This is a monthly guest post, by consulting firm Rosenheim Advisors, which highlights the most interesting acquisitions, financings and partnerships within the Food Tech & Media ecosystem – digital content, social, local, mobile, grocery, e-commerce, delivery, ordering, payments, marketing and analytics – to give you insights into the latest funding and growth trends.

Together with more than $220 million raised in the global private markets through funding and acquisitions, and Square’s IPO totaling $279 million in primary shares, over $500 million was infused into the food tech landscape in November.

Among the seven acquisitions, seventeen private capital raises and one IPO, activity within the delivery and on-demand sector was dominant, with continuing trends towards consolidation in this sector and a prevalence of “acqui-hires.” Over two thirds of the deals were international, with companies from India, the UK and France representing the majority.

M&A

Velocity Acquires Uncover. The London, UK-based mobile restaurant booking app will allow Velocity to add mobile booking to its mobile hospitality app, which currently includes mobile payments, restaurant suggestions, and rewards. In the past two months, Velocity has also acquired Cover and Tab Payments, in addition to receiving $16 million in Series A funds in September.

Announced: 11/19/15 Terms: Not Disclosed Previous Investment: $1.5m Founded: October 2013

Sattviko Acquires Call A Meal. The Jaipur, India-based food delivery service will strengthen the delivery services offered by Sattviko, a Delhi-based healthy dining chain, making delivery “a key business vertical for the company”. The restaurant company also plans to launch fine-dining restaurants, beginning in Jaipur.

Announced: 11/19/15 Terms: Not Disclosed Previous Investment: NA Founded: April 2014

Lidl Acquires Kochzauber. The acquisition of the Berlin, Germany-based healthy food delivery service, which delivers recipe meal kits with fresh ingredients and cooking instructions, will allow Lidl, the German supermarket chain, to increase its sales by entering into e-commerce.

Announced: 11/18/15 Terms: Not Disclosed Previous Investment: Not Disclosed Founded: February 2012

Deliv Acquires Zipments. The acquisition of the New York, NY-based platform for same-day delivery gives the Menlo Park, CA-based retail delivery service greater access to driver services and customer relationships in New York City, including startups Plated, Casper, and Handy and local merchants such as B&H, Murray’s Cheese and Epicerie Boulud.

Announced: 11/09/15 Terms: Not Disclosed Previous Investment: $2.3m Founded: 2010

Shadowfax Acquires Pickingo. The Pune, India-based on-demand delivery service has been acqui-hired by Shadowfax, which offers a similar on-demand delivery service. Shadowfax has hired 45 management team members as well as over 100 deliverers. The new teams will assist Shadowfax with achieving deliveries within 30 minutes to an hour.

Announced: 11/09/15 Terms: Not Disclosed Previous Investment: $1.3m Founded: 2014

Postmates Acquires Sosh. The San Francisco, CA-based local discovery mobile app has been acqui-hired by Postmates, the mobile app for on-demand food delivery. Both Sosh founders, as well as 16 of Sosh’s engineers, product managers, designers, and operations specialists will join Postmates’s teams. Sosh will cease independent operations.

Announced: 11/05/15 Terms: Not Disclosed Previous Investment: $16.3m Founded: 2010

GeoPost Acquires Resto In. GeoPost, the international express delivery subsidiary of Le Groupe La Poste has acquired an 80% share in Resto In, a Barcelona-based virtual market place for restaurants offering quick home delivery solutions. The company offers a delivery to over 1 million registered customers and partners with more than 800 restaurants, pastries and stores in 5 countries (France, Belgium, UK, Germany and Spain). This acquisition bulks up GeoPost’s focus on the food category, and comes alongside GeoPost’s investment in local delivery startup Stuart (details in Funding section below), which was also founded by partners of Resto In.

Announced: 10/29/15 Terms: Not Disclosed Previous Investment: $10.0m Founded: 2006

FUNDING

Ele.me Raises Strategic Investment from Didi Kuaidi. The Beijing, China-based ridesharing market leader has invested an undisclosed amount into the Shanghai-based food delivery service, which was valued at $3 billion during the most recent fundraise in August. The companies plan to link their services, which will allow Ele.me to expand the range of their delivery service from a 3-mile radius to citywide. As Tech in Asia points out, it is likely a move that’s “aimed at keeping up competition with Uber and Baidu” given each company’s increasing presence in the food vertical.

