We are thrilled to partner with Ryan Williams to offer our first U.S. Branded Food Investment Report. A reformed banker, Ryan now leads finance and special projects for RISE Brewing Co., an award winning nitro cold brew coffee brand. On the side, he likes techno, backpacking, helping other food entrepreneurs, and long walks through the grocery store.

We are thrilled to partner with Ryan Williams to offer our first U.S. Branded Food Investment Report. A reformed banker, Ryan now leads finance and special projects for RISE Brewing Co., an award winning nitro cold brew coffee brand. On the side, he likes techno, backpacking, helping other food entrepreneurs, and long walks through the grocery store.

Editors Note: Please note this database relies on a variety of public sources of information such as industry publications, newsletters, social media mentions, and SEC filings to track investors and investments. While a best effort is made, no guarantee is given regarding its comprehensiveness or accuracy. The database covers the U.S. branded food and beverage category, which includes in-market products sold to consumers through e-commerce or traditional retail channels. Please see our 2018 report for updated 2017 data.

$1.08B in Venture Capital Invested Across 99 Food & Beverage Deals

With acquisitions on the rise and more capital flowing into the industry, 2017 was a great year for U.S.-based food and beverage startups. The year saw $1.08 billion in venture capital invested across 99 deals, according to our research. This is an 87.8% increase from the 66 deals reported by Dow Jones Venture Source in 2016. There were 124 reported VC financings in 2017, however only 99 reported the amount of capital invested. The largest check size of the year was for $190 million to Brewdog, with a median check size of $4.25 million and average check size of $10.9 million. Despite a slight decline from 142 deals in 2016, M&A remained strong with 136 food and beverage deals closed in 2017, according to SDR Ventures.

Please see our 2018 report for updated data, available to us

Notable Trends Driving 2017 Food & Beverage Investment

1. Food is Hot: More people than ever are paying attention to, creating, and investing in food brands. What was once an overlooked, stodgy industry now has a “cool” factor the natural food pioneers of yesteryear could only have dreamed of. As food choices have become a manner of self-expression, categories ranging from craft beer to salty snacks have exploded to fulfill consumer demands, and celebrities and tech investors are taking notice. This is reflected everywhere from the growing number of investors and funds in the space (450+ last year alone), to the record number of attendees at events like Expo West (85,000 attendees), to the mainstream media coverage of food businesses.

2. E-Commerce is Here: For many, Amazon’s acquisition of Whole Foods validated food’s e-commerce future. While meal kit companies like Blue Apron have struggled, nascent digitally-native food brands like Daily Harvest and Soylent have shown great promise. The U.S. e-commerce food and beverage category is expected to grow from just $4 billion and 0.8% of e-comm market share in 2015 to $31 billion and 5.5% of e-commerce market share by 2022 and the events of 2017 are important markers on that trajectory.

3. Plant Power: The most innovative food and beverage startups, by and large, have focused on supplanting traditionally animal-based products with plant, nut and other alternative nutrition sources. Startups such as Ripple, which makes milk from peas, and Impossible Foods, which creates impossibly realistic plant-based “burgers,” are leading the charge in products that do not sacrifice taste for their environmental and ethical benefits.

4. Incumbents Try to Regain Market Share: As big CPG companies continued losing market share, there was again significant M&A activity in 2017 with 136 deals compared to 142 in 2016. As such, corporations continue to adjust their size expectations for targets, acquiring startups with lower EBITDAs as a strategic, defensive move to rebalance eroding market share.

Investor Trends

Increased participation of traditionally tech focused investors, a greater emphasis on data driven investing, celebrity participation, and a lopsided funneling of dollars towards the hottest deals and categories defined the major trends of the year.

Many deals reflected the increased sector interest from traditionally tech focused VCs, such as Greycroft (investor in Penrose Hill), GV (investor in Soylent, Blue Bottle and Ripple Foods), and Lightspeed Venture Partners (investor in Daily Harvest). Horizons Ventures, which primarily invests in bleeding-edge tech, helped lead both JUST’s $150 million round and the $75 million Series E for Impossible Foods. As CircleUp CEO Ryan Caldbeck argued in a TechCrunch article, “The uptick in tech VC dollars going to the CPG market is partly because tech investing is brutally competitive and saturated, and largely because these VCs are awakening to the strong historical returns in CPG, especially with the trend leaning towards small brands stealing market share.”

Traditional F&B investors focused on emerging trends and categories like cleaner labels, higher protein, better-for-you snacks and cold brew. Tech-first investors seemed to favor new models of distribution from startups like ALOHA and Daily Harvest, as well as startups with a heavy food science focus like Impossible Foods, Beyond Meat, and Perfect Day.

CircleUp brought data science to CPG investing in 2017 with the release of Helio, a proprietary machine learning platform that collects billions of data points on over 1.2 million consumer and retail companies in the U.S. to analyze the relative strength and likelihood of success of companies. Helio is designed to help investors make better bets and to inform investment decisions for its newly launched $125 million fund CirlceUp Growth Partners. Notably, CircleUp also launched CircleUp Credit Advisors, a credit platform that provides approved startup CPG businesses with revolving lines of credit to help businesses finance business growth.

The trendiness of food startups has garnered celebrity involvement and investment. Leonardo DiCaprio invested in Hippeas and Beyond Meat, Drake invested in MatchaBar, Serena Williams and Gwyneth Paltrow bought into Daily Harvest, and Olivia Munn took a stake in Chef’s Cut. Celebrities are also getting their hands dirty, with Jennifer Garner joining baby food startup Once Upon a Farm and Ayesha Curry debuting her meal kit startup Homemade. Expect to see more of this in 2018 as celebrities embrace the sales driving potential of their influence.

Notable Exits

As big CPG companies continued losing market share, there was again significant M&A activity in 2017 with 136 deals compared to 142 in 2016. Starting with Mars’s minority investment in KIND at a $4 billion valuation and continuing with the announced $1.6 billion SkinnyPop acquisition by Hershey’s and the $4.9 billion Snyder’s-Lance acquisition by Campbell’s Soup, the mega CPGs may be prioritizing stability and needle moving, immediate top line impact over lofty growth projections. Perhaps, some big companies fare best acquiring medium size companies, as there remains a more navigable cultural and operational philosophy between organizations of comparable size.

Still, incumbents are also acquiring earlier stage startups that are on-trend, clean label, and aligned to consumer demand. Unilever, for example, acquired Sir Kensington’s, a maker of “condiments with character,” for $140 million. Kellogg’s purchased RXBAR, a producer of clean label protein bars, for $600 million. Additionally, Otsuka Pharmaceutical Co. acquired plant-based cheese manufacturer Daiya for $325 million driven by its desire to capitalize on the growth of the plant based market.

In 2017, tech backed food had headline grabbing successful exits, like Blue Bottle’s $425 million majority acquisition by Nestle, as well as flops like Juicero shutting down after raising $120 million. This begs the question of whether the additional capital entering the ecosystem will find its ROI from CPG incumbents who have essentially outsourced innovation to startup M&A or if valuations will need to decrease.

Investment Categories & Trends

2017 saw $1.08 billion invested in food and beverage startups. The majority of the funding went towards alternative protein focused brands, although other categories and characteristics, such as e-commerce and RTD coffee, also drew investor attention.

