Every week we track the business, tech and investment trends in CPG, retail, restaurants, agriculture, cooking and health, so you don’t have to. Here are some of this week’s top headlines.

A select number of brands in our industry are driving meaningful change in the industry, but way more needs to be done, argues Robyn O’Brien in her provocative blog post about Expo West. Top trends that could use some attention include B-corp certification, transparent financing, zero waste, supply chain focus, packaging and giving back to charities. Both Starbucks and Coca-Cola are launching blockchain initiatives to create safer, more transparent supply chains. Starbucks is planning to track how impactful blockchain technology is to the farmers and report results publicly.

Packaged-food companies already are struggling to respond to a shift in consumer preferences toward healthier, simpler foods. Now they also have to contend with higher input prices–General Mills announced it would raise prices on select products to reflect higher ingredient and shipping costs.

In retail news, HelloFresh is acquiring organic meal kit company Green Chef for an undisclosed sum. Albertsons is launching a digital marketplace for small wellness brands.

And finally, Agrifood technology VC Anterra Capital has extended its first fund to $200 million, making it the largest single dedicated agtech fund in the world.

Check out our weekly round-up of last week’s top food startup, tech and innovation news below or peruse the full newsletter here.

_______________

1. 10 Trends That the Food Industry Missed – Robyn O’ Brien

Food companies should give more attention to B-Corp certification, transparent financing, zero waste, supply chain focus, packaging and giving back to charities.

2. Anterra Capital Extends Fund to $200M and Widens View with Three New Investments – AgFunder

Anterra Capital has extended its first fund by $75m to $200m, making it the largest single dedicated agtech fund in the world. Additional funds came from Rabobank and Eight Roads.

3. The Meal Kit Company HelloFresh Buys Green Chef – Inc

With the purchase of Green Chef, HelloFresh can now cater to special dietary needs like gluten-free and keto. Financial terms of the deal were undisclosed.

4. General Mills to Raise Food Prices to Offset Costs – MarketWatch

The maker of Cheerios and Yoplait will raise prices on some cereals and snacks to reflect higher ingredient and shipping costs, as food companies battle inflationary pressures that are eating into profits.

5. Coca-Cola, US State Dept to Use Blockchain to Combat Forced Labor – Reuters

The new venture is using blockchain to create a secure registry for workers and their contracts. F&B companies are under pressure to address the risk of forced labor in countries where they obtain sugarcane.

6. Starbucks Is Brewing Up Blockchain for ‘Bean to Cup’ Tracking – CIO Dive

Starbucks is launching a pilot program to trace coffee beans from Costa Rica, Colombia and Rwanda. It will take place over the next years and track how impactful blockchain technology is to the farmers.

7. Albertsons Brings the Fight to Amazon with Small Brands Marketplace – Food Dive

This summer, Albertsons will launch a digital marketplace for wellness products from small brands. Suppliers will ship products directly to shoppers and are responsible for providing customer service through the grocers’ platform.

8. Amazon Is Looking for Larger Whole Foods Stores to Support Delivery Plans – Bloomberg

Amazon is hoping Whole Foods locations can serve as both grocery stores and urban distribution centers for delivering goods to online shoppers more quickly. Parking areas will be converted into stalls for Amazon deliveries.

9. Seventure Partners and Adisseo Launch €24M Livestock Tech Fund – AgFunder

The fund will focus on animal health, feed and nutrition as well as digital technologies serving the livestock industry, investing at every stage, regardless of geography.

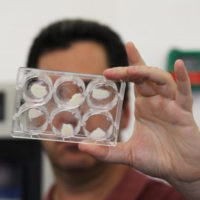

10. Lab-Grown Dog Food Is First Step to a Clean Meat Empire – Neo.Life

Founders behind the biotech accelerator IndieBio are about to launch a line of cell-cultured dog kibble under the brand Wild Earth this spring. The next line will be cat food made with lab-grown mouse meat.

11. Monsanto Backs New Company Focused on Gene Editing, not GMOs – Reuters

Monsanto will pay Pairwise $100m over the next five years to finance research on gene editing tools. Pairwise will also research how to use the tools to alter commodity crops exclusively for Monsanto.

12. India: SoftBank Leads $62M Funding Round in Online Grocery Startup Grofers – Inc42

SoftBank now holds a 40% stake. Tiger Global and Russian tech billionaire Yuri Milner also participated in the round. Grofers will continue to invest new capital in building private labels and supply chain improvements.

13. Women Dominate Pastry Chef Jobs. So Why Is Netflix’s New ‘Chef’s Table’ Season Dominated by Men? – The Washington Post

The question has come up in the industry after the trailer for the new season made its debut featuring four chefs including Christina Tosi of Milk Bar.

14. France: Carrefour Acquires Stake in French Meal Kit Quitoque – ESM

The meal kit company is now the market leader in France, delivering 3m meals last year. Carrefour’s investment will allow it to increase its food e-commerce turnover to €5b.

15. Hungryroot’s Revenue Went From $1M a Month to Zero. Now It’s Back with $22M in Funding – Forbes

Once the company neared its million-dollar mark in 2017, it stopped taking orders and shut down its food manufacturing facility. The company then shifted production to partner facilities so it could focus more on consumer preferences and personalization.

16. Spindrift Raises $20M in Series B-2 Round Led by VMG Partners – Food Navigator

Prolog ventures, Karp Reilly, Riverpark Ventures and other existing investors joined the round to help fund its first national advertising campaign.

17. When the Death of a Family Farm Leads to Suicide – New York Times

Fred Morgan considered committing suicide so his family could receive a life insurance payout after he was unable to repay his dairy farm’s debts.

18. Here Are the 2018 James Beard Awards Restaurant, Chef and Media Finalists – Eater

The 2018 semifinalist list marked the Foundation’s first steps to address the industry crisis after the explosive sexual harassment allegations. Its voting committee was asked to consider behavior when making suggestions.

19. McDonald’s Promises Huge Environmental Strides – Food & Wine

McDonald’s will change how its beef is produced, which should prevent the release of some 165m tons of greenhouse gases into the air by 2030. The company did not disclose how it will work with its beef producers to reduce its carbon footprint.