We’ve said it before, and we’ll say it again: food startup investment is on F I R E. A few weeks back we published a roundup of the recent IPOs and $5 million + raises, including 7 startups which have collectively raised $177 million since the start of 2014.

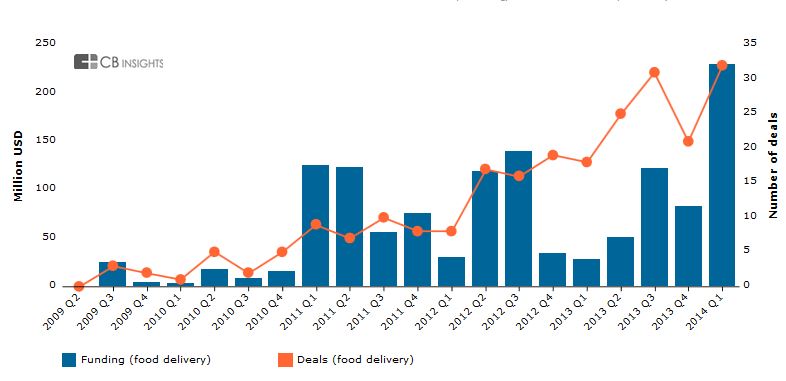

CB Insights has been tracking the space, too. Earlier this month, the research firm released a report, which finds that over the last four quarters, food and grocery e-commerce and delivery companies have raised nearly $486 million across 109 deals globally. And year-over-year, funding in the space has grown by a whopping 51 percent, while deal levels are up 55 percent. It also finds that food and grocery delivery startup funding hit a 5 year high in Q1 2014, with investors pouring over $200 million into deals

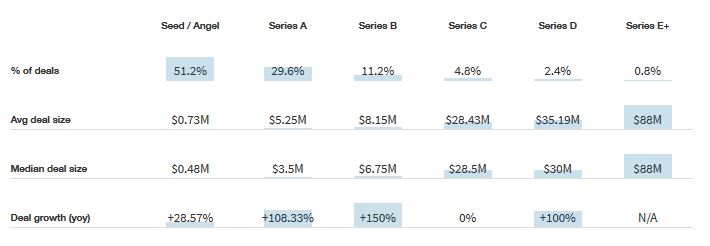

Just over half of all the investments in the space over the last 8 quarters have come at the seed-stage, the report finds. Series A rounds have made up almost 30 percent of deals, with year-over-year deal growth surpassing 100 percent, while late-stage investments (Series D and above) have represented less than 5 percent of deals.

In terms of geography, the report finds that Silicon Valley has taken roughly 1/5 of all the food and grocery delivery deals over the past 8 quarters. Interestingly, however, the bulk of deal growth has been happening in international markets, with startups like Just-Eat and Delivery Hero – which scarfed up an additional $85 million earlier this week – aiming to to own the international online restaurant ordering space.

So why the recent funding bump? Some believe that GrubHub’s wildly successful IPO may have helped kickstart the VC funding frenzy. Another factor is consumer reliance on technology and social media; they’re comfortable with doing everything from renting rooms to hailing cabs via their smartphone and are inundated by all things food on every social channel. They’re ready for food tech to be a part of their day-to-day, which is why startups offering everything from culinarily-adventerous dinner boxes (Blue Apron & Plated) to 1-hour grocery delivery (Instacart) are seeing massive user growth.

And then there’s the competition factor, as Carmel Deamicis at PandoDaily points out, “There’s a lot of money in Silicon Valley, and with an incredible amount of competition for hot deals in consumer software, good VCs have to get creative and start taking risks on untapped, unproven markets where there’s still space for windfall investments.”

Quite simply, consumer demand is ripe, the technology is there to meet it and investors are making big bets in the hopes of major windfalls. And while $10 million + rounds seem to be falling from the sky lately, only time will tell which of the growing army of venture-backed food startups succeed, fall flat or get acquired.