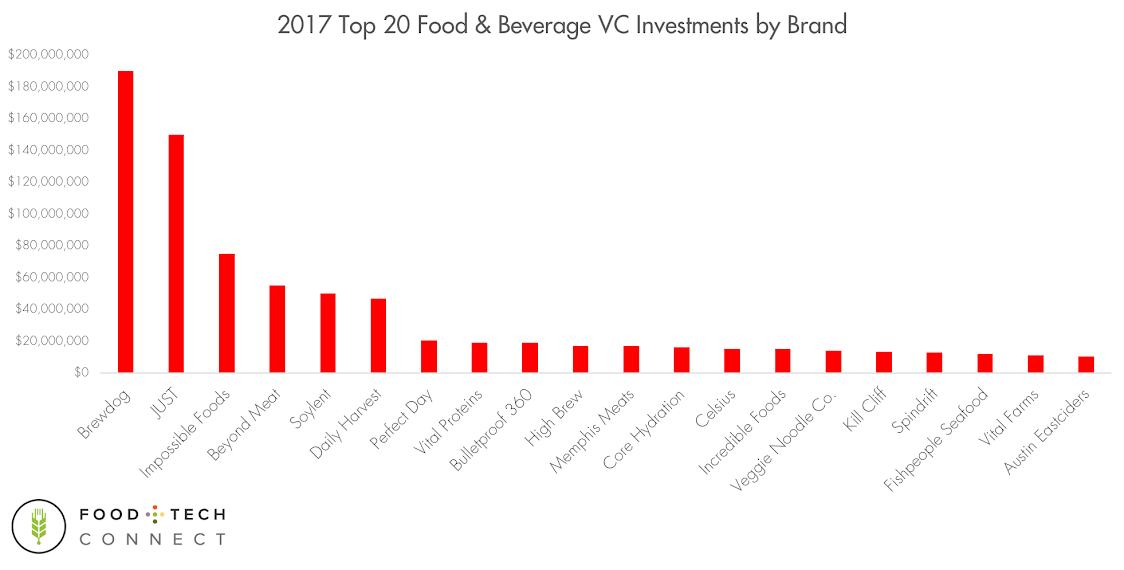

Top 20 Food & Beverage VC Investments

There were some mega deals in 2017. Occupying the 2nd, 3rd, 4th, 5th, and 7th spots were plant-based protein brands. The Top 20 deals (of 99 disclosed financings) accounted for over 72% of total VC funding.

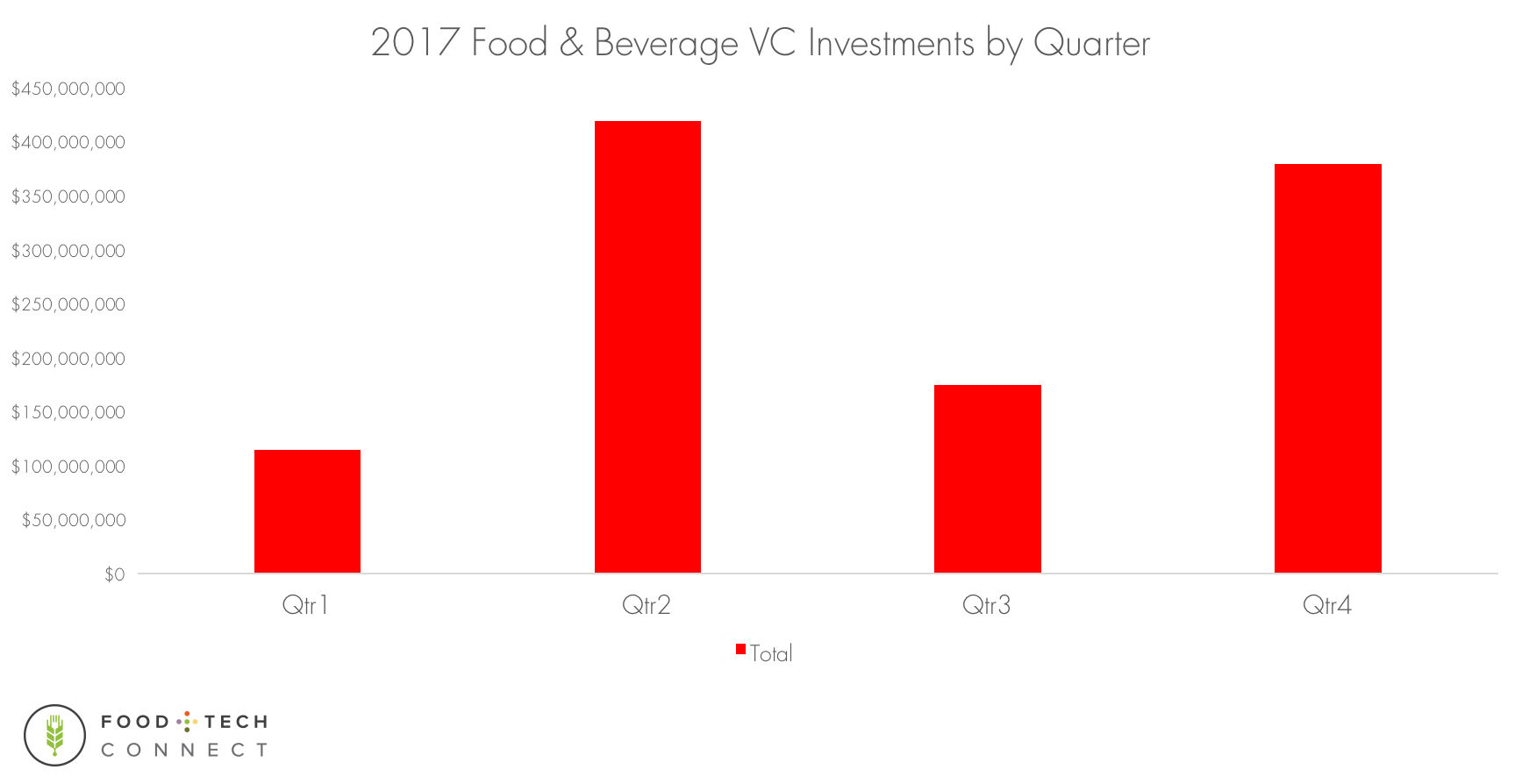

Food & Beverage VC Investments by Quarter

While there does appear to be significant quarter over quarter changes in deal activity, it’s usually the result of outlier investments skewing the trend in an upward direction. For instance, Q2, the largest quarter of the year, saw over $418,000,000 worth of checks went out in that period. Nearly half of those dollars, however, went towards just two companies: JUST ($150,000,000) and Soylent ($50,000,000). That said, investors and founders seem relatively likely to close a deal before year end but if not, are in no rush judging by January and February.