Announced: 11/25/15 Participating Institutional Investors: Didi Kuaidi Previous Investment: $1.085 billion (or $1.175 billion according to Tech In Asia) Founded: September 2008

Deliveroo Raises $100m. The London, UK-based restaurant delivery service allows consumers to order food from exclusive restaurants for on-demand delivery. The user, restaurant, and deliverers each receive information from connected apps, which allows restaurants to respond to orders within 90 seconds and deliveries within 30 minutes. The company currently operates in 50 cities across 12 countries in Europe. Coming on top of a $70 million raise this summer, the new investment will be used for international expansion outside of Europe, with plans to expand to Dubai, Hong Kong, Singapore, Melbourne, and Sydney.

Announced: 11/23/15 Stage: Series D Participating Institutional Investors: DST Global (lead), Greenoaks Capital (Lead), Index Ventures, Accel Partners, Hummingbird Ventures Previous Investment: $99.6 million Founded: February 2013

Square Raises $279m in IPO. The San Francisco-based payment technology company priced its Initial Public Offering at $9 per share, valuing the company at approximately $2.9 billion at IPO. Although the pricing was below the initial proposed range of $11-$13, and significantly lower than the $6 billion valuation in 2014, shares have rallied moderately on the secondary market, and have generally been in the range of $11-$12 range since IPO. The lower public valuation, however, has continued to fuel the narrative of a pullback in the tech IPO market, as well as private market tech valuations.

NYSE Listing Date: 11/19/15 Valuation at IPO: $2.9 billion Stage: IPO Previous Investment: $590.6 million Founded: 2009

Place of Origin Raises Seed Funding. The Bangalore, India-based specialty foods platform allows users to discover a variety of “authentic” foods from across India. Users can choose from over 500 products from 25 cities, with delivery available to 20 cities in India. The funds will be used to enhance the company’s technology and infrastructure and to expand menu offerings.

Announced: 11/18/15 Stage: Seed Participating Institutional Investors: Axilor Ventures Previous Investment: Not Disclosed Founded: September 2014

Salido Raises $2m. The New York, NY-based SaaS operating system for restaurants allows restaurants to manage the front and back of house together, including point of sale, reporting, customer and labor management, inventory, and recipes. The company will reportedly use the investment to expand to 350 restaurants in the next year.

Announced: 11/18/15 Stage: Seed Participating Investors: Highline Venture Partners (lead), 500 startups, Accelerator Ventures, Great Oaks Venture Capital, Tom Colicchio, Stephen Starr Ben Daitz Previous Investment: Not Disclosed Founded: 2012

Stuart Raises $23.4m. The Barcelona, Spain-based delivery service, founded by founders of Resto In (recently acquired by GeoPost), is pre-launch, yet describes itself as an “on-demand urban logistics app and platform.” The company plans to allow consumers to make purchases for same-hour on-demand delivery, reportedly done by “allowing anyone to deliver anything at any time.” According to TechCrunch, “rather than going down the surge-pricing route, Uber-style, the startup’s algorithm will where necessary ‘pool’ deliveries to keep the cost down”. The funds will be used for international expansion, with plans to expand to Brussels, London, and Berlin.

Announced: 11/18/15 Valuation: ~€45 million Stage: Series A Participating Institutional Investors: Geopost Previous Investment: $1.7 million Founded: 2015

Eating with the Chefs Raises “Seven-Digit” Seed. The Berlin-based food startup offers affordable high end sous-vide dinners created by rising chefs for customers to heat up at home. The startup was launched in September 2015 by former StudiVZ CEO Clemens Riedl, Eatüber founder Chanyu Xu and Jochen Wolf. The team plans to use the funds to expand operations.

Announced: 11/16/15 Stage: Seed Participating Institutional Investors: Founders Fund, Holtzbrinck Previous Investment: Not Disclosed Founded: 2015

EatFirst Raises $8m. The London, UK-based online restaurant allows customers to order meals online for on-demand delivery. Meals are designed and prepared by professional chefs and made available for order. Restaurants currently operate in London and Berlin. The start-up claims to have already achieved 30% month-on-month sales growth and has delivered over 100,000 meals to date. Initially backed by Rocket Internet, the new funds will be used to grow the company, with plans for international expansion.

Announced: 11/17/15 Stage: Series A Participating Institutional Investors: DMGT, HV Holtzbrinck Ventures Previous Investment: Not Disclosed Founded: August 2014

AirGrub Raises $1.5m. The Millbrae, CA-based mobile app allows travelers to pre-order healthy meals for pickup at airports. AirGrub currently operates in San Francisco International Airport, John F. Kennedy International Airport (New York), and Logan International Airport (Boston). The funds will be used for expansion by adding new restaurant partners and locations.

