Sanjeev Krishnan

This is a guest post by Sanjeev Krishnan, Chief Investment Officer and Managing Director at S2G Ventures

The COVID-19 pandemic has caused a global health and economic crisis like none we have seen in our lifetime. In the food supply chain this has impacted employees that ensure that food is planted, harvested and processed, grocery shelves are stocked and food is available to all people. It takes a global village to feed the world, and we have seen selfless sacrifice and silent grit to ensure the continuity of our food system. Because, if our food supply breaks down, this pandemic may move from a crisis to a catastrophe.

Over the past several months several cracks have shown up in the food supply chain. The pandemic is challenging the nature of our global supply chain, stressing logistics networks and reinforcing the importance of labor. There are concerns about food nationalism, continued access to labor and redefining the nature of food security from global to national systems. While now is the time for urgent action – from government and private sector – there is a need for longer-term investments required for building a more innovative and resilient future food system.

Our team at S2G Ventures spent several months researching and monitoring COVID-19 and its implications to better understand these questions, keeping a close eye on the news cycle, conducting extensive desktop research and speaking with various experts across many fields. We spoke to epidemiologists, healthcare professionals, farmers, entrepreneurs, philanthropists and other investors to gather insights and develop our perspective on the implications of COVID-19 on the world of food and agriculture. We have compiled our finding into a report that explores the implications of the COVID-19 pandemic to the food and agriculture industry and identifies the areas of innovation critical to building a healthier and more sustainable food system.

As an investor in companies across all stages of the food system, we believe our role in the recovery is to ensure we build a more stable, resilient, sustainable and healthy system. We will continue to invest in entrepreneurs and innovations that are the catalysts for meaningful progress. Below, we offer a summary of our report, which can also be downloaded in full here.

Pandemics 101: A History of Recovery & Innovation

Taking a look back in time, the world suffered a deadly pandemic in 1918. The Spanish flu, whose origin is believed to be a farm outside of Kansas City, spread quickly across the globe. Although the world was not as connected, World War I was still ongoing, and troops were being shuttled between the United States and Europe. Between 1918 and 1919, the Spanish flu is believed to have infected nearly a third of the global population and killed between three and 20 percent of those who were infected. In the end it killed between 40 and 50 million people. In the years following the Spanish flu, there was a bright period of innovation that included the adoption of the Bell telephone and modern medicine. It was an event that helped shape the future.

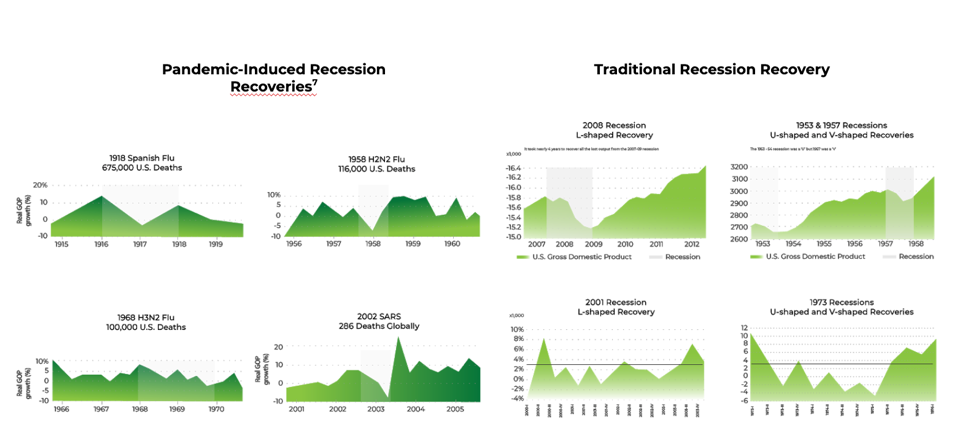

Between the Spanish flu and today’s pandemic, there have been seven major epidemics or pandemics. Each varies in mortality, duration and contagion, but ultimately all come to an end. The economic recovery period that follows a pandemic-induced recession is generally different from traditional economic recessions. Pandemic-induced recession recoveries have generally seen a V-shaped recovery, while traditional recessions have varied between V-, U-, W-, and L-shaped recoveries. The global financial crisis of 2008 saw a L-shaped recovery. Typically, economic recessions have a longer duration and deeper economic consequences.