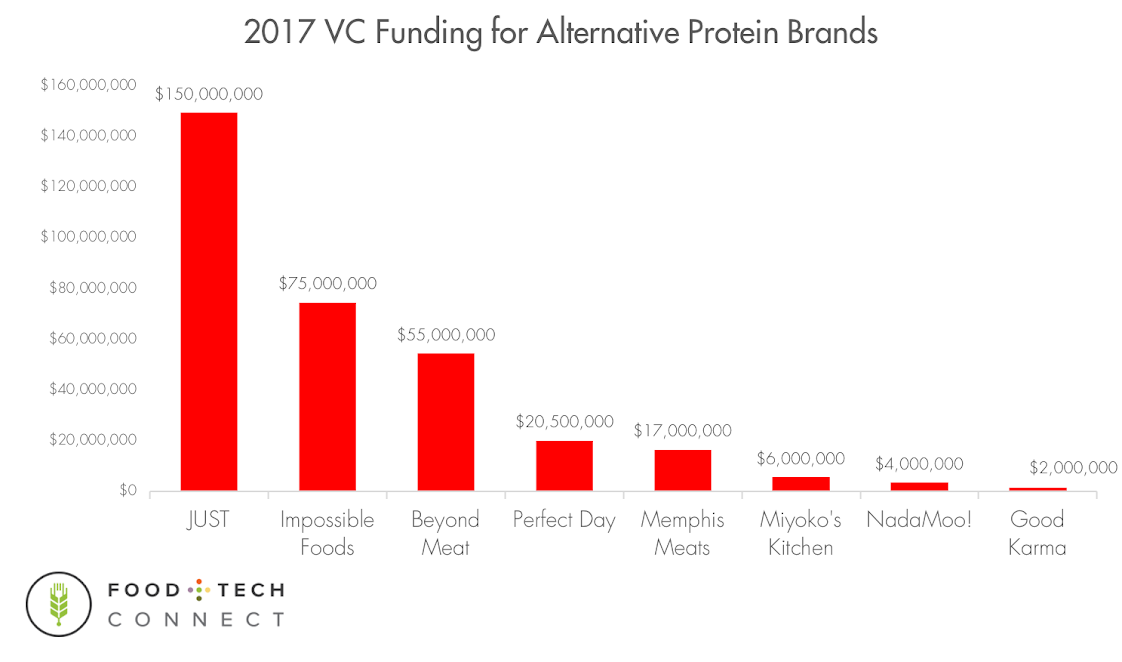

VC Funding For Alternative Protein Brands

VC’s invested $179.5 million in alternative protein brands developing everything from meat to milk. The top funders in this category include Horizons Ventures, Collaborative Fund, and Khosla Ventures. Tyson doubled down on its investment in Beyond Meat, which it already owned a 5 percent stake in. Consumer demand for plant-based food and investor activism are driving growth in this sector. A Nielsen study commissioned the Plant Based Foods Association and The Good Food Institute the leading retail sales research company, found that the total market for the plant-based food sector tops $3.1 billion in sales in 2017, up 8.1 percent from the previous year. The Plant Based Foods Association also released new SPINS data indicating that the total market for the plant-based sector (excluding data from Whole Foods Market) tops $5 billion in sales.

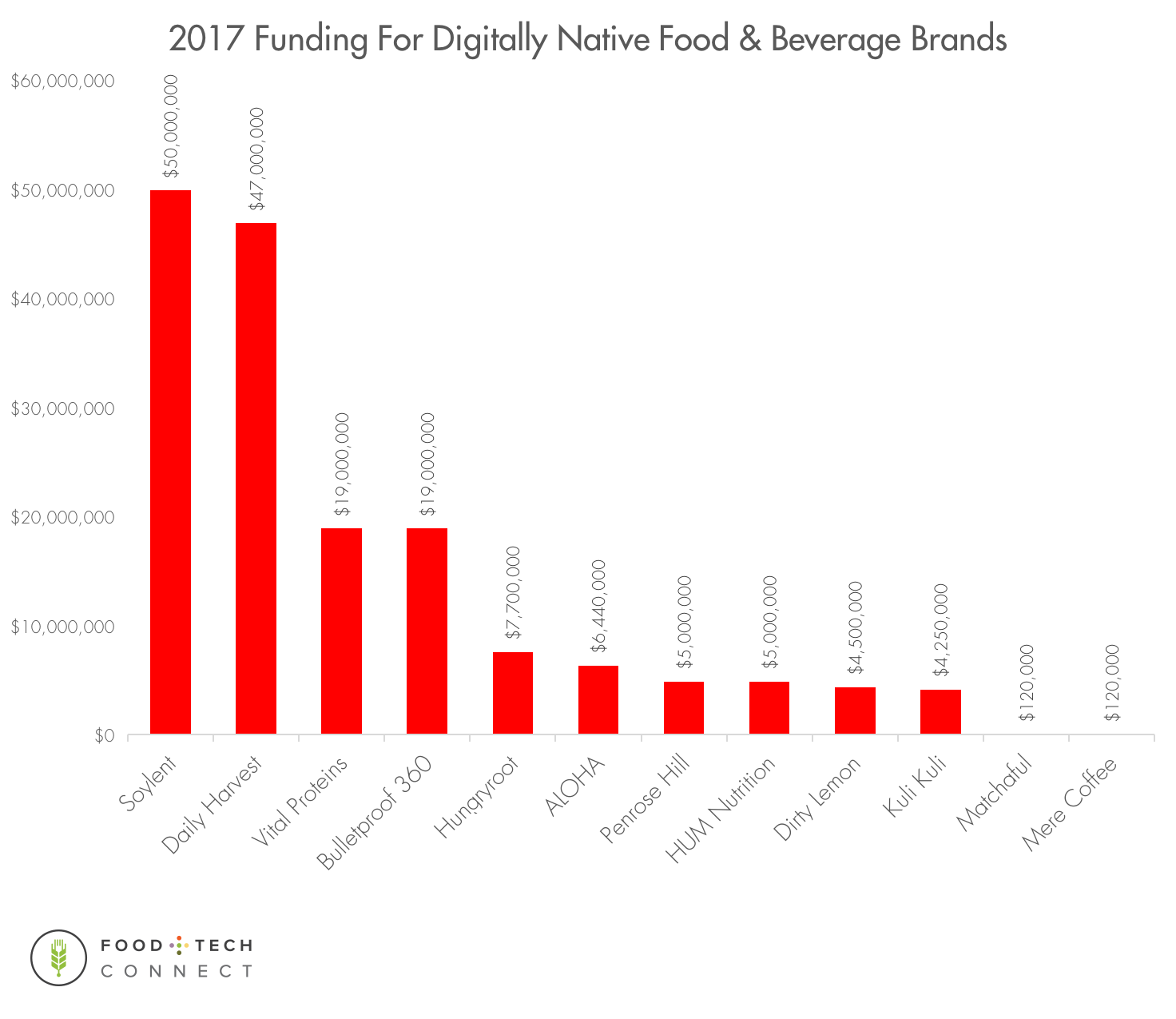

Funding For Digitally Native Food & Beverage Brands

Offsetting what The Atlantic dubbed The Great Retail Apocalypse of 2017 has been the meteoric rise of e-commerce across all categories, but especially food. According to Statista, the domestic Food & Personal Care e-commerce category will grow from roughly $47 billion in 2017 to $78 billion by 2022, a CAGR of ~10.7%. Riding this wave are numerous digitally native brands such as Soylent, Daily Harvest and Vital Proteins, who collected much of the $168 million in venture funding for e-commerce food and beverage brands in 2017.