Announced: 11/16/15 Stage: Angel Participating Investors: Not disclosed Previous Investment: Not Disclosed Founded: October 2014

CircleUp Raises $30m. The San Francisco, CA-based online investment platform connects consumer packaged goods entrepreneurs with potential investors. Currently, CircleUp has allowed over 120 companies to raise a total of $135 million. Funds will be used to expand the company’s platform and product teams.

Announced: 11/11/15 Stage: Series C Participating Institutional Investors: Collaborative Fund (lead), QED Investors, Rose Park Advisors, Maveron, Canaan Partners, Union Square Ventures Previous Investment: $23.0 million Founded: October 2011

Frichti Raises $1.1m. The Paris, France-based meal delivery service allows consumers to order meals online for on-demand delivery. Meals are prepared in Frichti kitchens and delivered with ingredient descriptions and instructions for reheating.

Announced: 11/10/15 Stage: Seed Participating Investors: Quentin Vacher, Alven Capital Previous Investment: Not Disclosed Founded: June 2015

Chefs Basket raises $6m. The Mumbai, India-based ready-to-cook food startup provides consumers with meal kits. The investment will be used to develop new products and expand the company to 15 cities in India as well as internationally to South Africa, Canada, and Australia. The company has partnered e-commerce websites including Amazon, Flipkart, Snapdeal, BigBasket, Paytm and Grofers, along with supermarket chains Hypercity, D-Mart and Big Bazaar to sell its products. With this expansion, Chefs Basket aims to increase products sales from 130,000 units per month to 400-500,000 units per month by March 2016.

Announced: 11/10/15 Stage: Series A Participating Investors: Haresh Chawla, SAIF Partners Previous Investment: Not Disclosed Founded: 2012

BrightFarms Raises $13.65m. The New York, NY-based grower of local produce builds and operates greenhouse farms throughout the United States. Each greenhouse is partnered with supermarkets and vendors to provide consumers with fresh, local produce year-round. The company will use the funding to commercially scale greenhouses to meet increasing demand.

Announced: 11/06/15 Stage: Series B-1 Participating Institutional Investors: NGEN Partners, Emil Capital Partners, WP Global Partners Previous Investment: $9.2 million Founded: 2011

Satvacart Raises $1.8m. The Gurgaon-based grocery delivery startup offers over curated products across grocery, fruits and vegetables, personal care, household essentials, and baby care through its online platform. After raising an initial seed in July, the company stated that the funding will be used to strengthen technology backbone and expand into other geographies.

Announced: 11/06/15 Stage: Seed Participating Investors: “Three senior executives in the insurance, telecom and investment banking sectors”, Palaash Ventures Previous Investment: Not Disclosed Founded: 2014

Innit Raises $25m. The Redwood City, CA-based cloud-based connected home platform “connects food information to appliances and devices.” The platform allows for a smart kitchen which will assist consumers with food selection and preparation.

Announced: 11/05/15 Stage: Venture Participating Institutional Investors: Not Disclosed (“Unnamed strategic backers”) Previous Investment: Not Disclosed Founded: September 2013

ZenChef Raises $6.5m. The Paris, France-based website creator (previously named 1001menus) allows restaurants to design and create their own digital presence, including website, social media, management systems, and reviews. ZenChef positions itself as a one-stop solution for all marketing and communications purposes, and currently operates in France, Germany, the United Kingdom, and Spain. The investment will be used for international expansion, and the company aims to have 25,000 clients by 2018.

Announced: 11/04/15 Stage: Series B Participating Institutional Investors: Edenred Capital Partners (lead), Elaia Partners, Kima Ventures, Xange Private Equity Previous Investment: $2.2 million Founded: November 2010

Boibanit Raises $150k. The Vadodara, India-based meal delivery service, allows consumers to order restaurant food online for on-demand delivery. Customers have the option to combine foods from multiple restaurants in one order. Boibanit currently operates in 350 restaurants in Indore, Lucknow, Surat, Noida, and Vadodara. The investment will be used to expand to Ahmedabad, Bhopal and Ghaziabad.

Announced: 11/03/15 Stage: Angel Participating Investors: Anubhav Verma, Varun Ahuja Previous Investment: Not Disclosed Founded: 2014

Twigly Raises $200k. The Guragon, India-based kitchen-on-a-cloud service allows customers to order meals online to be delivered directly to their homes from a central-based kitchen. The company models itself after the United States-based company, Sprig, which delivers organic meals in 15 minutes. The investment will be used to expand kitchen locations and partner with delivery services.

