Source: S2G Ventures’ The Future of Food: Through The Lens of Retail

This is a guest post by Audre Kapacinskas, Vice President at S2G Ventures

Food+Tech Connect and S2G Ventures are partnering to host Reimagining Retail, a series of conversations exploring how this unprecedented moment in time will shape food retail over the next five years.

Why Now? How the Pandemic of 2020 is reshaping grocery retail, why today is different and what it will change about how and what we eat.

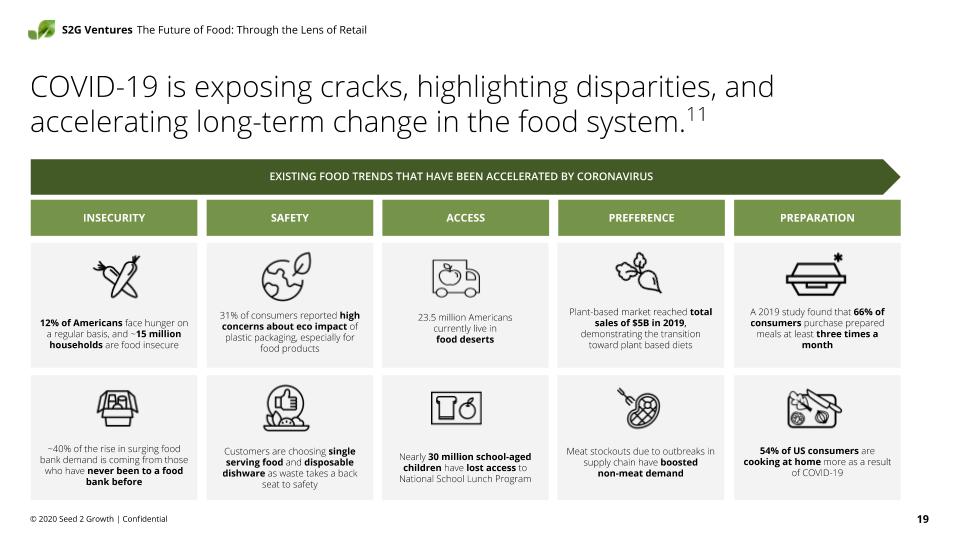

The pandemic of 2020 is shining the brightest of lights on our present day food system and exposing both its resiliency and vulnerabilities. No industry touches more aspects of our lives than food – it employs 11 percent of our population, represents 10 percent of household expenditures, underpins our social fabric and directly relates to the health of our communities and planet. Over the last 100 years, we have developed a massive food supply chain that is efficiently humming in the background of our everyday lives – delivering food consistently, cheaply and without question. Over the last year, cracks emerged across our food system and showcased some of the tradeoffs we have made over the last century — efficiency at the cost of resiliency; scale at the expense of variety; price at the expense of value; globalization at the expense of our local communities.

At the same time, Covid-19 accelerated trends that had been percolating for years – expanding digital footprints, refining e-commerce offerings, exploring automation opportunities. As Covid-19 persists and retailers continue to forge ahead, the pandemic is separating the leaders from the laggards. New technologies and behaviors are becoming engrained and we are crossing a chasm from which the industry will not return unchanged.

Taking online grocery shopping as an example, the last 30 years have seen a slow evolution. Peapod was founded in 1989 – despite requiring customers to physically download software, the company had enough buzz to go public in 1996 but ultimately closed its digital doors in February of 2020 (ironically). Webvan received its first order in 1999, spent $1 billion building distribution centers in 2000 and closed in 2001. Instacart was founded several years later and offered a more accessible, hybrid model for consumers and retailers that connected physical and digital. Despite these fits and starts, online grocery sales remained low – 3-5 percent of total grocery in the US. As Covid-19 persists, it is influencing behavior and offering a real opportunity to make online grocery shopping a meaningful part of our food system – projections estimate that 1 in every 5 grocery dollars will be spent online in 2025. Today’s emerging digital models are underestimated in their ability to change how, what and why we eat what we eat.