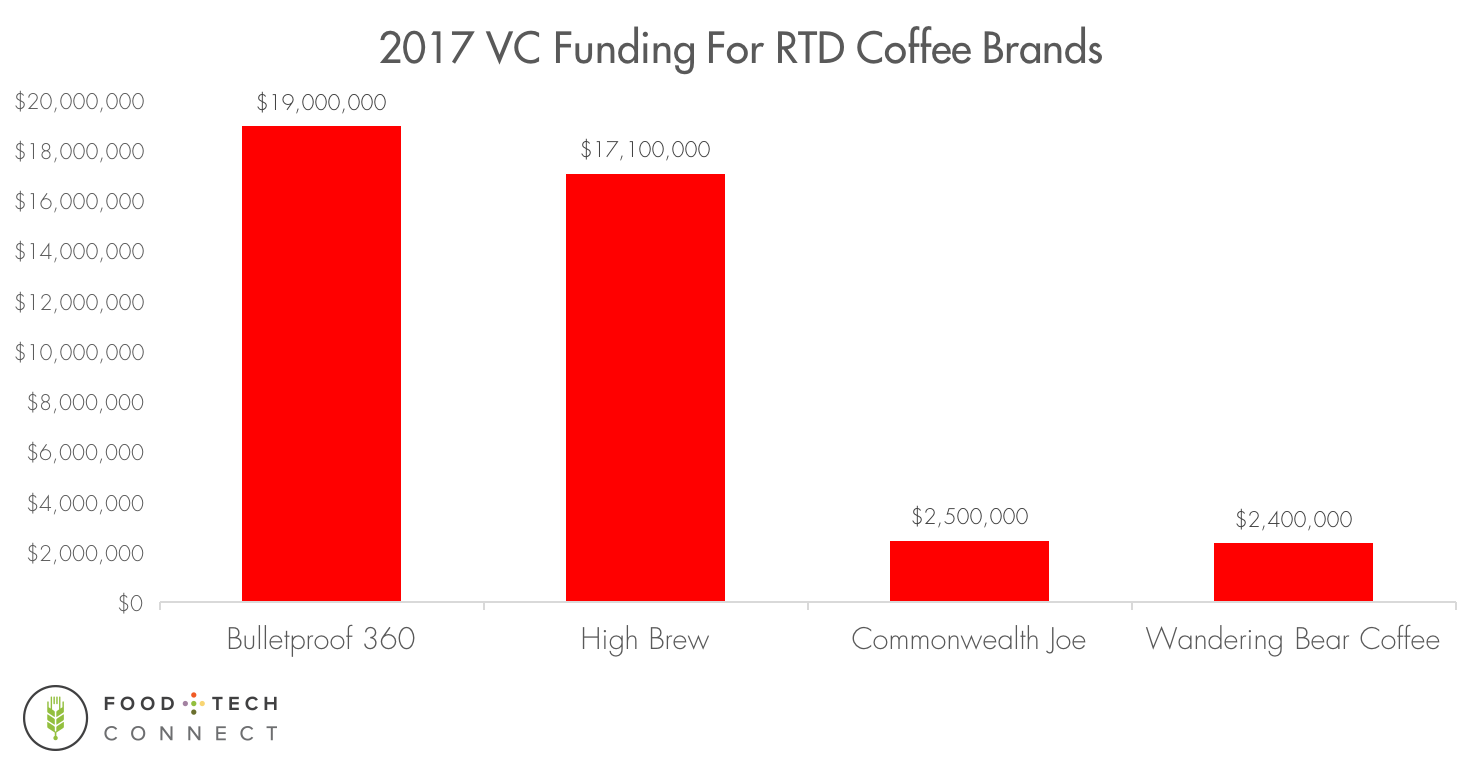

VC Funding For RTD Coffee Brands

Cold brew has popped up in VC portfolios just as fast as it’s flown off store shelves. The top four publicly disclosed financings brought in $41,000,000 million in 2017 alone. According to Euromonitor, cold brew, “is going to continue to be a double-digit value growth winner.” After growing by nearly 15 percent in 2017-2018 to over $3 billion, the category is expected to grow a further 10.3 percent in 2018-2019. By 2022, the category is expected to be over $4.8 billion.

2017 Food & Beverage M&A Deals

Bai

- Product(s): Antioxidant Infusion Drinks

- Acquirer: Dr. Pepper Snapple Group

- Date: 1/31/17 (closed)

- Price: $1,700,000,000

- Why It Matters: Because it was a big Bai that hasn’t quite panned out. Snapple quickly replaced founder Ben Weiss and downgraded its projections for the brand. Anyone familiar with Zico and Coke’s failed marriage would find this situation dejavu. A huge cult audience does not always translate into true, mass market appeal.

Blue Bottle Coffee

- Products: Retail Coffee Shops; RTD Cold Brew

- Acquirer: Nestle

- Date: 9/14/17 (announced)

- Price: $425,000,000 (for 68%)

- Why It Matters: Because it validates the retail first strategy. As La Colombe has done with its Draft Latte, the in person appeal of Blue Bottle’s beautifully designed retail stores, along with their loyal VC following, paved the way to launch one of the top performing ready-to-drinks on the market.

Casamigos Spirits

- Products: Tequila

- Acquirer: Diageo

- Date: 6/21/17 (announced)

- Price: $1,000,000,000 (including earnout)

- Why It Matters: Because it shows the power of influencer-led brands. From beauty with Michelle Phan’s IPSY to alcohol with George Clooney’s Casamigos, many successful brands are being built top down. Influencers can best turn their fame into fortune by monetizing their audience around packaged products.

Chameleon Cold Brew

- Products: Cold Brew Coffee

- Acquirer: Nestle

- Date: 11/3/17

- Price: Undisclosed

- Why It Matters: Because acquirers continue to adjust their size expectations for targets. Chameleon had approximately $18M in sales in 2016. These acquisitions are strategic and somewhat defensive in that they don’t move the needle but instead, rebalance eroding market share. Also, because the coconut water wars have given way to the cold brew battle and Nestle isn’t content to let JAB, who already owns Peet’s, Stumptown, Keurig, and Intelligentsia – and is rumored to be eyeing Dunkin – own the entire category.

Daiya

- Products: Alternative Dairy Food Products:

- Acquirer: Otsuka Pharmaceutical

- Date: 7/27/17 (announced)

- Price: $323,201,340 (converted from CAD)

- Why It Matters: Because it validates what many saw as the biggest trend of 2017: the adoption of plant based proteins. No longer limited to tasteless, hippy looking “fake” meats and cheeses, alternative proteins have rightly gained mainstream acceptance for their superior environmental, health and nutritional properties.

Hi-Ball / Alta Palla

- Products: Soft Drinks; Sparkling Water

- Acquirer: AB-InBev

- Date: 7/20/17 (announced)

- Price: Undisclosed

- Why It Matters: Because the world’s largest beer company, AB-InBev, clearly has non-alcohol aspirations. Coupled with what seems a better understanding of “craft” than its peers and its forward-thinking investments through ZX Ventures in Owl’s Brew, GoLive, and Canvas, Coke and Pepsi may have to fend off not just nimble startups but also, a massive third player.

Rao’s Speciality Foods

- Products: Tomato Sauce

- Acquirer: Savos Brands

- Date: 6/8/17 (announced)

- Price: Undisclosed

- Why It Matters: Because it shows strategic acquirers haven’t totally pushed out PE dollars. It’s also nice to see an iconic brand acquired by someone other than Metropoulos & Co. The strategics are buying fast growing, low-profit startups, leaving the legacy, stable cash flows of brands like Rao’s for PE.

RXBAR

- Products: Protein / Snack Bars

- Acquirer: Kellogg

- Date: 10/6/17 (announced)

- Price: $600,000,000

- Why It Matters: Because it does not always take massive amount of outside capital to build a brand. In a time where capital availability for food and beverage brands has skyrocketed, RXBAR hit a grand slam with just $10,000 raised. RXBAR also demonstrates how taking transparency to the extreme – their packaging is the nutrition label – resonates so strongly with Millennial consumers.

Sir Kensington’s

- Products: Condiments

- Acquirer: Unilever

- Date: 4/20/17 (announced)

- Price: $140,000,000

- Why It Matters: Because the brand epitomizes shifting consumer preferences and doing the opposite of the Heinz Ketchup playbook. This demonstrates how even the most iconic brands are not immune to disruption. Like new wave startup darling Hippeas, Sir Kensington’s managed to create both a differentiated brand and innovative products, especially it’s chickpea based mayo, Fabanaise. Read more about the acquisition here.

SkinnyPop (Amplify Brands)

- Product(s): Popcorn

- Acquirer: Hershey’s

- Date: 12/18/17 (announced)

- Price: $1,600,000,000

- Why It Matters: Because it’s personal. I attended the same high school as founder Pam Netsky and started my career in investment banking at Houlihan Lokey, which advised Amplify on its initial sale to TA Associates, a Chicago based private equity firm. This experience, along with witnessing the initial sale of Snack Factory to Snyder’s-Lance, is what drew me into the food industry and I couldn’t be happier!

Snyder’s-Lance

- Products: Salty Snacks

- Acquirer: Campbell’s Soup

- Date: 12/18/17 (announced)

- Price: $4,980,000,000

- Why It Matters: Because Millennials don’t eat, they snack. This trend has taken a bite out of Campbell’s core soup business and the Snyder’s acquisition enables Campbell’s not only to capitalize on this shift but also amass a portfolio of brands including Cape Cod, Snack Factory Pretzel Crisps and Late July with a hipper image than its iconic tomato soup.

Thanasi Foods

- Products: Jerky; Seeds Snacks

- Acquirer: Conagra

- Date: 3/16/17 (announced)

- Price: Undisclosed

- Why It Matters: Because protein is still in and because Conagra apparently sees a brighter future in branded CPG. In 2016, it acquired Frontera Foods, a Chicago based salsa and Mexican foods company while selling off its lower margin, high volume private label division sale to TreeHouse.

