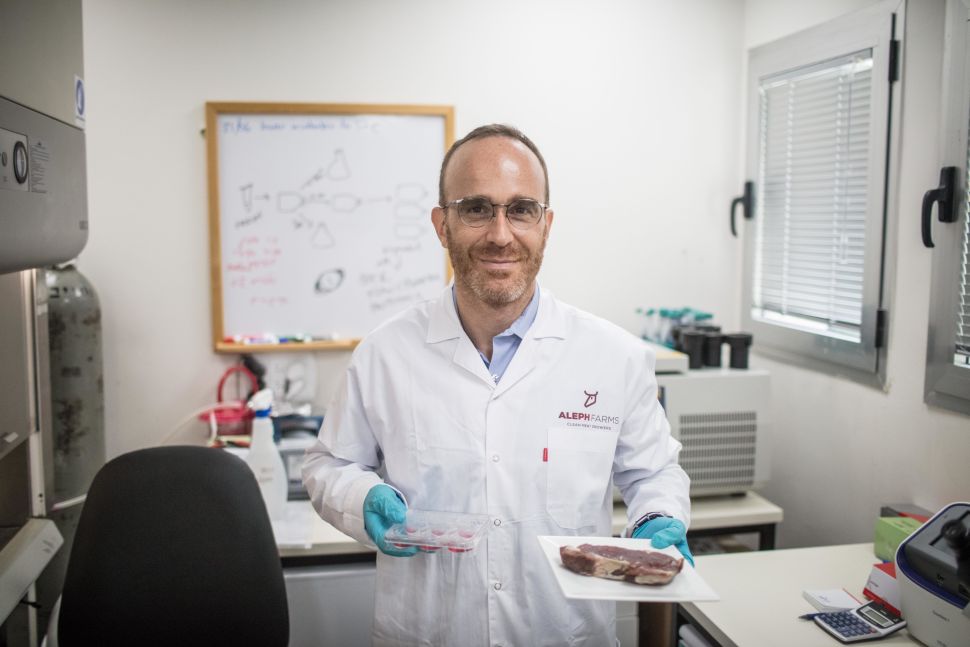

Source: Ilia Yechimovich via Getty Images

Every week we track the business, tech and investment trends in CPG, retail, restaurants, agriculture, cooking and health, so you don’t have to. Here are some of this week’s top headlines.

Faux meat startups continue to go head to head in the race to go to market. Israeli cultivated meat maker, Aleph Farms, has announced a $105 million Series B that will help it scale its manufacturing capabilities and expand its operations internationally. Meanwhile, Meati has raised a $50 million Series B to build a production plant for its fungi-based steaks. Beyond Meat has launched plant-based chicken tenders at 400 restaurants.

In other news, Chobani has quietly filed for an IPO that could value it at $10 billion. Siete Foods now wants to go global.

Our newsletter takes a lot of time and resources to produce. Make a one time or monthly contribution to help us keep it going. Whether it’s $5 or $500, every bit helps and shows us that you value our work.

Check out our weekly round-up of last week’s top food startup, tech and innovation news below or peruse the full newsletter here.

1. Israel’s Aleph Farms to Expand Cell-Based Operations Globally after $105M Series B – Green Queen

The company will use capital to scale up its manufacturing capabilities and expand its operations internationally ahead of its initial market launch in 2022.

2. Expect Fungi-Based Steak on Your Plate by 2022: Meati Raises $50M – Forbes

Meati, a company commercializing vegan protein sourced from mycelium, secured a series B to build a production plant and get its cuts to restaurants around the US.

3. Yogurt Maker Chobani Confidentially Files for US IPO, Valuation May Exceed $10B – CNBC

The company, which has factories in New York, Idaho and Australia, has not yet determined the number of shares it plans to sell or the price range for its proposed offering.

4. A Decade Later, Beyond Meat Reveals Its Second Attempt At Faux Chicken Tenders – Forbes

Consumer demand for chicken has skyrocketed as the industrial poultry production industry has faced shortages and supply issues. Beyond is hoping those tailwinds will help convince buyers that its new tenders should go out to fast food chains, restaurants, cafeterias, hospitals and other locations.

5. Gluten-Free Is Mainstream Now. Just Look at Siete’s $1B Ambition – Bloomberg

Siete, a Mexican food brand, is in 16k locations and sees sales hitting $200m this year. Now it wants to go global.

6. India: Ant-Backed Food App Boosts India IPO Target to $1.3B – Bloomberg

Bernstein values Zomato at about $10b. The company vies with its main rival Swiggy as well as smaller contenders in a fast-growing Indian food services market that is estimated to balloon to $97b by 2025.

7. Satellite Imagery Company Planet Labs Is Going Public, Backed by Google, BlackRock and Marc Benioff – CNBC

The company’s imagery then feeds into a data index that Planet says makes the Earth “searchable” for its more than 600 customers. The deal is expected to raise $434m.

8. MaxAB, the Egyptian B2B Food and Grocery Delivery Startup, Raises $40M for Expansion – TechCrunch

The company will be expanding its physical footprint across the Middle East and North Africa. MaxAB’s platform manages procurement and grocery delivery to shops in Egypt.

9. C3 Raises $80M to Expand Its Virtual Food Hall Concept – The Spoon

The company operates more than 40 virtual restaurant brands, leveraging underutilized kitchen spaces around the country to cook and fulfill those orders.

10. Instawork Raises $60M to Connect Local Businesses with Hourly Workers – The Spoon

Instawork checks references and makes sure each worker is qualified, then connects them with open shifts available at different companies. Workers can get paid within hours of completion and rate their shift.

Our newsletter is the absolute easiest way to stay on top of the emerging sector, so sign up for it today and never miss the latest food tech and innovation news and trends, Already signed up? Share the love with your friends and colleagues!