their recipes. The acquisition by the Tokyo-based recipe network Cookpad will enable Cucumbertown to expand to international markets and monetize the business through a “Tumbler model” of personalized themes and domains. The Economic Times further reports that Cucumbertown and Cookpad will work together on building a global culinary map.

Announced: 06/16/15 Terms: “Multi-millions” Previous Investment: $300k Founded: October 2012

Tasting Table Acquires Flavour. The New York-based restaurant discovery app which mines social graph data to find noteworthy restaurants in addition to collecting reviews from critics, bloggers, and industry experts, will help Tasting Table provide restaurant recommendations that are more personalized and curated. Users can search by city, by collection, or by dish, and make reservations through a connection with OpenTable. Flavour is available in eight cities, and Tasting Table plans to collaborate with Flavour’s team of developers, engineers, and designers to enrich user experience through expanding the app’s services.

Announced: 06/16/15 Terms: Not Disclosed Previous Investment: $1.1 million Founded: 2014

BigBasket Acquires Delyver. The Bangalore-based hyper local ecommerce platform. which uses its own logistics technology to connect offline retailers to customers in the neighborhood, will manage BigBasket’s new launch of one-hour delivery service in Bangalore. Delyver will retain its brand name and function as an independent entity. In addition, BigBasket will provide funds for Delyver to expand into eight major cities and 50 tier-II cities, and increase team size in existing cities.

Announced: 06/12/15 Terms: cash and stock Previous Investment: $1 million Founded: March 2010

Brit + Co Acquires Snapguide. The San Francisco-based publishing system lets people create step-by-step mobile guides, and will be renamed as “Snapguide by Brit + Co.” Brit + Co, an online lifestyle and e-commerce platform focusing on DIY, plans to use content from the acquisition to build out its platform. TechCrunch reports the acquisition is an asset sale, covering the Snapguide’s website and app, its user network, DIY guides, and technology platform.

Announced: 06/09/15 Terms: Not Disclosed Previous Investment: $10 million Founded: 2011

Fexy Media Acquires Roadfood.com and SeriousEats. According to the New York Times, Fexy Media launched in 2014 and is making acquisitions as part of its broader strategy to become a force in the digital food media space. Fexy has plans to re-energize the Roadfood.com, which features regional and small town highway eateries across America, to boost its appeal to the younger generation. The core offering of Serious Eats won’t be changed beyond increasing its video content, as the acquisition will provide Serious Eats with new technology to bolster its digital video offering and opportunities for partnership with Fexy’s other portfolio companies.

Announced: 06/02/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: Roadfood.com: 2000; Serious Eats: 2006

FUNDING

MangoPlate raises $6.1m. The Seoul-based mobile application for personalized dining recommendations features restaurant reviews and pictures crowdsourced from real users. Using algorithms and location data, MangoPlate generates customized restaurant recommendations and restaurant deals based on a user’s whereabouts and cuisine preference. The company aims to double the restaurants it captures in Korea from 40 percent to 80 percent and roll out money making features, such as enabling restaurant owners to provide targeted deals to consumers who have shown interest in their restaurants. Funding will also be used to test overseas markets.

Announced: 06/30/2015 Stage: Series A Participating Institutional Investors: Qualcomm Ventures (lead), SoftBank Ventures Korea, YJ Capital Previous Investment: $900k Founded: April 2013

Bento Raises $1.5m. The San Francisco-based on-demand food delivery service specializes in delivering Asian food. Customers can choose from a menu of meals and have the option of specifying low-carb or gluten-free selections. To ensure quick delivery, Bento delivers curbside only. TechCrunch notes that Bento has seen 15 percent growth per week, and plans to expand its service into East Bay.

Announced: 06/25/2015 Stage: Seed Participating Institutional Investors: LAUNCH Fund (lead), Slow Ventures, 500 Startups Mobile Collective fund, FundersClub Previous Investment: Not Disclosed Founded: March 2015

Postmates Raises $80m. The San Francisco-based online delivery service is a developer of consumer-facing logistics software that dispatches and guides couriers through major metropolitan areas to deliver local goods including prepared food, groceries, and retail goods. The company currently operates across 28 different markets and has reportedly surpassed 2.5 million deliveries. TechCrunch reports that while one weakness of Postmates has been its high delivery costs, which ranges from $5 to $20, the company has addressed the problem somewhat through its newly launched Postmates Merchant Program, which charges a flat $4.99 delivery fee for over a thousand partner restaurants. To further undercut its rivals, Postmates plans to roll out a new service in August that will charge customers around $1 for deliveries of food and other goods to high-density zip codes at peak times. The company will also use the funding to move into a range of other areas of delivery, including groceries and healthcare and beauty products.