2017 Food & Beverage VC Deals

BANZA

- Founders: Brian Rudolph, Scott Rudolph

- Product(s): Chickpea Pasta

- Investment Date: 6/12/17

- 2017 Funding: $7,500,000

- Total Funding: $9,400,000

- Known Investors: Beechwood Capital, Chobani Food Incubator, Strand Equity Partners, SWAT Equity Partners, Vayner/RSE, Rosecliff Ventures, DGNL Ventures

- Comments: Behold the power of the humble chickpea. Beyond its direct explosion when Sabra revitalized hummus, chickpeas have silently become the quiet kale, powering three major brands in distinct categories – Sir Kensington’s Fabnaise, Hippeas salty extruded snacks, and BANZA pasta.

Barnana

- Founder: Caue Suplicy

- Product(s): Upcycled Banana Snack

- Investment Date: 1/18/17

- 2017 Funding: $5,300,000

- Total Funding: $10,300,000

- Known Investors: Blueberry Ventures, Boulder Food Group (BFG), CircleUp, Finn Capital Partners, Trently Advisors, V3 Capital Partners

- Comments: Barnana is one of a handful of companies harnessing the environmental and economic advantages of would-be-wasted food. As Bai did with the frequently scraped coffee cherry husk or brands like Imperfect Produce and Misfit Juicery are doing with unaesthetic fruit, Barnana is doing – deliciously – with bananas.

Beyond Meat

- Founder: Ethan Brown

- Product(s): Plant Based Meat

- Investment Date: 1/18/17

- 2017 Funding: $55,000,000

- Total Funding: $150,900,000

- Known Investors: 301 Inc., DNS Capital, GlassWall Syndicate, Kleiner Perkins Caufield & Byers, New Crop Capital, Obvious Ventures, S2G Ventures, Stray Dog Capital, Tyson New Ventures, Cleveland Avenue

- Comments: Beyond Meat is a fascinating player among the truly believable meat replacement startups. Unlike Impossible Foods, whose go to market strategy has been to partner with premium branded on-premise chains where they guide distribution and preparation standards, Beyond Meat has been faster to mass market and is already in 12,000 stores and have sold over 11 million Beyond Burgers to date. It’ll be interesting to see if they can lock in brand loyalty from most customers before Impossible Foods, Memphis Meats and others can achieve similar scale.

Bhakti Chai

- Founder: Brook Eddy

- Product(s): Chai Tea

- Investment Date: 9/11/17

- 2017 Funding: $5,278,397

- Total Funding: $9,128,937

- Known Investors: 301 Inc., DNS Capital, GlassWall Syndicate, Kleiner Perkins Caufield & Byers, New Crop Capital, Obvious Ventures, S2G Ventures, Stray Dog Capital, Tyson New Ventures, Cleveland Avenue

- Comments: In 2010, Spark Capital’s Andrew Parker wrote a now famous blog post examining the “Spawn of craigslist.” As tech startups from StubHub to AirBnB have nipped away various functions with their own standalone platforms, similarly, food and beverage startups have begun to transform subsets of the largest categories into standalone brands. In the case of the massive $5.8 billion domestic RTD tea category, the obvious leaders are chai and matcha.

Bobo’s Oat Bars

- Founder: Beryl Stafford

- Product(s): Bars

- Investment Date: 3/2/17

- 2017 Funding: $8,000,000

- Total Funding: $8,000,000

- Known Investors: Ridgeline Ventures, Boulder Investment Group Reprise (BIGR Ventures)

- Comments: In what is arguably the most competitive category in food and with brands like RXBAR already chosen as the acquisition worthy winners, it’ll be interesting to see just how many more, however delicious, can succeed.

Bonafide Provisions

- Founder: Sharon Brown

- Product(s): Bone Broth, Vegetable Smoothies

- Investment Date: 8/8/17

- 2017 Funding: $4,500,000

- Total Funding: $4,500,000

- Known Investors: AccelFoods, Boulder Investment Group Reprise (BIGR Ventures), Ridgeline Ventures

- Comments: A recent Washington Post expose noted, “acolytes say the resulting collagen-rich liquid reduces inflammation, cures leaky guts, nourishes the immune system, strengthens bones and promotes radiant hair and skin. Detractors think it’s a ridiculous rip-off.” Will bone broth live up to its lofty expectations or will it bust like an over-hyped draft prospect? The verdict is out.

Bulletproof

- Founder: Dave Asprey

- Product(s): Butter Coffee; Fat Water; Snacks; Supplements

- Investment Date: 5/24/17

- 2017 Funding: $19,000,000

- Total Funding: $31,300,000

- Known Investors: CAVU Ventures, Trinity Ventures

- Comments: Stemming from Dave Asprey’s audaciously titled 2014 book, “The Bulletproof Diet: Lose up to a Pound a Day, Reclaim Energy and Focus, Upgrade Your Life,” the brand offers, “high performance food, drinks & supplements to power your life.” It remains to be seen whether its current fanatical following will translate into long-term success, with one potential pitfall being that “Diets Do Not Make Good Investments.” Bulletproof’s core coffee line will also be competing with the other darling child of cold brew, nitro, which offers a latte like experience without calories, fat or other additives. Which do you prefer?

Celsius

- Founder: Janice Haley

- Product(s): Energy Drinks

- Investment Date: 3/14/17

- 2017 Funding: $15,000,000

- Total Funding: $34,000,000

- Known Investors: Horizons Ventures

- Comments: Legions of startups have attempted to dethrone the long-reigning Red Bull, but only Monster has landed a market share blow. And yet, Celsius and others bravely continue to charge forward alongside brands in adjacent categories like cold-brew who are attempting to sway energy drink consumers their way as a healthier option. Consumer preferences continue to shift away from unnatural ingredients, however, and Celsius’s significant capital backing and superior health positioning may just give it a fighting chance.

Core Hydration

- Founders: Lance Collins, Lukasz Gottwald

- Product(s): Water; Flavored Beverages

- Investment Date: 5/24/17

- 2017 Funding: $16,200,000

- Total Funding: $43,100,000

- Known Investors: Halen Brands

- Comments: Founder Lance Collins is the Elon Musk of beverage, having also successfully founded FUZE and NOS Energy. This goes to show the value of connections and experience in such a competitive field and the power of a rockstar CEO. The ability to access capital, distributors and high profile supporters such as Katy Perry and Adam Levine has put Collins well on his way to a third successful exit.

Daily Harvest

- Founder: Rachel Drori

- Product(s): Smoothies, Soups

- Investment Date: 6/8/17

- 2017 Funding: $4,000,000

- Total Funding: $4,900,000

- Known Investors: VMG, Brand Project, M13 Company, Collaborative Fund, 14W

- Comments: Daily Harvest deserves a ton of credit. First, Rachel Dori and her team have created a scalable, direct-to-consumer frozen supply chain in a category seemingly ill suited to e-commerce. And second, they have one of the most impressively curated feeds on Instagram with 195,500 engaged followers and counting. The ability to build a loyal audience without sampling and engaging customers at a retail level is a remarkable accomplishment. It paves the way for Daily Harvest to enter brick and mortar with pre-existing demand and velocity as other consumer brands such as AWAY with luggage and Casper with mattresses have begun to do.

DrinkMAPLE

- Founders: Kate Weiler, Jeff Rose

- Product(s): Maple Water, Melon Water

- Investment Date: 2/28/17

- 2017 Funding: $3,880,000

- Total Funding: $5,340,000

- Known Investors: FreshTracks Capital, Centerman Capital, Cleveland Avenue

- Comments: A potential challenger to the coconut water category, DrinkMAPLE shares many similarities with the incumbent: single ingredient, hydrating, and a polarizing flavor profile. It arguably takes better to flavors than coconut water and it’s primary source – maple trees – are available domestically, making it more sustainable to boot.

