Image Source: Amazon

Every week we track the business, tech and investment trends in CPG, retail, restaurants, agriculture, cooking and health, so you don’t have to. Here are some of this week’s top headlines.

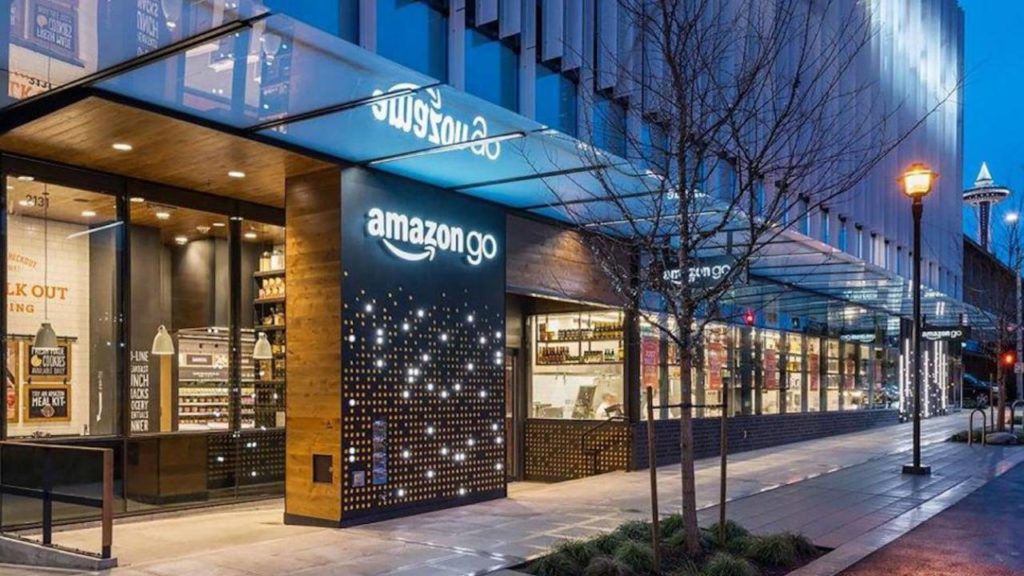

Amazon’s physical retail strategy shifted in a major way this week when the retail giant announced that it will be launching a new grocery format, separate from Whole Foods, and shutting down its 87 pop-up locations. In the UK, Marks & Spencer closed a $944 million partnership with Ocado to propel its online food delivery capabilities.

In CPG news, Chilean startup NotCo closed a $30 million round from the Jeff Bezos Fund in order to expand its vegan mayos into the U.S. and Mexico. Once Upon a Farm has launched a line of baby purees that are WIC-approved in West Virginia and Florida. Clif Bar released a statement challenging KIND bar to follow its lead in transitioning to organic ingredients.

And finally, Corelle Brands has merged with Instant Brands to form a combined entity worth more than $2 billion.

Check out our weekly round-up of last week’s top food startup, tech and innovation news below or peruse the full newsletter here.

_______________

1. Introducing Biodiversity: The Intersection of Taste & Sustainability

We interviewed 45+ CEOs, execs, farmers and investors about the role biodiversity plays in our food industry.

2. Amazon to Launch New Grocery-Store Business – Wall Street Journal

Amazon is planning to open dozens of grocery stores in several major US cities separate from Whole Foods, with its first outlet planned to open in Los Angeles at the end of next year. The company is also exploring the idea of purchasing regional grocery stores.

3. Chile: Vegan Startup Secures $30M from Jeff Bezos Fund – LiveKindly

NotCo has secured funding from the Craftory, a new fund co-founded by Elio Leoni Sceti and Bezos Expeditions. It plans to use funding to develop more products and expand its distribution to Mexico and the US later this year.

4. UK: Marks & Spencer Makes Deal with Ocado for Online Food Delivery – Forbes

The UK retailer will create a joint venture with Ocado Group. Through the $944m deal, Marks & Spencer will own 50% of the online delivery company.

5. Owners of Instant Pot, Corelle to Merge – Wall Street Journal

Instant Brands is merging with Corelle Brands for an undisclosed sum. The combined companies would be valued at more than $2b.

6. Garner, Foraker Launch Baby Food for Supplemental Nutrition Program – Nosh

The company has launched a line of baby food purees that meet the guidelines for the WIC in West Virginia and Florida, which has the potential to help 125k children.

7. An Open Invitation to KIND Bar from Clif Bar – Clif Bar

The company is challenging KIND bar to join it in using organic ingredients, offering its expertise.

8. Amazon to Shut All US Pop-Up Stores as It Rethinks Physical Retail Strategy – Wall Street Journal

The retail giant plans to close 87 pop-up locations, ending a year-long experiment, by April.

9. India: Zomato to Sell UAE Food Delivery Business for $172M – New York Times

Zomato will continue to run the business on its own platform.

10. UK: Samsung Fast-Tracks Entry into Food Tech with Acquisition of Whisk – The Spoon

The deal brings Whisk into the fold via Samsung Next, the company’s software and services innovation hub. Financial terms were not disclosed. Whisk powers commerce from within the recipes of publishers.

11. General Mills Has a Plan to Regenerate 1M Acres of Farmland – Fast Company

One of the largest food companies in the US is calling for farming practices that keep carbon trapped in the earth and create healthy, rich soil.

12. Tyson Bets on Omnivores with New Alternative Protein Business – Bloomberg

The company plans to accelerate and develop its own alternative-protein business line. Every kind of protein is on the table, from legumes and peas to mushrooms and insects.

13. Why Mondelēz, the Snacking Giant Behind Oreo and Wheat Thins, Is Taking on Gut Health – Forbes

The world’s largest snacking company has purchased a minority stake in Uplift Food, a startup that sells a powdered daily fiber supplement infused with prebiotics and probiotics, for an undisclosed sum.

14. Women, Women of Color & Gender Non-Conforming Innovator Database

We created this open-source list to increase representation, support and investment in women, women of color & gender-nonconforming innovators in food. Join the list & help us spread the word using #womxninfood