Announced: 06/25/2015 Valuation: $400 million to $500 million Stage: Series D Participating Institutional Investors: Tiger Global Management (lead), Slow Ventures, Spark Capital Previous Investment: $58.0 million Founded: May 2011

VenueNext Raises $9m. The Palo Alto-based app for venues is designed to help attendees and operators at live events by connecting to the venue’s food and retail POS systems, e-ticketing solution, and parking pass validation systems, to offer live, in-app content for fans at the stadium. The VenueNext technology is available for licensing and provides both a customized guest-facing app and a backend platform for the venue to use. The company has had its first rollout at Levi’s Stadium, which sold $1.25 million of snacks and merchandise and experienced a 30 percent app adoption rate. VenueNext is expected to expand in 30 venues by the end of the year, going beyond sports stadiums to other venues, such as hotels.

Announced: 06/24/2015 Stage: Series A Participating Institutional Investors: Causeway Media Partners (lead), Live Nation Labs, Twitter Ventures Previous Investment: Not Disclosed Founded: 2013

Kitchenbowl Raises $1.3m. The Seattle-based startup describes itself as a community in which users can share and discover recipes. The platform aims to reinvent the recipe format to make it accessible to millennial users, emphasizing the use of photos in teaching users to cook. GeekWire reports that the average recipe contributor has uploaded about five recipes with six to nine photos. The capital injection will be used to help Kitchenbowl grow its team and platform.

Announced: 06/22/2015 Stage: Angel Participating Angel Investors: Jon Staenberg, Kurt Dammeier, Bill Moore, Scott Svenson Previous Investment: $1.0 million Founded: 2013

Offpeak Raises $800k. The Selangor, Malaysia based-restaurant booking and discovery platform startup focuses on helping restaurants get reservations during off peak hours. Available as iOS and Android apps, Offpeak offers recommendations based on a user’s location, and enables users to book tables at discount with as little as 10 minutes advanced notice. The capital will be used for expansion into other Southeast markets starting with Bangkok, establishment of local teams, and strengthening its marketing signal.

Announced: 06/22/2015 Stage: Series A Participating Institutional Investors: Gobi Partners Previous Investment: Not Disclosed Founded: 2014

HolaChef Raises $3.1m. The Mumbai-based web and mobile app for food delivery offers users a different menu from which to choose food every day. Professional and amateur chefs can sell meals once approved by the company, which will then package and deliver the food. HolaChef is currently serving 1000 orders a day, and plans to use the funds to set up a central kitchen and invest in modern infrastructure, technology and delivery.

Announced: 06/20/2015 Stage: Seed Participating Institutional Investors: Kalaari Capital (Lead), India Quotient Previous Investment: $320k Founded: 2014

La Ruche qui dit Oui Raises $9m. The Paris-based startup makes it possible for consumers to buy directly from local farmers and foodmakers at nearby “ruches.” The company employs independent contractors as ruche managers to facilitate the local marketplace. TechCrunch notes that because vendors set their own prices and receive 80 percent of the proceeds from sales, prices are competitive without being a “race to the bottom.” There are currently over 600 ruches in France, and the company additionally operates in France, Spain, Germany, Italy, and the UK. Funding will be used to solidify existing markets.

Announced: 06/16/2015 Stage: Series B Participating Institutional Investors: Felix Capital (Lead), Union Square Ventures (Lead), Quadia, XAnge Private Equity Previous Investment: $4.1 million Founded: 2011

FoodAbhi Raises Seed Funding. The Mumbai-based online tiffin marketplace aims to distinguish itself by catering to both daily and on-demand meals. The company currently partners with over 30 vendors, which are listed free of charge on the company website, and has delivered over 15,000 meals. To ensure quality, FoodAbhi packages meals itself and organizes surprise audits to check on hygiene, ingredients used. The company will use the funding to expand its technology and its scale, with plans to build apps that track deliveries and vendor activities. FoodAbhi additionally plans to expand into Pune, Bangalore, and eventually Delhi.

Announced: 06/15/2015 Stage: Seed Participating Institutional Investors: Not Disclosed Previous Investment: Not Disclosed Founded: 2013

Lavu Raises $15m. The Albuquerque-based provider of point of sales systems for restaurants is currently being used by over 4,000 restaurants in 86 countries. Lavu’s system can track sales and is customizable for coffee shops, food trucks, bars, and nightclubs. As with other next generation POS services, Lavu asserts that its services are less expensive than those of traditional POS systems, which can charge tens of thousands of dollars up front. The capital will be used towards sales and marketing.