Farmhouse Culture

- Founders: Kathryn Lukas

- Product(s): Gut Healthy Chips, Vegetables, and Beverages

- Investment Date: 3/13/17

- 2017 Funding: $7,750,000

- Total Funding: $12,80,000

- Known Investors: Renewal Funds, White Road Partners, 301 Inc, Advantage Capital

- Comments: Instead of building a company around a brand or product line, Farmhouse has built it around the body, creating a line of products unified by their claimed digestive benefits. This appears to be a successful and unique strategy, allowing them to extend across different areas of the store naturally.

Fishpeople Seafood

- Founders: Duncan Berry, Kipp Baratoff

- Product(s): Sustainable Seafood

- Investment Date: 6/6/17

- 2017 Funding: $12,000,000

- Total Funding: $18,400,000

- Known Investors: 3×5 Special Opportunity Partners, Advantage Capital Partners, Blueberry Ventures, Collaborative Fund, S2G Ventures

- Comments: The seafood industry has been noticeably resistant to innovation compared to the snack aisle and beverage cooler. Fishpeople has brought transparency to one of the most environmentally threatened categories while making consumer facing products that are approachable for modern consumers.

Foodstirs

- Founders: Galit Laibow, Greg Fleishman, Sarah Michelle Gellar

- Product(s): Baking Products

- Investment Date: 7/31/17

- 2017 Funding: $5,000,000

- Total Funding: $4,000,000

- Known Investors: Beechwood Capital, Cambridge SPG

- Comments: Convenience? Check. All natural, organic and non-GMO? Check. Celebrity founder? Check. Direct-to-Consumer? Check. Foodstirs has all the checks modern, informed shopper are looking for.

good culture

- Founders: Jesse Merrill

- Product(s): Cottage Cheese

- Investment Date: 9/12/17

- 2017 Funding: $6,000,000

- Total Funding: $9,800,000

- Known Investors: 301 Inc., CAVU Ventures

- Comments: Good Culture has reawakened a stale but high potential category. High protein, low in fat and snackable, the well executed branding alongside creative flavors has transformed staid cottage cheese into an appealing option.

Grainful

- Founders: Jeannine Sacco, Jan Pajersk

- Product(s): Oat Centric Frozen and Prepared Meals

- Investment Date: 6/13/17

- 2017 Funding: $3,300,000

- Total Funding: $6,010,000

- Known Investors: Advantage Capital Partners, CircleUp, Rand Capital

- Comments: Grainful has been a fantastic, differentiated addition to prepared meals. They demonstrate the eureka possible in food and beverage – the brand started when the founders wanted to make dinner but didn’t have traditional grains like rice and pasta on hand and still managed to make a delicious meal using steel cut oats.

High Brew

- Founders: David Smith, Elizabeth Smith

- Product(s): Cold Brew Coffee

- Investment Date: 5/30/17

- 2017 Funding: $17,100,000

- Total Funding: $28,400,000

- Known Investors: Boulder Investment Group Reprise (BIGR Ventures), CAVU Ventures, Tasty Ventures

- Comments: High Brew has seen some high growth as the cold brew category continues to explode. Its affordable, straightforward, right-sized cans have won over consumers from convenience to conventional and things show no sign of slowing. They’ve also dipped their toes into the protein and coffee subset, which brands such as Sunniva are focusing on full time. It’ll be fascinating to see which areas under the cold brew umbrella, from butter to protein to alternative dairy, perform best.

Hippeas

- Founder: Livio Bisterzo

- Product: Chickpea Puffs

- Investment Date: 10/10/17

- 2017 Funding: $10,000,000

- Total Funding: $10,000,000

- Known Investors: CAVU Ventures, Green Park Brands, Strand Equity Partners

- Comments: Hippeas has a visionary founder who has created one of the most successful launches in industry history. From starting in mid-2016, Hippeas has closed two rounds from top tier firms and with participation from the likes of Leo DiCaprio, presciently built its snacks using the deservedly on-trend chickpea and was generating monthly revenue of nearly $1,000,000 barely a year post launch. Part of their success has been understanding The ROI of Surprise and Delight.

Humm Kombucha

- Founders: Jaime Danek, Michelle Mitchell

- Product(s): Kombucha

- Investment Date: 6/5/17

- 2017 Funding: $10,000,000

- Total Funding: $17,600,000

- Known Investors: VMG

- Comments: Next to cold brew, kombucha remains one of the hottest areas of beverage and Humm is well positioned to meet the demand. The company announced it’s opening of a new plant at the end of 2016 capable of producing 36,000,000 bottles per year. Traditional CPG startups have looked to co-packers to handle production, but those at the forefront of innovation seem to be increasingly consider keeping production in house. This strategy, however operationally demanding, enables more rapid innovation, fuller control and a more compelling brand story than employing a third party producer allows.

ICONIC

- Founders: Billy Bosch

- Product(s): Protein Drinks

- Investment Date: 9/13/17

- 2017 Funding: $8,000,000

- Total Funding: $9,000,000

- Known Investors: AccelFoods, KarpReilly

- Comments: In keeping with the social issue zeitgeist of 2017, ICONIC’s success is due in large part to creating a healthy, high-protein drink void of the hyper masculine branding which characterizes Muscle Milk and others. Everyone needs food and ICONIC’s success serves as an important reminder for new products and innovations to not overlook the diversity of consumer wants and needs.

Impossible Foods

- Founders: Patrick Brown

- Product(s): Plant-Protein Meats

- Investment Date: 7/28/17

- 2017 Funding: $75,000,000

- Total Funding: $313,000,000

- Known Investors: Collaborative Fund, Horizons Ventures, Khosla Ventures

- Comments: As an avowed carnivore, my first bite of the Impossible Burger was the most memorable food experience of my life. Beyond multi-star Michelin hauts or the fantastic pizza of Brooklyn, the likeliness of Bareburger’s rendition to the real deal cannot be overstated. Goldman Sachs recently declared “meatless meats” as one of “8 Huge Trends That Are About to Change the World” and companies like Impossible are turning the future into reality.

Just, Inc. (formerly Hampton Creek)

- Founders: Josh Tetrick, Josh Balk

- Product(s): Vegan Cookies, Eggs and Sauces

- Investment Date: 5/26/17

- 2017 Funding: $150,000,000

- Total Funding: $373,000,000

- Known Investors: Khosla Ventures, Founders Fund, Radicle Impact, Collaborative Fund, AME Cloud Ventures, Horizon Ventures, Ali Partovi, Hadi Partovi, Ashvin Patel, Scott Banister, Kat Taylor, Mustafa Salesman, Far East Ventures, Tao Capital Partners, Demis Cassabas, WP Global Partners, Jean Piggozzi, Eduardo Severin, Velos Partners, OS Fund, BlackPine Private Equity Partners, Marc Benioff, Brian Meehan, Uni-President Enterprises Corporation

- Comments: JUST has continued to push forward on its mission driven path, overcoming product and personnel hiccups along the way. Despite its board walking out, accusations of deceptive buy back practices and inappropriate work relationships, the company closed one of the largest financing rounds of the year and launched a new egg free ‘scramble’ product to glowing reviews.

JUST Goods

- Founders: Grace Jeon, Ira Laufer

- Product(s): Bottled Water

- Investment Date: 9/29/17

- 2017 Funding: $2,010,000

- Total Funding: $15,700,000

- Known Investors: Cranberry Capital, DGNL Ventures, HDS Capital, Raptor Consumer Partners

- Comments: Often, the intersection of two superior qualities creates disruptive mass appeal. In the case of JUST Goods, the maker of a sustainable bottled water, they are price and eco-friendliness. The specially designed Tetra Pak paper-based packaging allows the brand to stand out on a crowded shelf, is more economical at scale than plastic and is 82% recyclable. Given the threats of climate change, economically viable improvements to our global consumption of one million plastic bottles per minute ought to be applauded.

