Photo Credit: Compete Pulse

Thanks to e-commerce companies like Amazon and Zappos, consumers can shop from anywhere, at anytime, for almost anything. A next day e-reader delivery for that last minute birthday gift, a 3 am sandal splurge, free delivery on Fido’s 80 pound bag of kibble, are all accessible with the swipe of a screen. And this has had profound implications for the way people shop. As technology adoption increases, consumers also want more interaction with companies, and they are more likely to rally together using social media to demand product changes in real-time. For CPG companies, this sophisticated, empowered smartphone-slinging consumer demographic presents both challenges and significant opportunities for growth.

Growth Strategies: Unlocking the Power of the Consumer, the recent financial performance report conducted by the Grocery Manufacturers Association(GMA) and PwC US, outlines a 3-step process for how CPG companies can create new rules of engagement and increase profits, which includes identifying consumer needs and increasing engagement, harnessing consumer-driven innovation and developing direct-to-consumer (DTC) channels.

“CPG companies that engage with consumers directly through digital channels and build out their direct-to-consumer processes will have the best advantage for creating new growth,” says Steven Barr, PwC’s US leader of retail and consumer industry in a press release. “Fifty-two percent of U.S. consumers are already buying directly online from brands they trust, proving that CPG companies now have far greater opportunities to walk alongside their shoppers in real time while driving sales of existing and new products.” And more than 40 percent of CPG companies surveyed for the report expect to sell products directly to consumers in 2013, up from 24 percent in 2012, which could mean a lot of opportunity for startups like NatureBox who are developing robust direct-to-consumer sales and analytic channels.

The following is a summary of the reports findings.

STAGE ONE: GETTING TO KNOW THEM

Today’s consumers expect to participate and make a difference in the brands they care about. They “are no longer buying products, they are buying experiences,” the report notes. CPG companies have incredible opportunities to “weave innovative content and personalized experiences that inspire consumers to become advocates for their brands. The challenge is creating experiences that respond to consumers’ changing preferences, while also creating brand value.”

A recent PcW survey found that fully engaged customers are 23 percent more profitable than average customers, and 12-15 percent of loyal customers generate 55-70 percent of sales. CPG companies are listening to their customers and redefining antiquated loyalty models. According to Clorox CMO Tom Britanik, these new loyalty programs “have less to do with providing a financial benefit and more to do with developing a relationship with customers, giving them relevant and meaningful information over a long period of time.”

STAGE TWO: MEETING THEM WHERE THEY ARE

For CPG companies, social media is the new loyalty card. By leveraging data-driven insights, delivering targeted content, engaging in real-time dialogue and continuously innovating outreach strategies, these companies can build brand awareness, establish customer preference and gain unwaveringly loyal customers.

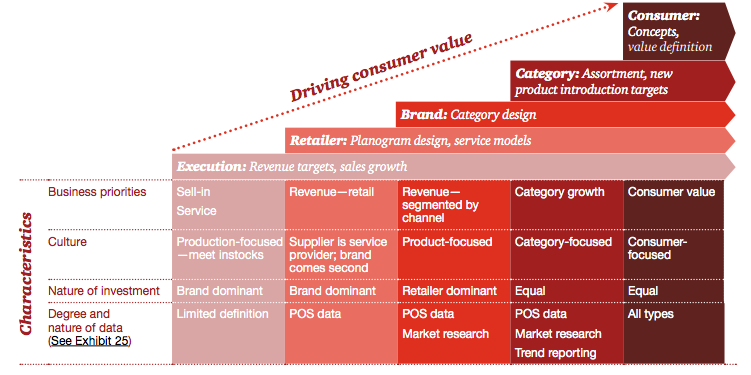

Successful collaborations between CPG players are inspiring retailers and suppliers to work together more effectively. The report encourages CPG companies to define their collaboration agenda and goals upfront, manage partner expectations in advance, and preemptively agree on how success will be measured. The figure below explores different collaboration agendas for CPG brands and retailers.

STAGE THREE: INNOVATING YOUR PANTS OFF

After identifying customer needs and engaging with them in real-time, CPG companies can use the valuable information they’ve gleaned to enhance value and “cement the consumer bond.” This type of innovation requires new frameworks, such as layering “intrapreneurial” innovation on top of historically favored R&D and M&A. “Identifying customers’ unspoken and unmet needs can help companies generate ideas for going beyond merely selling products to create new forms of value,” the report notes.

The title chief innovation officer (CIO) is a relatively new one. Companies of all kinds, including CPGs, are hiring CIOs and building full-fledged innovation teams to provide a “center of gravity” that bridges the gap between R&D and strategy/brand-development.

Hillshire Brands CFO Maria Henry explains, “Our innovation organization is very integrated with our brand teams, our R&D teams, and our sales force…while it’s separate and has pockets of expertise and specific roles, [it] is incredibly collaborative with the other front-facing teams, to bring together all the best thinking under one umbrella.”

This crossover between traditional R&D and new innovation models is still being tested through various innovation approaches including rapid prototyping, cross-disciplinary innovation tournaments and ethnography tools to tap into deep unmet customer needs. The figure below compares traditional R&D and new innovation models.

Direct-to-consumer is just one piece of the CPG innovation model puzzle, but it provides a faster and more effective way to test new products and reach new customers. In order to create smooth integration of DTC, the report recommends that CPG companies utilize three platforms:

- transactional: enhanced sales through e-commerce,

- relational: building relationships with valuable customers and influencers

- strategic: utilizing stakeholders in the field to co-create the brand’s future.

As technologies rapidly evolve, so too will the business models and opportunities facing CPG companies. Flexibility will be key, as companies will also need to manage a new set of risks and security concerns. Yet “the barriers to entry are low on the relational and co-creation DTC platforms.” “This train is leaving the station,” the time has come for CGP companies to stop talking and strategizing about DTC and just jump on board and learn as they go.