Announced: 11/02/15 Stage: Angel Participating Investors: Mukhal Singhal, Sahil Barua, Amit Gupta Previous Investment: Not Disclosed Founded: August 2015

PARTNERSHIPS

Zipongo Partners with Yummly to provide suggestions for healthy eating.

Starbucks Partners with Postmates to offer on-demand delivery.

Hello Curry Partners with IRCTC to enhance on-board meal options for train riders in India.

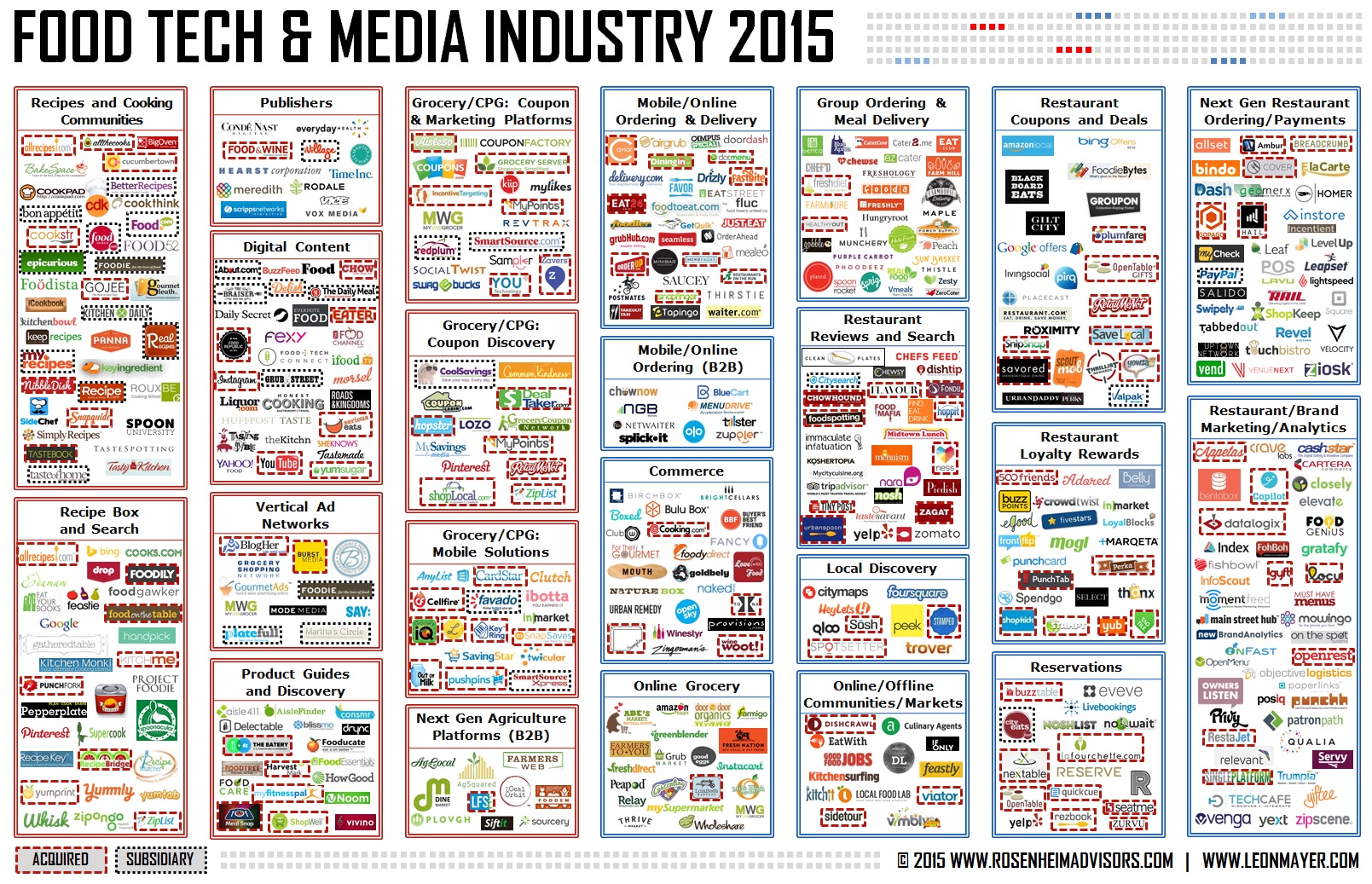

INDUSTRY LANDSCAPE

As The Food Tech & Media ecosystem continues to see rapid change, Rosenheim Advisors created The Food Tech & Media Industry Map to help entrepreneurs, participants and investors understand this quickly evolving landscape. Let us know about your recent or upcoming funding, partnerships or acquisitions here.