Kidfresh

- Founders: Matt Cohen, Gilles Deloux

- Product(s): Frozen Kids Meals

- Investment Date: 5/9/17

- 2017 Funding: $10,300,000

- Total Funding: $10,300,000

- Known Investors: AccelFoods, Emil Capital Partners, Monogram Capital Partners

- Comments: There are few areas where consumers are less price sensitive than the their children’s health. Despite this, frozen and refrigerated kids meals has been stagnant for some time and Kidfresh has placed itself at the nexus of a general shift towards healthier, all natural food preferences and modern, highly informed parents seeking to provide their kids with superior nutrition.

Kill Cliff

- Founders: Todd Ehrlich

- Product(s): Energy Drinks

- Investment Date: 8/10/17

- 2017 Funding: $13,500,000

- Total Funding: $24,700,000

- Known Investors: Sherbrooke Capital, Sunrise Strategic Partners

- Comments: In the notoriously competitive energy drink market, Kill Cliff has found its niche within the CrossFit community. The brand also donates a portion of its sales to a foundation benefitting Navy Seals, in which founder Todd Ehrlich previously served. By combining a loyal niche and a genuine mission, they are successfully attacking the well defended territory of Red Bull and Monster.

koia

- Founder: Chris Hunter

- Product(s): Plant Protein Beverages

- Investment Date: 7/13/17

- 2017 Funding: $7,500,000

- Total Funding: $8,180,000

- Known Investors: AccelFoods, KarpReilly

- Comments: In his second beverage startup act, Chris Hunter has demonstrated a remarkable degree of entrepreneurial versatility. Formerly of Four Loko fame, Hunter has since adopted a healthier lifestyle as reflected in his new company, koia, which makes fresh, plant protein based smoothies. They’ve come a long way since their initial MVP and in a short period, have earned national distribution at Whole Foods with no signs of slowing.

Kuli Kuli

- Founders: Lisa Curtis

- Product(s): Moringa Bars and Powders

- Investment Date: 7/13/17

- 2017 Funding: $4,250,000

- Total Funding: $5,350,000

- Known Investors: Eighteen94 Capital, InvestEco, Radicle Capital, S2G Ventures, Terra, Village Capital

- Comments: It’s always exciting when a new food is introduced domestically. From matcha to quinoa to, in Kuli Kuli’s case, moringa, a nutrient dense leaf common in parts of Africa, the Americanizing of ingredients popular in other cultures and countries can be a tricky balancing act between approachability and respect for the original. Kuli Kuli is doing a great job, especially in its impact efforts: to date, it has planted over 1,000,000 moringa trees and provided more than $1.5 million in income to women-led farming cooperatives and nonprofits in Ghana.

nona lim

- Founders: Nona Lim

- Product(s): Bone Broth; Soups; Noodles

- Investment Date: 6/5/17

- 2017 Funding: $1,950,000

- Total Funding: $2,100,000

- Known Investors: AccelFoods, Cambridge SPG, CircleUp, Echo Capital Group, Harbinger Ventures

- Comments: Originally founded as a meal kit company, nona lim successfully pivoted away from what’s proven a problematic business model even for public companies like Blue Apron to zeroing in on asian inspired broths and noodles. The willingness to adapt without losing the incipient brand flavor is an important lesson for all early stage startups, but particularly those, like nona lim, attempting to create new categorizes such as bone broth.

Once Upon a Farm

- Founders: Jennifer Garner, John Foraker, Cassandra Curtis, Ari Raz

- Product(s): Baby Food

- Investment Date: 2/8/17

- 2017 Funding: $3,100,000

- Total Funding: $3,100,000

- Known Investors: Cambridge SPG, Harbinger Ventures, S2G Ventures

- Comments: If anyone can muscle their way into the crowded baby food category (eg. Kidfresh, NuturMe, etc.) it’s a dream team including John Foraker, who sold Annie’s to General Mills for in excess of $800 million and grounded A-lister Jennifer Garner. The brand also deserves bonus points for its supply chain transparency and excellent e-commerce design, the later an increasingly vital channel in the Age of Amazon.

Owl’s Brew

- Founder: Jennie Ripps

- Product(s): Mixers, Alcoholic Beverages

- Investment Date: 1/4/17

- 2017 Funding: $4,080,000

- Total Funding: $4,520,000

- Known Investors: Cambridge SPG, ZX Ventures, Crimson Seed Capital

- Comments: Not only has Owl’s Brew been a leader of the mixers category, they also debuted one of the most creative offerings in beer – the Radler, a part beer, part tea combo which pairs perfectly with outdoor summer evenings. The brand has justifiably earned the attention of ZX Ventures, the investment arm of AB InBev and it will be exciting to see if they have a third creative, category defining creation in the pipeline for 2018.

peeled snacks

- Founder: Noha Waibsnaider

- Product(s): Dried Fruit Snacks

- Investment Date: 5/17/17

- 2017 Funding: $4,460,000

- Total Funding: $7,230,000

- Known Investors: Fireman Capital Partners, Hammerstone Capital, Seurat Group, Avondale Ventures, TFIC

- Comments: The company is attacking the snack aisle from two angles: healthy fruit snacks and, more recently, extruded, plant-protein rich puffs. Upon closing their latest round, Noha Waibsnaider remarked, “one thing I learned from the dried fruit category is that when we started we didn’t really have strong competitors and it made it really hard to disrupt a category alone.” This touches on a fascinating, broader debate within food and beverage circles: is it wiser to “create” a category (eg. coconut water) or “disrupt” an established one (eg. cold brew coffee)?

Penrose Hill

- Founders: Erik Steigler, Philip James

- Product(s): Wine

- Investment Date: 2/27/17

- 2017 Funding: $5,000,000

- Total Funding: $7,250,000

- Known Investors: Prehype, Greycroft

- Comments: There is a clear lack of innovation in alcohol compared to the overall food and beverage industry. Beyond Smirnoff Ice, Fireball, Spiked Seltzer and Underwood canned wine, precious few truly differentiated alcohol brands emerge. The three tier system and generally tight TTB regulations explain most of the industry’s conservativeness, yet innovative businesses like Penrose Hill have nonetheless emerged. Using structured data and customer feedback, they’ve adopted a decidedly modern approach to product development in a craft characterized by its long standing traditions. It’s a unique, Millennial minded approach that’s won over both investors and customers alike.

Perfect Day

- Founders: Ryan Pandya, Perumal Gandhi

- Product(s): Alternative Dairy

- Investment Date: 5/3/17

- 2017 Funding: $20,500,000

- Total Funding: $26,700,000

- Known Investors: Horizons Ventures

- Comments: The majority of science focused food startups have come from Silicon Valley and Perfect Day is no exception. A self described “cellular agriculture company making milk from cell culture,” the company underwent a rebrand from Muufri to Perfect Day in August 2016, marrying their high growth worthy technology with a high growth worthy brand identity. Perfect Day is also among a growing number of startups backed by Hong Kong based billionaire Li Ka-shing, whose portfolio also includes Impossible Foods, JUST and Celsius.

Powerful

- Founders: Carlos Ramirez

- Product(s): Protein Enhanced Yogurt and Oatmeal

- Investment Date: 11/7/17

- 2017 Funding: $4,000,000

- Total Funding: $7,500,000

- Known Investors: CircleUp, River Hollow Partners, Reason Venture Partners, SWAT Equity Partners

- Comments: Powerful gained initial traction by launching a well covered irreverent marketing campaign targeting male consumers. Since then, they’ve toned down the bravado and expanded their product line while growing to $11 million in annual sales. Clearly the protein trend has enough capacity to support both female focused brands like Iconic and, albeit less than at its outset, male geared companies like Powerful.

