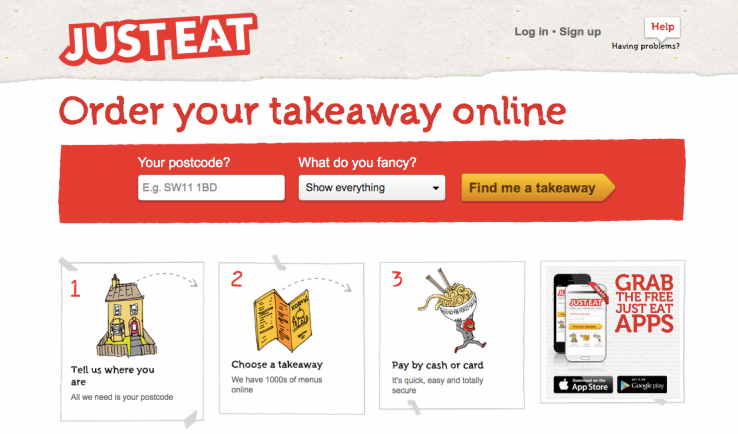

Earlier this month, UK-based online food delivery startup Just-Eat announced it had snapped up rival Meal2Go, intending to bring Meal2Go’s electronic point of sale (POS) tech to its restaurant partners. Today, the food ordering giant announced its plans for an IPO (initial public offering) of up to £100 million in common stock on the London Stock Exchange, reports The Financial Times (FT). This IPO would be the biggest local exit for a company from London’s “Tech City“ hub,” reports FT, and closely follows US-based delivery giant GrubHub’s $100 million IPO announcement last month.

The startup plans to use the money raised from the IPO to tackle “less mature and new markets,” Just-Eat CEO David Buttress tells FT. More acquisitions – it previously acquired GrubCanada,Urbanbite.com and SinDelantal, to name a few – may be on the horizon too as a result of the IPO, he hinted.

The startup operates in 13 countries and has over 38,000 restaurant partners, with more than 12,000 of those in the UK. It processes nearly 900 real-time orders per minute at its busiest times in the UK, and has seen impressive financial growth, generating £96.8 million in revenue in 2013, up by a whopping 61.9% from 2012, according to its IPO document.

In addition to its impending electronic POS services, Just-Eat aims to grow its platform through food order collection, which means users will be able to place orders for in-person pick up in addition to delivery orders, TechCrunch reports. This opportunity is “largely untapped and significant,” says the company, and could potentially give it a competitive edge against its main rival Delivery Hero. Tackling in-person pickup may also help Just-Eat tap into the phone-ordering demographic, which Buttress tells The Independent is the startup’s biggest competitor. Most people still order by phone; only 20 percent place orders online in the UK, its largest market, for example.

Additionally, the company plans to expand its reach to higher-quality eateries, in order to give customers more variety, Buttress tells FT. We’re excited to see what this IPO will mean for Just-Eat in terms of new features, acquisitions and growth.