Announced: 06/15/2015 Stage: Series A Participating Institutional Investors: Aldrich Capital Partners Previous Investment: Not Disclosed million Founded: 2010

Blue Apron Raises $135m. The New York-based meal delivery service company packages a recipe and pre-portioned ingredients that are delivered to customers’ homes on a weekly basis. In the past six months, Blue Apron has tripled its volume and is selling 3 million meals per month. Blue Apron will use the funding to scale its growing network of farms, suppliers, and fulfillment capabilities throughout the country, and has plans to invest in automation and add custom fulfillment software tools, enabling the company to reach home chefs in over 99% of the continental United States.

Announced: 06/09/2015 Valuation: $2 billion Stage: Series D Participating Institutional Investors: Fidelity Investments (Lead), Bessemer Venture Partners, BoxGroup, Stripes Group Previous Investment: $58 million Founded: 2012

Swiggy Raises $16.5m. The Bangalore, India-based food delivery mobile app accepts orders from users and employs personnel to pick up and deliver food from restaurants to customers’ doorsteps. After a recent close of $2 million in April, the current funding will be used towards expansion into other cities in India and strengthening of its brand platform. By employing its own delivery fleet, Swiggy does not have an order minimum and offers users with multiple payment options. TechCrunch notes that, as one of 14 grocery delivery startups based in India, Swiggy has seen 10x growth in order numbers in recent months and distinguishes itself with its provision of a curated list of restaurants and ensured delivery time.

Announced: 06/09/2015 Stage: Series B Participating Institutional Investors: Norwest Venture Partners (lead), Accel Partners, SAIF Partners Previous Investment: $2.0 million Founded: August 2014

Delivery Hero Raises $110m. The Berlin-based network of online food ordering sites now features a network of 200,000 restaurants across 34 countries. Over 10 million orders each month are processed by Delivery Hero, which generates $165 million in monthly sales. The capital infusion will be used “for selective acquisitions and intensive product innovation.” TechCrunch reports that this could suggest further expansion into other countries, as well as other food product markets, such as meal kits, grocery delivery, or high end restaurant delivery.

Announced: 06/07/2015 Valuation: $3.1 billion Stage: Private Equity Participating Institutional Investors: Not Disclosed (“leading public market investors”) Previous Investment: $1.3 billion Founded: September 2010

TabbedOut Raises $21.5m. The Austin-based mobile payment app is currently installed in over 10,000 venues in the U.S. and allows patrons to open, review, and securely pay their tab. Restaurants and bars can use TabbedOut to track and use customer baskets and behavior to create comprehensive consumer databases that offer actionable insights into their customer’s spending habits. Proceeds from the round will be used to accelerate user acquisition through the implementation of automated loyalty and rewards programs, integration with other mobile consumer services, and expansion into 20 new U.S. markets.

Announced: 06/04/2015 Valuation: $78 million Stage: Series C Participating Institutional Investors: Wellington Management Company (lead), New Enterprise Associates, Morgan Creek Capital Management Previous Investment: $17.5 million Founded: June 2009

EatTreat Raises $350k. The New Delhi-based social media platform for food lovers started out as a Facebook group focused on recipes, restaurant reviews, articles on cookbooks, and other food related content. With seed funding to build the website and make key hires to bolster company infrastructure, EatTreat will soon launch its independent web and mobile platforms which connect end users with service providers. EatTreat will feature new innovations in food, and aims to generate dialogue among foodies and revenues through advertisement.

Announced: 06/01/2015 Stage: Seed Participating Institutional Investors: Divitas Capital Previous Investment: Not Disclosed Founded: 2015

iFood Raises $50m. The São Paulo-based food delivery company enables users to order food through its website and mobile apps. Through iFood’s platform, users can consult restaurant menus and prices and select the desired delivery location to make their purchase. TechCrunch notes that Brazil is experiencing 21% year over year growth, making it the leader in the burgeoning space of Latin American e-commerce services. iFood captures 80 percent of the online restaurant delivery market and expects to hit one million deliveries per month by the end of 2015. Funding will be used towards growth in new cities and continued development of its team and infrastructure.

Announced: 06/01/2015 Stage: Series E Participating Institutional Investors: Just Eat, Movile Previous Investment: $11.9 million Founded: May 2011

PARTNERSHIPS

Jawbone Partners with Yummly to help users to be informed about their daily food intake via UP devices.