PRE Brands

- Founder: Lenny Lebovich

- Product(s): Beef

- Investment Date: 2/24/17

- 2017 Funding: $1,120,000

- Total Funding: $2,120,000

- Known Investors: BRJ Ventures

- Comments: PRE Brands continues what has been a more and more common trope – food companies describing themselves as technology startups. From Sweetgreen to JUST, the technology startup image presumably connotes open-minded innovation and helps justify a tech company valuation multiple. Unlike some other meat suppliers, PRE Brands outsources production to partner farms, allowing it to focus on the brand experience. That said, essentially using a co-packer does not a tech startup make. Apart from that, their introduction of high quality beef and well designed packaging to a generally staid category deserves plenty of praise.

Protein2o

- Founders: Bob Kral

- Product(s): Protein Enhanced Water

- Investment Date: 11/16/17

- 2017 Funding: $4,00,000

- Total Funding: $11,480,000

- Known Investors: CK Capital Management Corporation

- Comments: Capitalizing on the ongoing protein trend, Protein2o has created a unique concept in the enhanced waters space. One potential pitfall may be the name, Protein2o, which could hamper line extension possibilities and comes across a bit unnatural and scientific. Founded and run by a team of CPG veterans, however, they have both experience and differentiation working in their favor and saw sales grow 300% in the first half of 2017 alone.

Purely Elizabeth

- Founders: Elizabeth Stein

- Product(s): Granola, Snacks and Grains

- Investment Date: 4/3/17

- 2017 Funding: $3,00,000

- Total Funding: $3,000,000

- Known Investors: 301 Inc.

- Comments: Like RXBAR, Purely Elizabeth has successfully taken the approach of avoiding dependency on venture capital. Only after generating $12 million in sales did they decide to accept outside funding, further proving the best brands attract outside capital but are not built on it.

Rhythm Superfoods

- Founders: Scott Jensen, Keith Wahrer

- Product(s): Vegetable Snacks

- Investment Date: 1/1/17

- 2017 Funding: $6,00,000

- Total Funding: $17,200,000

- Known Investors: 301 Inc., Blueberry Ventures, CircleUp, M13 Company, Tasty Ventures

- Comments: Founded in 2009, Rhythm seems to have really hit its stride nearly a decade in with its proprietary, all natural, crispy yet unfried vegetable chips, Following in the footsteps of successes like Popchips who offered crunch with less calories and timing their growth with rising consumer adoption of plant centric and vegan diets, Rhythm has a great future ahead.

SAFE + FAIR

- Founders: Dave Leyrer, Pete Najarian

- Product(s): Grains, Snacks and Deserts

- Investment Date: 5/3/17

- 2017 Funding: $10,00,000

- Total Funding: $14,000,000

- Known Investors: Acre Venture Partners

- Comments: Allergy friendly foods is a formula that’s had success in the past. Enjoy Life Foods, also founded in Chicago, went on to be acquired by Mondelez in 2015 and clearly Acre, the V.C. arm of Campbell’s, sees an equally bright future for SAFE + Fair.

Sipp

- Founder: Beth Wilson-Parentice

- Product(s): Flavored Beverages and Mixers

- Investment Date: 3/21/17

- 2017 Funding: $1,250,000

- Total Funding: $2,650,000

- Known Investors: Emil Capital Partners

- Comments: Considering its seemingly widespread distribution, Sipp has expanded remarkably well on relatively little disclosed funding. From upscale independents throughout the metro NYC area to, more recently, expansion into Costco and Safeway, the high margin, high class line has national appeal and potential. There have even been rumors of a potential Coca Cola acquisition in recent months and it wouldn’t be shocking to see Sipp in the M&A section of next year’s report.

SomruS

- Founder: Pankaj Garg

- Product(s): Liqueur

- Investment Date: 10/16/17

- 2017 Funding: $3,600,000

- Total Funding: $3,600,000

- Known Investors: Cleveland Avenue

- Comments: SomruS, an Indian liqueur similar to Baileys, is entering the surprisingly large global liqueurs and cordials market, estimated at $111 billion as of 2016. As the “craft” movement slows down, the smart VC money seems to be flowing to “weird” concepts with a true chance of disrupting large, established categories.

Soylent

- Founder: Rob Rhinehart

- Product(s): Meal Replacement Shakes

- Investment Date: 5/4/17

- 2017 Funding: $50,000,000

- Total Funding: $71,500,000

- Known Investors: Andreessen Horowitz, GV, Lerer Hippeau Ventures, TAO Capital

- Comments: Soylent has many of the markings of a brand set for success: true differentiation, support from an A list roster of VCs and some to be expected hiccups along the way – in particular, multiple product recalls this year. Nonetheless, Soylent is selling close to two million bottles per month despite extremely limited retail presence. The company is yet another example of how matching a creative go-to-market distribution strategy to a product weird enough to stand out can be a recipe for success.

Spindrift

- Founder: David Kimmell

- Product(s): Fruit Juice Beverages

- Investment Date: 5/12/17

- 2017 Funding: $13,100,000

- Total Funding: $23,500,000

- Known Investors: KarpReilly, New Ground Ventures, Prolog Ventures, Revelry Brands, RiverPark Ventures, VMG Partners, Warbos Venture Partners

- Comments: No commentary needed other than declaring Spindrift (apart from RISE Brewing Co., of course!) my favorite beverage on the market today. The branding, nutrition and taste are all exceptionally well executed and I’m proud to count myself as a loyal supporter.

Temple Turmeric

- Founder: Daniel Sullivan

- Product(s): Turmeric Beverages

- Investment Date: 2/28/17

- 2017 Funding: $2,400,000

- Total Funding: $5,680,000

- Known Investors: Boulder Investment Group Reprise (BIGR Ventures)

- Comments: The latest two editions Google’s Beverage Trends report identified turmeric as something to, “keep an eye on.” Undermining its great health benefits, turmeric’s insolubility and color degradation under heat make it technically challenging to work with. It may turn out that brands like REBBL, which also raised a large funding round from BIGR, have the wisest approach – deploying certain superfoods and spices in supporting roles rather than as standalone stars.

Vital Proteins

- Founder: Kurt Seidensticker

- Product(s): Collagen Products

- Investment Date: 11/1/17

- 2017 Funding: $19,000,000

- Total Funding: $19,000,000

- Known Investors: CAVU Ventures

- Comments: Mansome, a collagen focused beverage, is popular throughout Southeast Asia, so why can’t a collagen forward brand do well here? That’s at least part of the calculus behind CAVU’s decision to lead its latest round. If Vital can continue its rapid, category creating ascent – the four-year-old brand has achieved 240%+ consecutive year-over-year-growth for the past three years and has grown its retail presence into over 8,000 retail stores – it’ll be nearly $20 million well spent.

Wandering Bear Coffee

- Founders: Matthew Bachmann, Ben Gordon

- Product(s): Cold Brew Coffee

- Investment Date: 4/6/17

- 2017 Funding: $2,400,000

- Total Funding: $2,450,000

- Known Investors: AccelFoods, M3 Ventures, RCV Partners

- Comments: Wandering Bear has built a spot for itself in the red hot cold brew category with a straightforward cold brew paired with innovative bag-in-box and Tetrapak serving options. The former is especially well suited to office environments where Millennial workers at top tier firms expect better offerings than K-cups and burnt, stale pots of day old coffee. As the cold brew category matures, the ability to offer both attractive flavors and serving mediums will help separate the pack .

Waterloo

- Founders: Daniel Barnes, Brandon Cason

- Product(s): Flavored Sparkling Water

- Investment Date: 8/7/17

- 2017 Funding: $3,200,000

- Total Funding: $3,200,000

- Known Investors: CAVU Ventures

- Comments: Most founders can only dream of being able to secure significant funding from a top tier investor pre launch. Waterloo’s team of seasoned execs was able to make that happen and is making a push into the zero cal sparkling water market, starting in Texas. It’ll have some catching up to do with Spindrift, but it’s on trend flavor and nutrition, well designed packaging, established network and capital backing should give it more than a fighting chance.