While we have built a massive supply chain, when we compare the capital that has flowed into other sectors like pharma or technology, food pales in comparison. For decades, the food industry has been underinvested, under appreciated and under digitized. Today, we have the opportunity to reimagine it taking into account technology advances, consumer preferences and impact to our economy, planet and health. We are at a distinct moment in time where critical infrastructure is coming together, technology costs have decreased and consumers are open to behavior change. Internet usage reached critical mass in 2000 in the US; the iPhone was launched in 2007; falling sensor costs are driving the proliferation of personal and IoT devices which in turn are contributing to the exponential rise of data – we have 44X the amount of data today than we did a decade prior. As we think forward to the next 100 years of food and retailing, there is opportunity to reimagine sourcing and verification, go-to-market channels and market places and ultimately who controls access to the market and the products that will win in the next century.

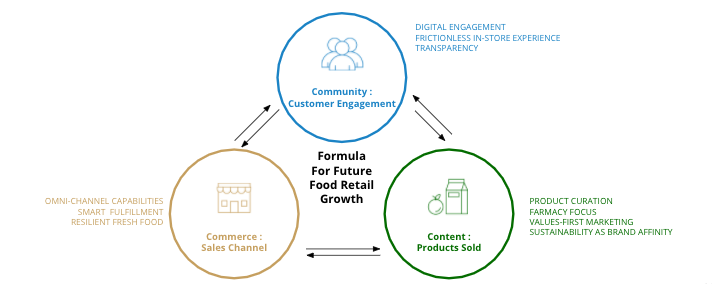

The increasing role of technology in retail transcends the growth of e-commerce during the pandemic. It will impact not only where consumers buy, but how and why they buy. It is within this context that we at S2G Ventures see opportunity to build a better food system by integrating content, community and commerce, which we outline in full in our Future of Retail Report. By leveraging cutting edge technologies with stakeholder-focused business models, we have an opportunity to build a 21st century food system grounded in trust that better connects consumers to their food.

Commerce: How emerging sales channels and new operational approaches are enabling 21st century business models and building a more resilient food supply chain.

In the early days of the pandemic, vulnerabilities across our food system emerged – from early stock-outs, to stories of infected workers to euthanized pigs. As consumers, we were confronted with the limitations of supply chains built for affordability, consistency, efficiency and safety. Using the meat industry as an anecdote, in the last 45 years the number of meat plants has been cut in half; in the US three pork processors control nearly two thirds of the pork processing capacity and four beef processors control nearly three fourths of beef processing. In some ways, consumers benefited from the greater access to cheap, safe, abundant food that this vast system enabled. According to ERS, “the average share of disposable personal income spent on food by Americans fell from 17.0% in 1960 to a historical low of 9.5% in 2019.” In other ways consumers became increasingly disconnected from food producers and more exposed to highly processed and less nutrient dense foods. This supply chain made sense for grocery retailers who also faced consolidation and were often competing on price. In 1996 the 20 largest grocery retailers represented 42 percent of the market; in 2018 they represented over 70 percent.

While today’s grocery retailers have more power than ever, the industry is concurrently becoming more complex as lines between physical and digital blur, new capabilities and organizational structures are required and relationships between consumers, sellers and producers evolve. Just as the television networks began to be disintermediated in the early 2000’s, the food system is beginning to experience a shift. Consumers are engaging across a variety of platforms and expectations are carrying over from other industries. If Netflix can serve-up content that is tailored to my tastes and preferences, why can’t the food providers in my life do the same?

Customer expectations around convenience and personalization are forcing retailers to do more, carry more, manage more as they compete with a new set of players. As complexity in grocery retail increases, retailers are digitizing their operations and investing in robotics, automation and smart fulfillment to improve the economics of personalization and convenience. The omni-channel evolution is changing the supply chain and even organizational structures – overhauling existing divisions between “digital” and “store” teams to create a unified approach both internally with their teams and externally with their customers. In some instances, the physical world is mimicking the digital as stores are being reconfigured to reflect online organization and digital footprints.