The coronavirus pandemic is unique among prior events. While many events have temporarily shut down regions, none have had the same global shutdown that we are currently facing today. So, despite being able to draw comparison and insights to learn from pandemic economics, the situation is different due to a staggering rise in globalization, digitalization across many sectors and the rise of fiat currencies. Pandemic economic history teaches us that one of the hallmarks is that innovation plays a critical role in the future normal that emerges. As professor Katherine A. Foss notes, “disease can permanently alter society, and often for the best by creating better practices and habits. Crisis sparks action and response.”

While the direct effect of COVID-19 is on the population – with infection rates, social distancing and shelter-in-place restrictions and continued operations of only essential businesses – there are significant implications across many industries. The second order consequences of coronavirus are reshaping industries, catalyzing innovation and encouraging resilience in business planning. Although the lasting impact on many industries is unknown, we see exciting innovation accelerating across automation, telemedicine, virtual reality and transparency systems (i.e., blockchain or similar technologies).

Everyone Eats – Pandemic Proof Demand, but Supply?

While the food and agriculture sectors are generally more resilient in bad economic situations, there are several sub sectors that rely heavily on in-person labor and are currently strained due to the unique social distancing pressures placed on businesses. One significant pressure point is meat processors. Several large meat companies have been forced to shutter processing facilities due to COVID-19 outbreaks. Smithfield had to shut down one of its pork processing facilities that supplied roughly 5 percent of the U.S. pork supply, while JBS had to close a Pennsylvania facility that processed beef. The second-order consequence of these closures is the farmer, who may be forced now to cull their herds of cattle and hogs. The strain on this pressure point affects not only the farmer, but also the consumer. Wendy’s felt the effects of this during this past week, when nearly one-fifth of all 1,043 locations ran out of beef.

While it will take an extended period of time to fully understand the implications of consumer purchasing data coming out of the pandemic – more specifically if the duration of the consumer behavior shift will be a ‘fad’ or ‘trend’ – certain areas of the market are seeing a quick adoption of trends that were previously accelerating. As slaughter-house closures have increased, plant-based meats sales have jumped 200 percent. Plant-based meats remain a small portion of the market, but this is a significant and notable demand signal from consumers.

Coronavirus is notably changing how consumers shop, prepare and consume food. Between 2009 and 2018, out-of-home eating rose from 50.1 percent to 54.4 percent of the market. Now, with social distancing limited the ability to eat at restaurants, many are turning to preparing food at home or ordering delivery or takeout. And, despite food being a resilient sector, the bifurcation between grocery and food service has become clear.

In the grocery store, private label market-share gains are poised to accelerate, as consumers tighten spending and look for value-focused alternatives. However, we expect consumers to prioritize a balance of value and better-for-you brands instead of a complete tradeoff to value, consistent with the consumer megatrend towards better-for-you products.

Taking a step back, and observing the broader food value chain, we observed three primary delivery vulnerabilities in the food system:

1. Agricultural inputs to farms (e.g., seeds, animal feed, fertilizer, et al.)

2. Farm products to processors, packagers, spot markets and export markets

3. Food to retail distribution

This is important, because the global food system relies on a just-in-time economy, where inventory levels are intentionally kept low. Meaning, that regardless if there is enough supply in existence, it may not be able to reach its proper destination if the supply chain is disrupted.

China, which provides a good example because it is further along in the lifecycle of the pandemic, has been suffering from this problem the last several months. Upstream and downstream logistics are a major challenge; at the ports there are thousands of frozen meat containers piling up because the trucking has effectively collapsed. Meanwhile, ports are running out of power, stoking fears that much of the food currently stored there will go bad. There is also an American company that makes immunization equipment for chicken that said their containers had been docked at Chinese ports for four weeks. Although China is doing its best to ensure that the grain planting season is not missed, the logistics of this supply chain are making it increasingly difficult.