Men’s Health Partners with Chef’d to bring Men’s Health branded meals to consumers’ homes.

DoorDash Partners with Whole Foods and Trader Joe’s to deliver prepared foods, including sandwiches and wraps.

INDUSTRY LANDSCAPE

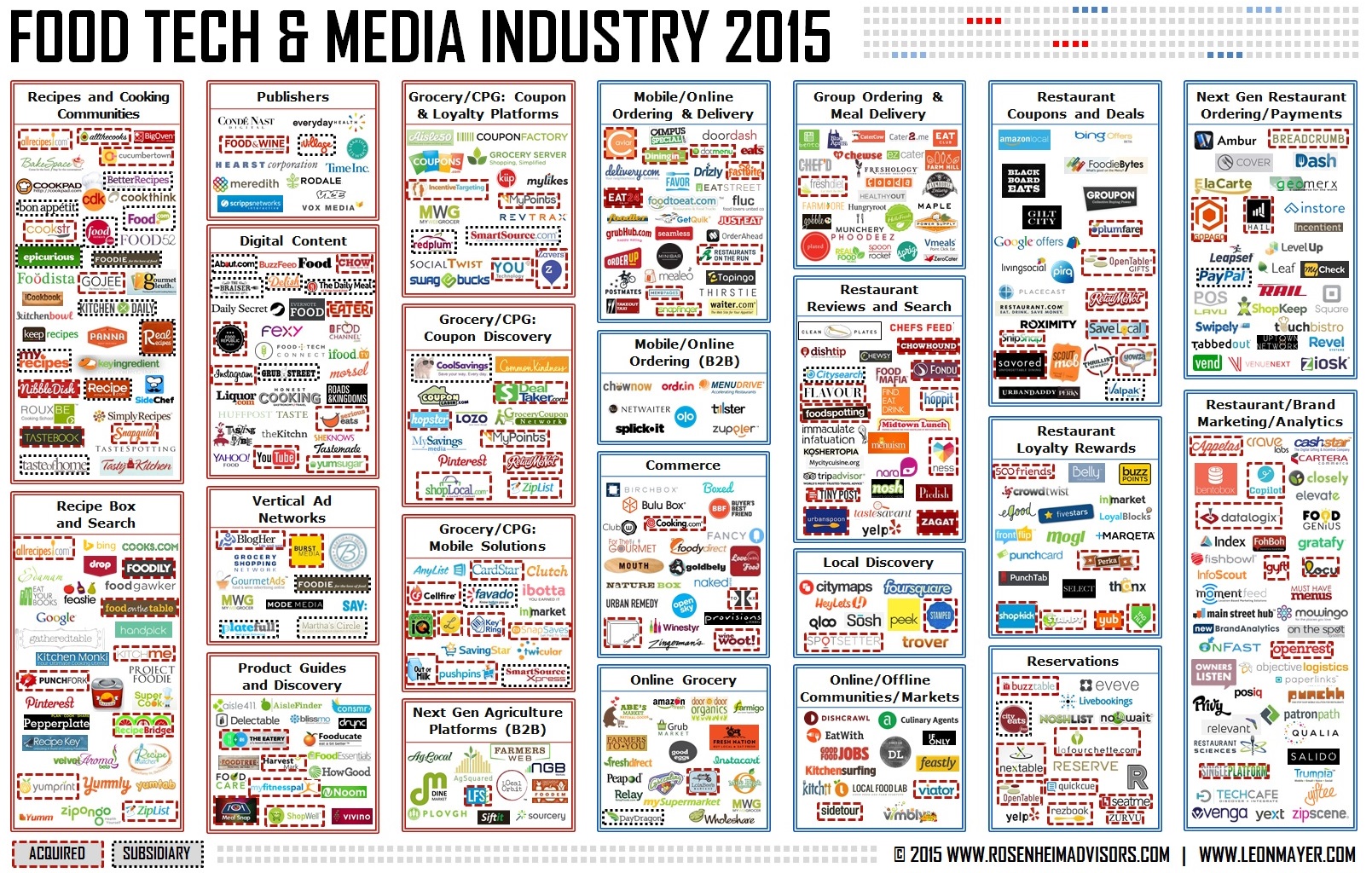

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.

Check out the 2014 Annual Report and last month’s round-up.

Love this monthly roundup? Please consider contributing, so we can keep bringing you the news, insights and community you depend on.