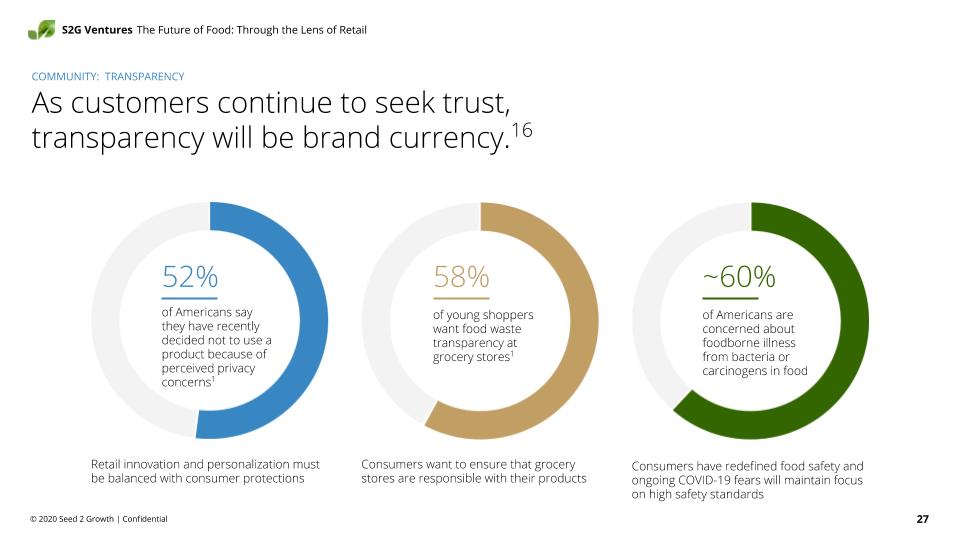

In addition to increasing organizational complexity, there are also supply chain shocks to manage. In 2019 there were 337 food safety recalls in the US. This highlights an opportunity for retailers to add value and resiliency by moving up the value chain. To enable transparency across our supply chain, we need better data and interoperability. The FDA is actively working on refining industry standards and many retailers have taken it upon themselves to work with their suppliers to put these systems in place. As concerns around sustainability, climate change and resource availability mount, there is another path to explore resilience: controlled environment agriculture (CEA) or “indoor ag.” A number of partnership models have arisen between retailers and CEA farms, ranging from hub and spoke organic models to operational improvements to bring down the cost of indoor produce to hyper-local agriculture. These new approaches to food production reduce freight cost, better balance supply and demand, improve sustainability and can even repurpose under-utilized real estate. Technology advances have made this opportunity more real than ever before. Advances in LED lighting systems, IoT capabilities, seed breeding platforms, to name a few, continue to make the economics of indoor agriculture compelling. With more controlled systems, there is opportunity to introduce more variety, more nuance that could not withstand the traditional supply chain. Through initiatives like better data from growers and indoor agriculture, retailers can shape not only what food is on a shelf, but how and where it is produced. This is reimagining the fresh perimeter and unlocking a more nutritious, sustainable and transparent food system for 21st century consumers.

The competitive landscape is evolving quickly for food retail. Traditionally, grocers competed with grocers. In the last decade we saw dollar stores (e.g. Dollar General) and general merchandisers (e.g. Target) establish greater footholds in food retail as a means to drive store traffic. During COVID, the food retail space grew increasingly noisy. Restaurants, farmers and brands were forced to seek new sales channels as restrictions, SKU rationalizations and tightening supply chains disrupted previous paths to market. New sales platforms and technologies offered flexibility and matched consumers with their desired food supply – from restaurants becoming local markets to brands selling through social media platforms. The consumer is no longer limited to what is available at their local supermarket; they are expecting more and have never had easier access to products that fit their needs and wants. This enables much more nuance in demand and supply – from locally produced food, to methodologies of production, to subscription-based convenience and nutrition for toddlers, to managing health conditions, to supporting local economies. Niches that previously fought for a spot on a retail shelf, are forging their own path to their customer.

The last mile continues to challenge economics. To enable convenience, new capabilities are required to shift massive infrastructure into more flexible deployments. A recent analysis by Bain laid out various sample scenarios: traditional grocers doing their own picking in store experienced -15 percent margins; those picking from a warehouse experienced -8 percent, 3rd party services improved margins to -5 percent. Ultimately, to get to profitability, automation and micro-fulfillment are necessary. By proactively laying the groundwork from the bottom up of a distribution model that takes last mile delivery into account, the economics begin to look more reasonable long-term but require significant capital upfront to invest in automation.