The Future of Food – COVID-19 and Calories

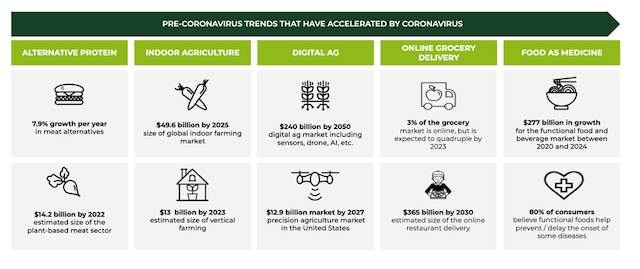

While we continue to watch the situation, and the strain it is placing on the food system, we view the common thread that could bridge the existing system to the future as technology. Consumer purchasing behavior coupled with innovation may drive changes in market share and pressure existing players in the market. Although we have not seen COVID-19 create a new trend, we have seen several trends that were in motion pre-coronavirus further accelerated by the pandemic, including alternative protein, indoor agriculture, digitalization of agriculture and grocery and food as medicine.

Although animal agriculture remains a large and growing market, the pandemic has exposed challenges with the industries long production cycles, centralized production and limited processing facilities. It has allowed for faster consumer adoption of alternative proteins, including plant-based protein, fungi, algae and other biomass concepts including cellular meat. Notably, some of these technologies are further along than other, for example plant-based protein has been a trend for several years, while cellular meat remains in a research and development phase. We continue to believe that whatever the next generation of protein is, it will be driven by production speed, price and taste.

A second trend we believe is accelerating is food as an immunity. The convergence of food, science and technology may unlock this sector and usher in a new era in microbiome, functional ingredients, precision and personalized nutrition and medical foods. Prior to COVID-19, this was largely driven by nutrition-related disease, but the pandemic has exposed at-risk populations, with approximately 90 percent of hospitalized patients having one or more underlying condition, with the most common underlying condition being obesity.

Beyond specific trend acceleration, several themes emerge throughout this research that we believe may be catalyzed and emerge in a post-COVID-19 world. Digitalization will likely be driven by dis-intermediation to allow for new relationships with the consumer and to reduce risk throughout the supply chain. Decentralized food systems allow for the automation of local (alternative protein and produce) and the reshaping of complex perishable supply chains to reduce shrink and waste. They are also more omnichannel congruent as e-commerce, specifically online grocery, adoption accelerates. De-commoditization in the food supply chain, coupled with technologies that place deflationary pressure on the industry, may help catalyze breeding for attributes beyond yield (taste, protein content, et al), a return to polyculture farming and a shift from a strict focus on yield to profit per acre. Lastly, food as an immunity has the potential to bridge healthcare and food production and consumption for treatment of specific nutrition-related chronic lifestyle diseases, as well as change the future of brands to focus on unique, functional ingredients. a

Our full report, The Future of Food in the Age of COVID, is available online.

_____________________________

Sanjeev Krishnan, Chief Investment Officer and Managing Director at S2G Ventures

Sanjeev has nearly 20 years of experience in sourcing, executing, managing and exiting venture and private equity investments, including a focus in agriculture and food companies. As Managing Director, Sanjeev is active in developing investments and managing portfolio companies including, serving on many portfolio company boards. His portfolio work ranges from genetics, crop protection, soil health, digital/IOT, crop insurance, merchandising, indoor agriculture, novel flavor and ingredients, new protein development, unique processors and brands that will feed this changing consumer.

He is passionate about the role of innovation, entrepreneurship, markets and system investing as a theory of change. Sanjeev has worked in the intersection of sustainability, technology and health in many regions, including Europe, Africa, Asia and North America. He has invested over $500 mm in venture and growth stage firms throughout his career.

Sanjeev began investing as a co-founder of the life sciences practice of the IFC, the $99 billion private investment arm of the World Bank. His previous investment roles include CLSA Capital Partners, Global Environment Fund, World Bank Group’s IFC and JPMorgan. Sanjeev is a graduate of the London School of Economics and Political Science.

About S2G Ventures: S2G Ventures (Seed to Growth) is a multi-stage venture fund investing in food and agriculture. The fund’s mission is to catalyze innovation to meet consumer demands for healthy and sustainable food. S2G has identified sectors across the food system that are ripe for change, and is building a multi-stage portfolio including seed, venture and growth stage investments. Core areas of interest for S2G are agriculture, ingredients, infrastructure and logistics, IT and hardware, food safety and technology, retail and restaurants, and consumer brands. For more information about S2G, visit www.s2gventures.com or connect with us on Twitter and LinkedIn.