Target has been a leader in the digital arena, making digital a priority for the company. As CEO Brian Cornell stated in 2017: “We’re investing in our business with a long-term view of years and decades, not months and quarters. We’re putting digital first and evolving our stores, digital channels and supply chain to work together as a smart network that delivers on everything guests love about Target.” Target’s conviction around this strategy has been paying off: in Q2 2020 it reported a 24 percent surge in sales (their largest increase, ever) and 195 percent growth in digital. This paired with partnership strategies with players like Ulta Beauty to reimagine space and expand serviceable footprints both digitally and physically are positioning the retailer well. While the economics of last mile delivery are being sorted out, hybrid offerings like click-and-collect are providing convenience to consumers while maintaining economics for retailers. Kroger was playing catch-up in the e-commerce space early in the pandemic, but has successfully accelerated a number of programs. Kroger’s buy online, pick-up in store (“BOPIS”) program is currently offered across 2,100 locations; this has contributed to the 127 percent increase in e-commerce sales in Q2 2020. To enable this model, Kroger is leaning into a partnership with Ocado to enable automated micro-fulfillment and improve margins for click-and-collect and delivery. Tomorrow’s supply chain will be built from the ground-up, with last mile delivery and automation being core considerations. These changing dynamics offer new partnership opportunities around technical capabilities (robotics; data; AI) and financing (CAPEX).

Join us on December 10 for a conversation with Walter Robb, former co-CEO of Whole Foods Market, Audre Kapacinskas, Vice President at S2G Ventures, and Danielle Gould, founder of Food+Tech Connect, to discuss how retailers might leverage cutting edge technologies and stakeholder-focused business models to build a 21st century food system. RSVP here.

Content: How reimagining product discovery can unlock opportunities for true product differentiation across taste, nutrition and function.

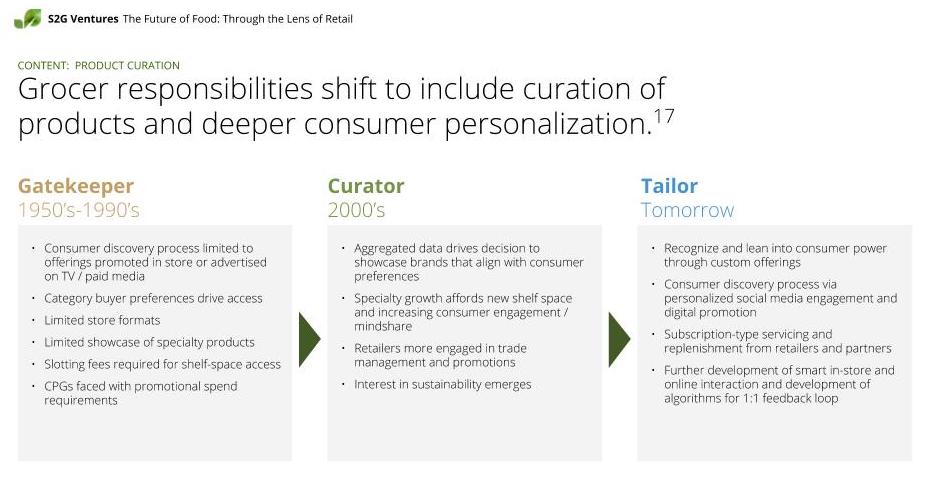

How do your parents decide what food to buy? While brands have more ways than ever to reach their customers, the way retailers enable product discovery is not so different from the first self-service grocery store 104 years ago. Shelf placement, in-store promotions and branded packaging were pillars of product discovery and key to the success of products in a pre-pandemic grocery store. There have been improvements to this discovery model, for instance, Whole Foods offering a community experience in-store by highlighting local / regional products and a “third place” to gather, but the model has remained largely unchanged for the better part of a century.

Today, we see two models at play. First, a legacy model that focuses on scale and volume. This top-down approach gives the broker and buyer control and positions the retailer as gatekeeper of shelf placement, which in turn determines brand exposure to consumers. The second model takes a bottoms-up approach and focuses on user needs and product attributes (verified organic, gluten free, etc). As the world continues to increase in complexity, centralized decision making will reach its limits. Keeping up with shifting preferences will require an open-source approach to curating products – retailers will need to think differently about category management, relationships with brands (including their own private label) and community engagement.

As consumers do more online, retailers must reimagine product discovery from the ground up, using data to better tailor products for consumer needs. Without granular data retailers will be unable to compete with digital platforms that understand user needs, wants and can begin to anticipate them. Amazon has written the playbook on this in other industries and is increasingly interested in the food space through its new grocery formats and delivery services. Data is critical because it enables the sales channel to add value to their consumers by reducing noise and surfacing content that is relevant to them in the moment. For those in the business of food manufacturing (branded or private label), it also offers an innovation path. As data about products and consumers improves, we will be able to better match attributes with needs. Companies like Thrive Market and Good Eggs are exploring new models that are built from the ground-up – aggregating data about ingredients, production methods, holistic product specifications – and can offer nuance, discovery and specificity that traditional models cannot. There is a long way to go to scale these concepts for the mass market, but they offer a glimpse into an attribute-based system where a dad looking for peanut-free snacks is not reviewing the nutritional labels of 15 boxes, but rather can review a curated set of products based on his needs. These models are also more brand-friendly, offering them better data and discoverability.

The concept of retailer as gatekeeper is changing. As more digitally native brands launch and leverage new selling platforms (e.g social media channels and e-commerce sites), brands can understand their consumers at a level of granularity nearly impossible in-store. This will enable brands to emerge that are laser focused not only on selling their products to consumers, but on understanding their motivations and iterating on new products based on the data they collect. Whether it’s a busy mom trying to find snacks for her child with an allergy or a baby boomer managing a recent diagnosis of osteoporosis or a Gen Z looking to vote with their pocketbook around sustainability. As the grocery channel becomes digitized, there is an opportunity to move beyond the ‘buyer’ model in which a single individual determines what is made available to consumers, but rather an open source approach which can cater to the preferences of various communities and curate products based on function, authenticity and needs. This model is unlocked when we have a bottoms-up understanding of our products and our supply chain. In this new digital context, authenticity has never been more important. And for investors, it will be the brands who are able to develop these kinds of relationships with their customers that will be the most compelling investment opportunities.

Another, longer wavelength variable to consider is the impact of biometric data being more widely available to consumers. Today, 21 percent of Americans use a smartwatch or fitness tracker. As this number expands, the intersection between food and wellness becomes more concrete at a personal level. The ability to pair personal biometric data (e.g. your blood pressure is 140 today, 10 percent higher than last week) with information coming online about ingredients and products will enable people to make more personalized decisions about what food they buy and why. Personal and IoT devices unlock new forms of engagement that enable the collapse of physical and digital worlds and offer bi-directional digital interactions between consumers, producers and retailers. This will create a feedback loop of information sharing that can unlock new discovery processes and product innovation.

As material science, genomics, food production and other technologies advance and we dig deeper into a treasure trove of better flavors and nutrition, we stand at the precipice of high throughput product innovation and true differentiation. We see some of this happening already – partnerships between retailers and heirloom seed breeders; cancer treatments paired with specifically bred plants; natural blue dyes that are price competitive with synthetic colorants; tomatoes that don’t taste like cardboard; more nuanced strains of cannabis. We have been living in the world of black and white television and we are about to go to HD Color. Just as the online world has gotten noisier, the food world is begging to experience the same, and it is the role of the retailer to help their customers navigate the 21st century food system. Retailers are poised to play a critical role in understanding customer needs, tailoring products that suit them and conveniently making them available.

Community: Tomorrow’s business models recognize the ecosystem we are part of and are built on trust across customers, employees, suppliers, local communities and shareholders.

As we move deeper into an era where sales channels are more fluid and consumers have the opportunity to discover products and purchase them through a variety of means, customer engagement is more important than ever. Millennials and Gen Z, a demographic of 150 million, are overtaking Baby Boomers in their purchasing power and their values are poised to have an impact on the trajectory of business. According to a recent Deloitte study, 80 percent of millennials and seventy percent of Gen Z said they will make an extra effort to buy products and services from smaller, local businesses to help them stay in business post-pandemic. Sixty percent of respondents plan to buy more from large businesses that “have taken care of their workforces and positively affected society during the pandemic.” Tomorrow’s consumers are looking to spend their money with organizations they trust.

According to Edelman’s ‘Trust Barometer,’ ethics are 3 times more likely to drive trust in business rather than competence. In this context, engagement across a variety of stakeholders is more important than ever. In 2019 Business Roundtable redefined its statement on the Purpose of a Corporation – showcasing how engagement across all shareholders is imperative to long-term success. Key tenants to building a community include delivering value to customers, investing in employees, dealing ethically with suppliers, supporting local communities and generating long-term value for shareholders. Humana’s Bold Goal of improving the health of the communities they serve by 20 percent by 2020 is an example of supporting local communities.

“By taking a broader, more complete view of corporate purpose, boards can focus on creating long-term value, better serving everyone – investors, employees, communities, suppliers and customers,” said Bill McNabb, former CEO of Vanguard. Retailers are in a unique position; having been a cornerstone to local communities they already occupy a trusted position among their customers. While trust exists it cannot be taken for granted, it needs to be earned on a daily basis. Whether it’s the products a retailer chooses to carry, how they maintain the health and wellness of their employees, support of community organizations, or enabling the health and wellness of the customers they serve. In an era that is going to have more information and optionality than ever better, being a trusted participant in your community is critical.

In the march toward low-cost production, we lost sight of some of the upstream and downstream impacts of our food system. Today’s burgeoning consumer class is increasingly paying attention to those considerations. Given advances in technology, data, food production methodologies and e-commerce platforms, there is an opportunity to improve our food system, to think holistically about the communities we are serving and drive long-term sustained results for business.

Looking Ahead: A 21st century food system grounded in trust

As 2020 draws to a close and we set our sights on a new year, we stand at the crossroads of what was, is and will be. New technologies are shortening the space between consumer and producer and as Gen Z and Millennials gain economic power and vote with their pocketbook, trust is more important than ever in what, how and why we buy what we buy.

Commerce

- Physical and digital worlds are blending together; integrated teams and systems focused on the holistic customer journey are key to providing consistency, flexibility and trust.

- Retailers are moving from gatekeeper to tailor; as digital sales channels become more common retailers can differentiate and add value to consumers by leveraging data and curating products.

- Food producers, brands and food service providers have an opportunity to sell in new ways to their consumers and benefit from better data and direct user feedback.

Content

- Online product discovery needs to be improved.

- Health and wellness are top-of-mind for many – as more functional ingredients come online, truly differentiated branded and private label products can build trust with consumers.

- Data is laying the foundation for tomorrow – having a data strategy is more important than ever.

- Complexity is increasing – in order to keep up, you need to decentralize and partner.

Community

- Trust is the currency of the 21st century food system. This needs to be earned through data, verification, consistency, transparency and authenticity.

- Long-term resiliency and value will be achieved through broad stakeholder engagement with customers, employees, the local community, and shareholders.

- Values have never been more important – as Millennials and Gen Z gain economic clout, they are looking to align their spending power with their values.

Channel digitization, advances in automation, new approaches to food production, the proliferation of data, new customer engagement models and the evolution of societal norms provide an opportunity to revisit some of the tradeoffs we made in the past century. Food is unique in its ubiquity. Everyone eats, and as the food supply chain evolves, we have an opportunity to build a system based on trust that is good for the health and wellness of consumers, producers, local economies and the planet.

Join us on December 10 for a conversation with Walter Robb, former co-CEO of Whole Foods Market, and Audre Kapacinskas, VP of S2G to discuss how retailers might leverage cutting edge technologies and stakeholder-focused business models to build a 21st century food system. RSVP here.

Join us for future Redesigning Retail conversations here.

Download S2G’s The Future of Food: Through The Lens of Retail Report here.

___________________

Audre Kapacinskas, Vice President at S2G Ventures

Audre Kapacinskas, Vice President at S2G Ventures

Audre Kapacinskas is a Vice President at S2G Ventures, where she focuses on unlocking value for S2G, its portfolio companies and strategic partners. Throughout her career, Audre has worked at the intersection of technology, strategy and operations to incubate new ideas and drive growth across organizations. Prior to S2G, Audre was a Director of Sales and Corporate Strategy at a predictive analytics start-up delivering artificial intelligence and IoT solutions to the Industrial sector. She started her career at a boutique strategy consulting firm working with private equity firms and corporate clients with growth acceleration, value assessments and investment diligence. Audre is a Fulbright Scholar, holds an Honours BA from the University of Toronto and an MA from Vilnius University.